Stock futures took a nice hit on the 8:30 am release of a hotter-than-expected CPI report. With days left in the trading week, the bears remain in control as the bulls would have to ramp this weekly candle back on QQQ on or above the former T3 (268) support. Still favoring continued downside to T4 at this time although anything can happen with two full trading sessions before the weekly candles finalize & we still have the big banks kicking earnings season into full gear starting with a slew of potential market-moving financials including MS, C, WFC, PNC, & the lead sled dog, JPM tomorrow before the market opens. Weekly chart below.

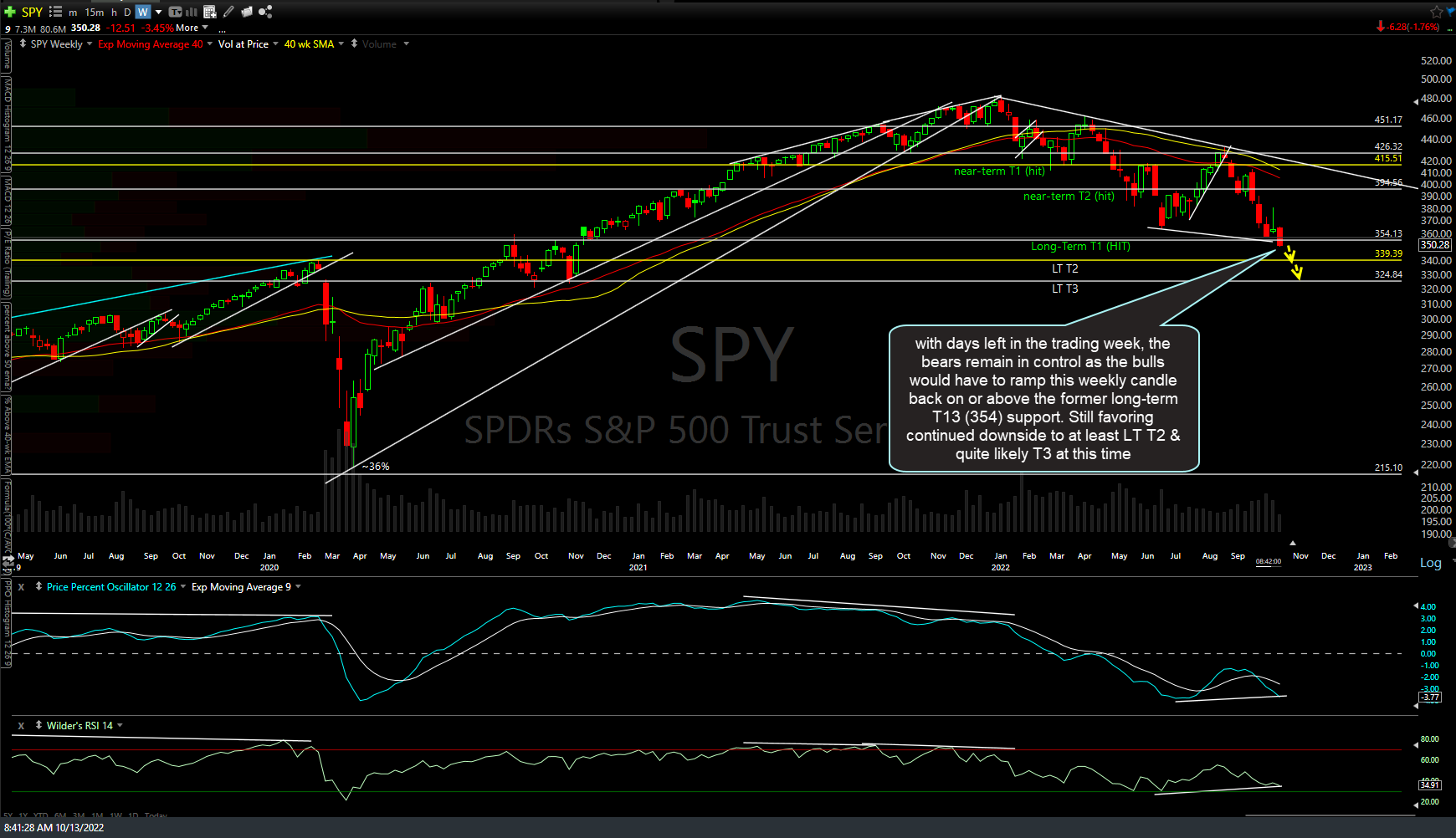

The sellers remain in control as the bulls would have to ramp this weekly candle back on or above the former long-term T13 (354) support on SPY. Still favoring continued downside to at least LT T2 & quite likely T3 at this time although ready to pivot, should the charts convince me to do so, especially with the (potential) divergences still intact, for now. Weekly chart below.

Zooming down to the 60-minute time frame of /NQ (Nasdaq 100 futures), we have another divergent low (only potential, not confirmed via a PPO bullish crossover to effectively put in a higher low) although, in recent weeks, the divergent lows have simply caused the market to stair-step lower with minor rallies followed by the next leg down.