SLV managed to trade & close above the key 14.70ish resistance level on Wednesday & Thursday but so far today, prices have fallen back below… a bearish sign for SLV, should it not be able to quickly regain & close back above. With GLD still below comparable key resistance, I would put odds on the fact that Wednesday’s breakout will prove to be a whipsaw signal. In the previous update on SLV & GLD a couple of days ago, I had stated that “SLV has managed to regain the recently highlighted 14.70 key resistance level although a solid close above that level & especially a few more days trading back above would help to strengthen the bullish case, especially with all the recent whipsaw signals lately.”

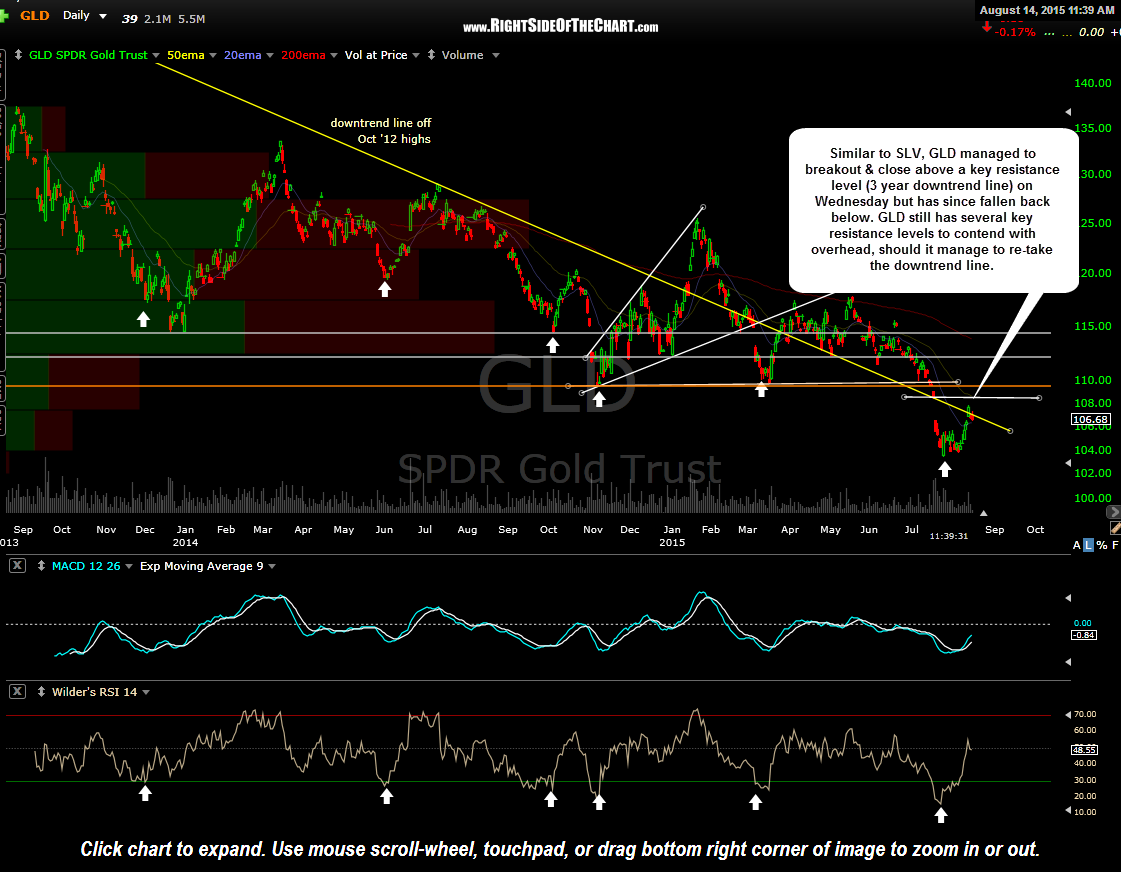

In that update I had also mentioned that the more “precious” of the two PM’s (gold/GLD) was also approaching key resistance while the miners (GDX) had actually hit key resistance at the time, where a reaction was likely. Similar to SLV, GLD managed to breakout & close above a key resistance level (3 year downtrend line) on Wednesday but has since fallen back below. GLD still has several key resistance levels to contend with overhead, should it manage to re-take the downtrend line.

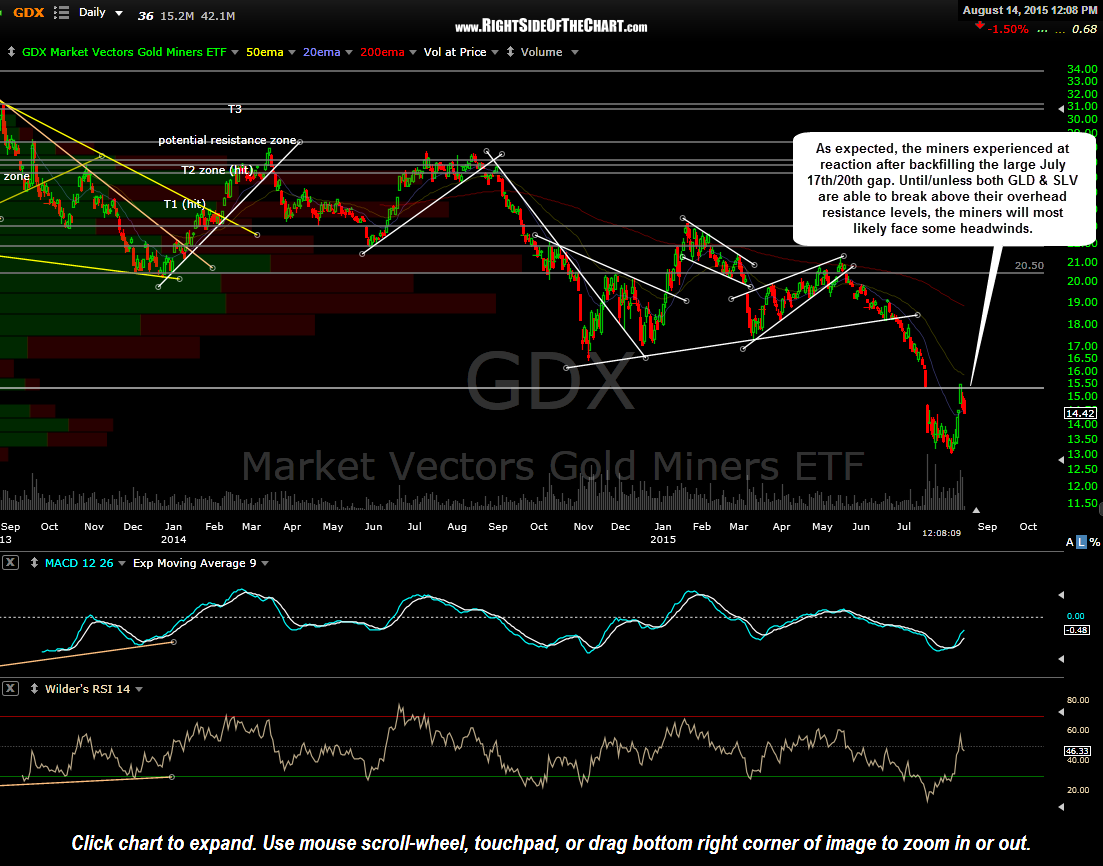

Also mentioned in that previous update as likely to occur, the miners did indeed pullback after backfilled that big gap and with GLD & SLV both having failed to break & hold above resistance we could see another leg down in the precious metals & miners. I was able to make a couple of successful trades on the miners, long & short, this week but at this time, I’m neutral to slightly bearish on the PM sector but have no desire to take any new positions at this time.

In this post on Monday, a breakout in GPL (Great Panther Silver) was highlighted along with a bullish breakout in SLV above a descending price channel (which was the impetus for the recent rally in Silver & the mining sector). GPL was mentioned as one of the more promising trading opps in the mining sector as listed as an unofficial trade idea. GPL went on to rally an impressive 36% in less than 3 day following that post (26% gain from the stated entry trigger price of 0.39), making a perfect kiss of the aforementioned downtrend line (one of the targets) before reversing sharply.

It is far from a coincidence that the both the tag of that primary downtrend line & GDX running into major resistance at the top of the gap on Wednesday coincided with each other. I track numerous gold & silver stocks and quite a few had also hit a key resistance level at the same time GDX backfilled that gap. GPL still holds potential for a longer-term trend trade or investment should it go on to break above that downtrend line if & when gold, silver and the mining sector take out their respective overhead resistance levels.

- GPL daily Aug 10th

- GPL daily Aug 14th