I had intended to cover the charts of gold, the Euro, & the US Dollar in this morning’s video but left them out. Gold remains in a near-term uptrend although 1759.75 is a potential pullback target on /GC (gold futures) should this uptrend line get taken out along with the uptrend line in /E7 & downtrend line in /DX. Should gold continue to rally, the next target comes in around 1817.

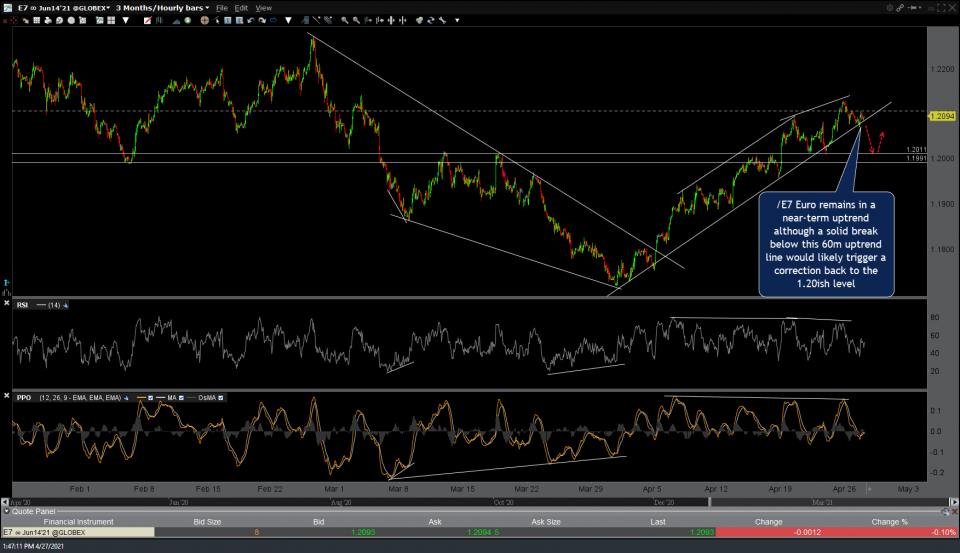

/E7 Euro remains in a near-term uptrend although a solid break below this 60-minute uptrend line would likely trigger a correction back to the 1.20ish level. Note the similarity between the charts of the Euro (below) & gold (above), highlighting the strong positive correlation between the two, as well as the inverse correlation between gold & the US Dollar (last chart below).

/DX (US Dollar Index futures) remains in a near-term downtrend although a solid break above this 60-minute downtrend line could spark a rally up to the 91.305 & 91.617 resistance levels. Until & unless these trendlines are clearly taken out, the near-term trend remains bullish in gold & the Euro, bearish in the US Dollar.