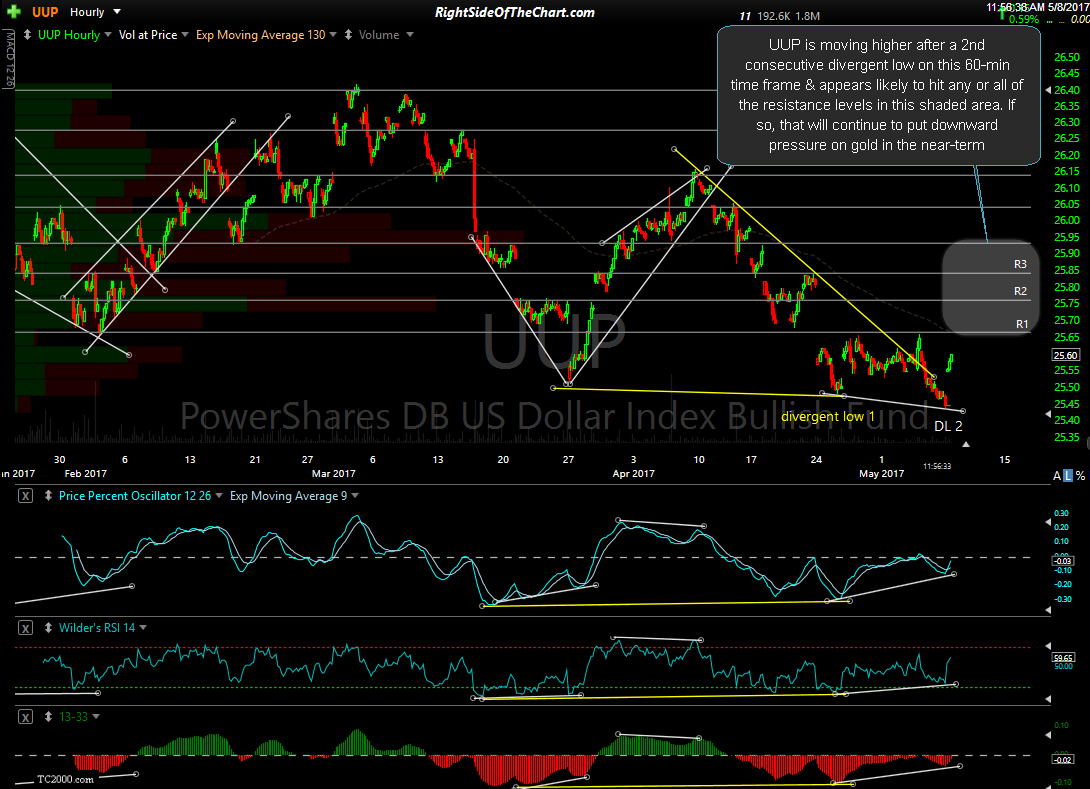

UUP (US Dollar Index ETN) is moving higher after a second consecutive divergent low on this 60-minute time frame & appears quite likely to hit any or all of the resistance levels in this shaded area. If so, that will continue to put downward pressure on gold in the near-term.

GLD (Gold ETF) continues to hug the top of the gap support zone but with a near-term bullish outlook for the US dollar, a move down to the bottom of the zone & quite possible down to the 115 area is certainly possible. I have no desire to short gold or the mining stocks & should the stock market begin correcting this week as I suspect, that may very well override this near-term neutral-to-bearish outlook for gold & GDX with gold catching a flight-to-safety bid. As such, I remain on the sidelines in regards to the GLD/GDX trade, patiently awaiting the next objective long entry to develop in the charts as I rather miss out on a rally than take a position when I don’t see a clearly bullish setup in gold with a bearish outlook for the US dollar at the same time.