Today was a mixed bag in the markets with the $SPX (S&P 500 Index) closing down slightly on the day with the Nasdaq 100 ($NDX) as the standout performer, largely due to the top-heavy component AAPL (Apple Inc), which closed up 6.5%. The fact that the $NDX-E (equal weighted Nasdaq 100 Index) closed down -0.17% while the $NDX closed up a solid +0.66% highlights the effect that one or a just few of the top weighted components can have on that well watched index. The AAPL boost to the NDX was also evidenced by the fact that only 40 of the 105 stocks in the Nasdaq 100 close the day positive, with 64 declining issues & one stock closing flat.

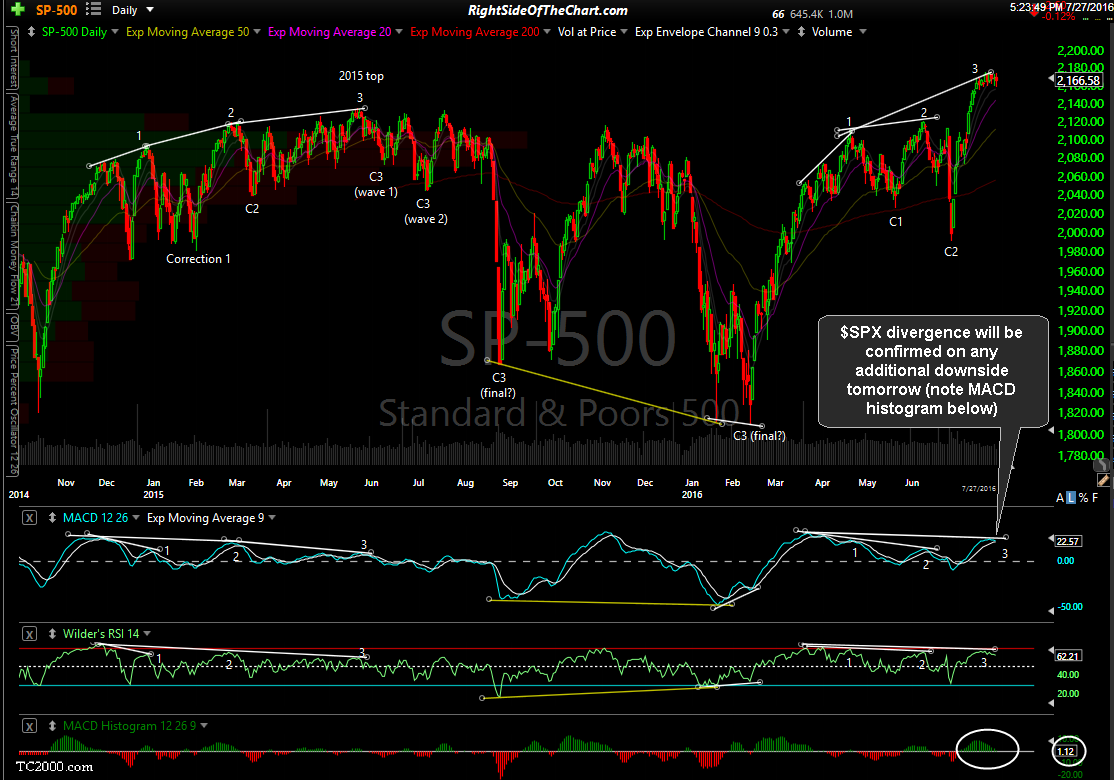

One thing that stood out to me today, besides the underperformance of the $SPX & $NDX-E relative to the $NDX, is the fact that the $SPX is now poised to confirm that large divergent high that I’ve been highlighting over the last several weeks. In fact, just one more red close this week is likely to do the trick. It should also be noted that any additional downside in the SPX/SPY will also trigger the recently highlighted pending sell signals on the 60-minute time frame… close, but not there just yet.

GLD has yet to give up the 125.47 support level but might offer an objective entry on a tag of this resistance zone which is defined by the July 12th gap. Both gold & the miners still look poised for a multi-month correction & GDX/NUGT may still be added as an official short trade idea soon but I’m still waiting patiently for an idea entry, ditto for any broad market shorts.