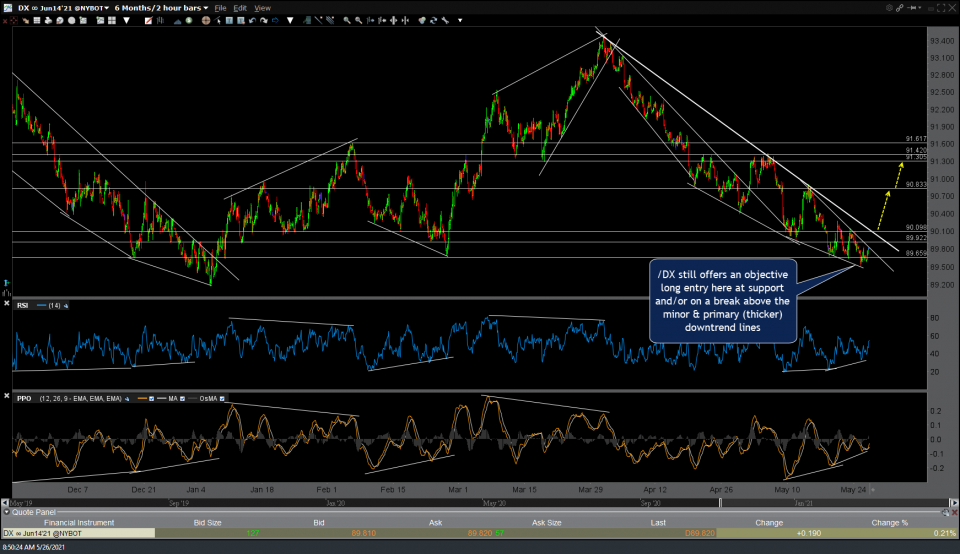

/DX (US Dollar Index futures) still offers an objective long entry here at support and/or on a break above the minor & primary (thicker) downtrend lines on this 60-minute chart.

With gold being a Dollar-sensitive asset, the negative divergences on the 60-minute chart of /GC (gold futures) raise the odds of a correction back down to the primary (thicker) uptrend line and/or 1845ish support level.

Likewise, a solid break of this 60-minute uptrend line would likely take /SI (silver futures) down to the 26.80 support level.

ETF & ETN proxies for trading gold, silver, and/or the US Dollar are: GLD, SLV, UUP as well as GDX (gold miners ETF), SIL (silver miners ETF), and various inverse & leveraged ETFs.