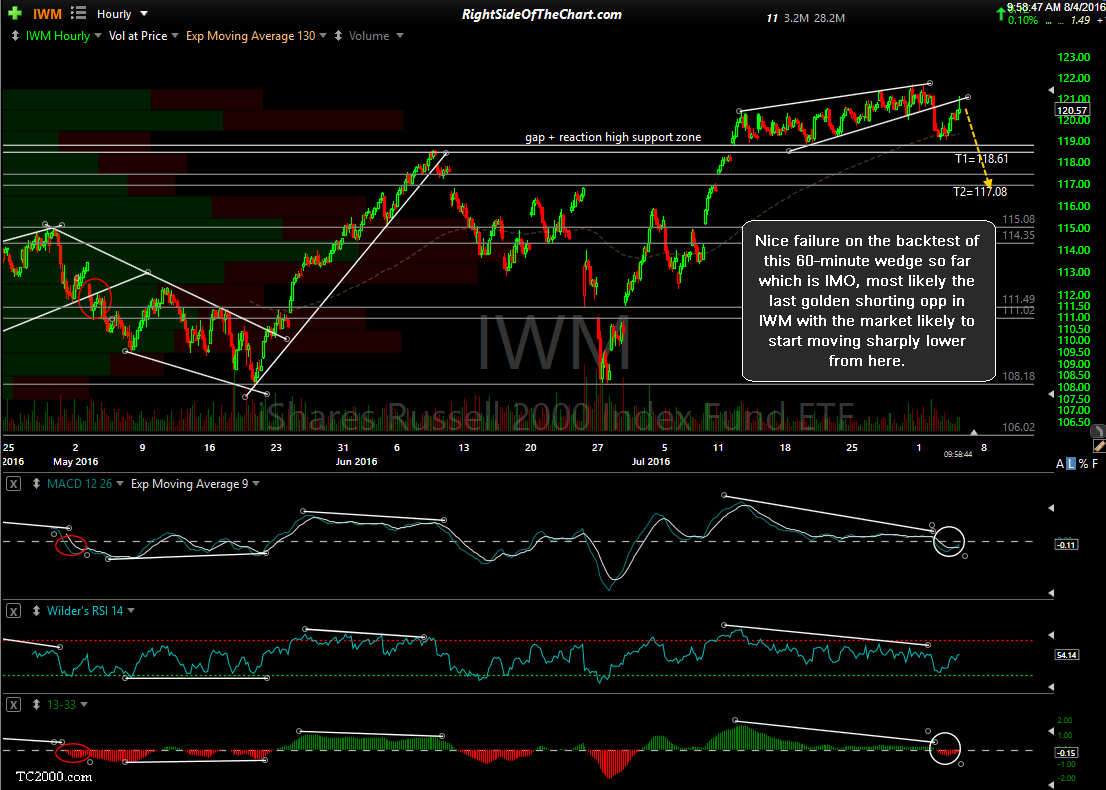

Nice failure on the backtest of this 60-minute wedge so far which, in IMO, will likely prove to be the last golden shorting opp on the IWM/TNA official short trade with the market likely to start moving sharply lower from here. Again, additional price targets will likely be added to this trade although the suggested stop remains any move above 121.65 which is very close to current levels & just basis points from today’s high so far. For those positioning for what could become a longer-term swing trade (beyond the two current near-term official targets), you might want to allow for a wider stop.

IWM Backtest Likely the Final Golden Shorting Opp

Share this! (member restricted content requires registration)

15 Comments