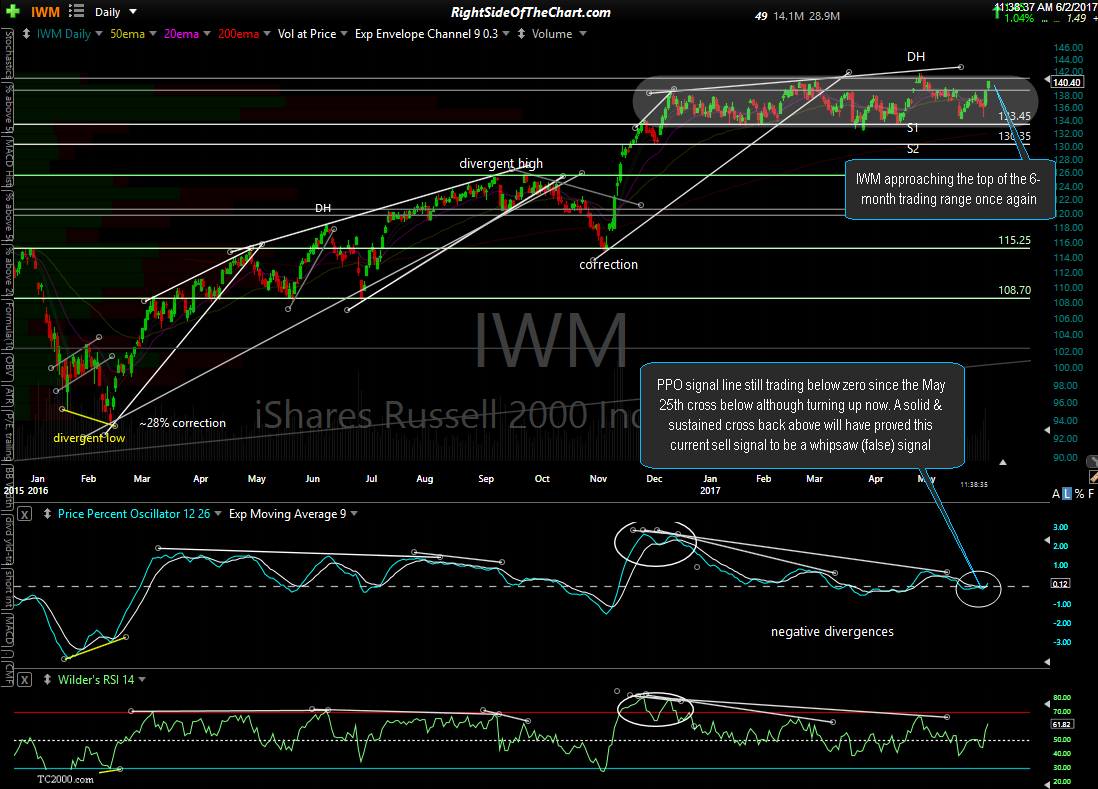

Member @jim requested an update on IWM (Russell 2000 Index tracking ETF) which has played a very impressive game of catch-up to the other major US stock indices over the last two sessions following a very sharp period of underperformance. I don’t see anything that stands out on the 60-minute chart other than the impressive rally from yesterday & today nor can I make a decent case for either a reversal soon or a continuation of this near-term rally.

I can say from looking at the daily chart above, IWM is once again approaching the top of the 6-month sideways trading range. I’ve also noted on that chart the fact that the PPO signal line (9-ema) has been trading below the zero level since May 25th although I’m not putting much of a weighting on that trend indicator at this time as whipsaw signals are very common when an index or a security has been trading range-bound for an extended period of time.

Without being able to make a decent case for a reversal, I’d have to say the odds are good that IWM will go on to take out the previous high, which was a divergent high. If that happens relatively soon, the same divergences that were & still are in place on that previous high will still be very much intact. I realize that the divergences on the broad markets highlighted in recent months haven’t played out for anything more than relatively shallow pullbacks, unlike similar divergences in the past. That’s doesn’t mean that they won’t play out at some point in the near-future just as one can’t rule out the possibility that IWM makes a solid & sustained breakout above this 6-month trading range & goes on to negate or take out those divergences with the PPO, RSI & various other price & momentum indicators going on to take out the previous highs.

- TLT daily June 2nd

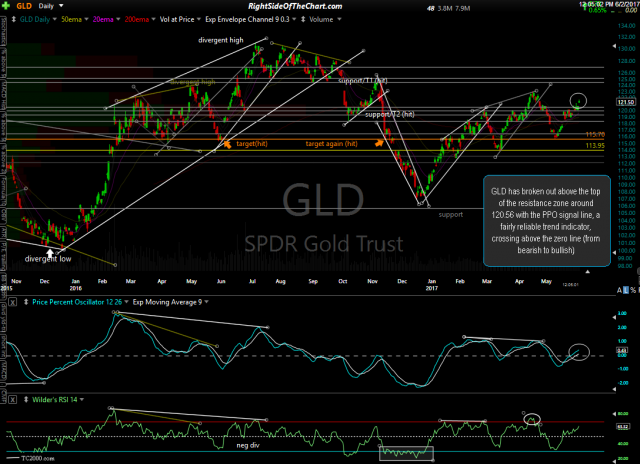

- GLD daily June 2nd

While I’ll continue to post analysis on the broad markets, my primary focus remains on trading the most attractive individual securities (stocks, commodities, ETF’s, etc…) & with QQQ taking out that recent 4-5 day tight sideways trading range today with an impulsive break to the upside, I closed my index shorts & will wait for the next objective entry, long or short. One thing that stands out today is the strength in the risk-off assets; gold & treasury bonds. Odd to see both rallying along with equities as they tend to have a fairly tight inverse correlation (stocks up = bonds & gold down and vice versa). Strong rally in TLT today to break out above the previous reaction high, opening the door to a move up to at least the 127.25 area & possible a backfill of the big Nov 9th gap. GLD has broken out above the top of the resistance zone around 120.56 with the PPO signal line, a fairly reliable trend indicator, crossing above the zero line (from bearish to bullish). This rally in the ‘flight-to-safety’ assets could indicate that the smart money (institutional traders) are passing the equity torch to the retail traders by selling equities into strength & moving funds into the safe-haven investments. One day does not make a trend but something to monitor.