/GC gold futures (or GLD) offers an objective long entry here just below the 2028ish support and/or on a solid recovery back above it. A long in gold, silver, and/or the miners could also be viewed as an indirect hedge to any stock index shorts as a decent rally in the precious metals would most likely coincide with a rally in EUR/USD (which, in turn, would likely be a tailwind for the highly correlated stock market). 60-minute chart below.

/SI silver (or SLV) also offers an objective long enter here just a hair below the 22.75ish support (and/or on a solid recovery back above it) with positive divergences on this 60-minute time frame. To be long/bullish gold & silver is also to be long/bullish the gold & silver mining stocks (GDX, SIL, etc.).

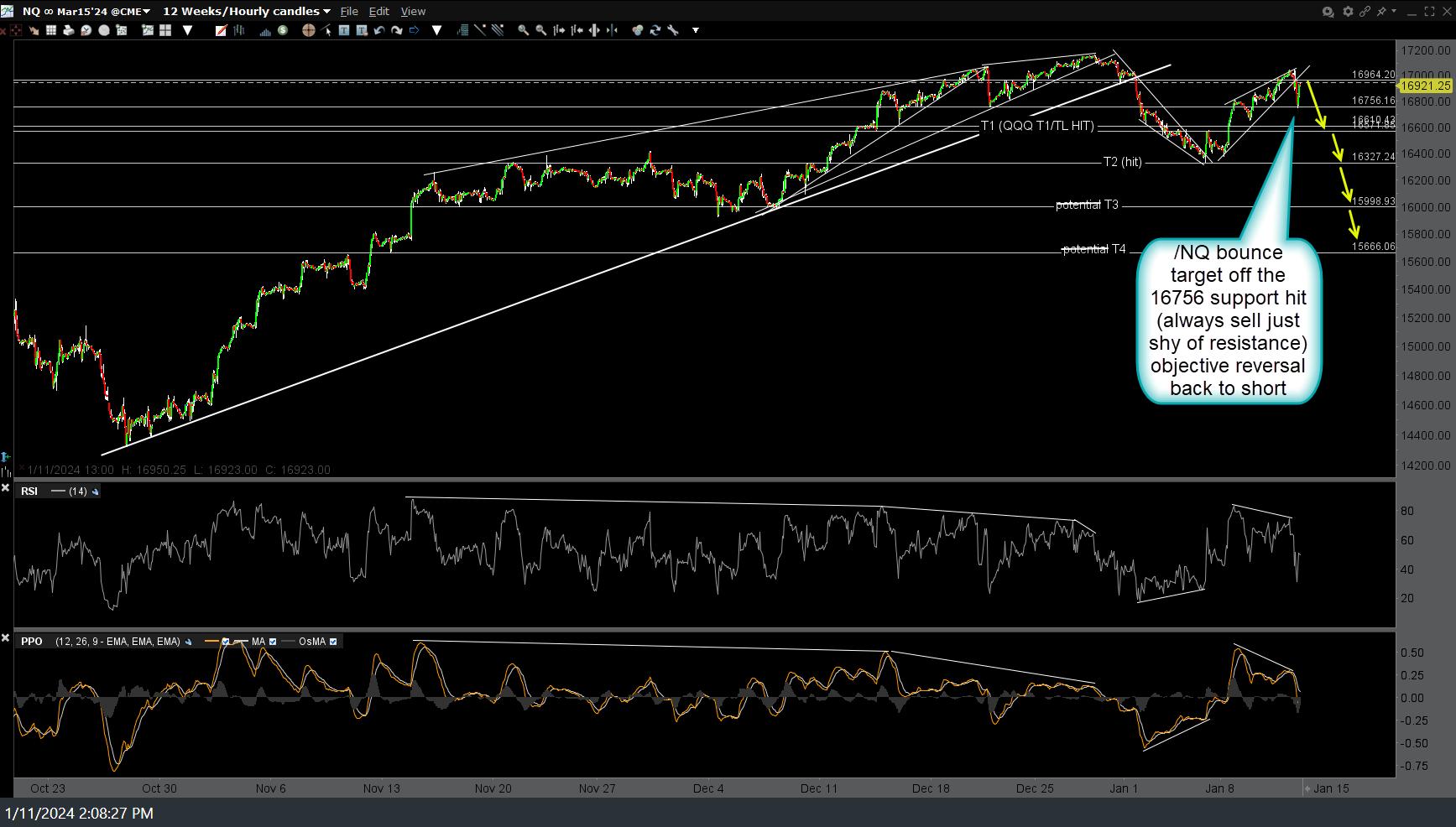

On a somewhat related note, since I typically only post active trading opps in the comment section below the home page posts or while recording videos, I did just recently post the following update on the /NQ active bounce trading opp that I shared earlier today (when /NQ & QQQ hit today’s low earlier). /NQ is currently trading at 16942 as I type, just shy of the 16964 bounce target for that trade. As such, /NQ (or QQQ) still offers an objective short entry, add-on, or re-entry as this time. (Previous & updated 60-minute /NQ charts below).

Therefore, this is an objective level for active traders to reverse from long back to short as would any additional drift up to backtest that 60-minute bearish rising wedge pattern from below. As with gold, silver, or GDX, the TSLA (and/or AAPL) long trade ideas could also be taken as an indirect hedge to any index shorts, in case the $NDX punches back above the top of that wedge.