Bullish divergences continue to build as GLD works it way down within this contracting price channel with a buy signal to come on a break above the channel and/or either of the yellow lines while SLV may or may not need one more thrust down to put in a larger divergent low (vs. the current DL from Nov 23rd). Watching SLV along with GLD & GDX for a possible official long trade on the miners. 60-minute charts:

- GLD 60-minute Dec 5th

- SLV 60-minute Dec 5th

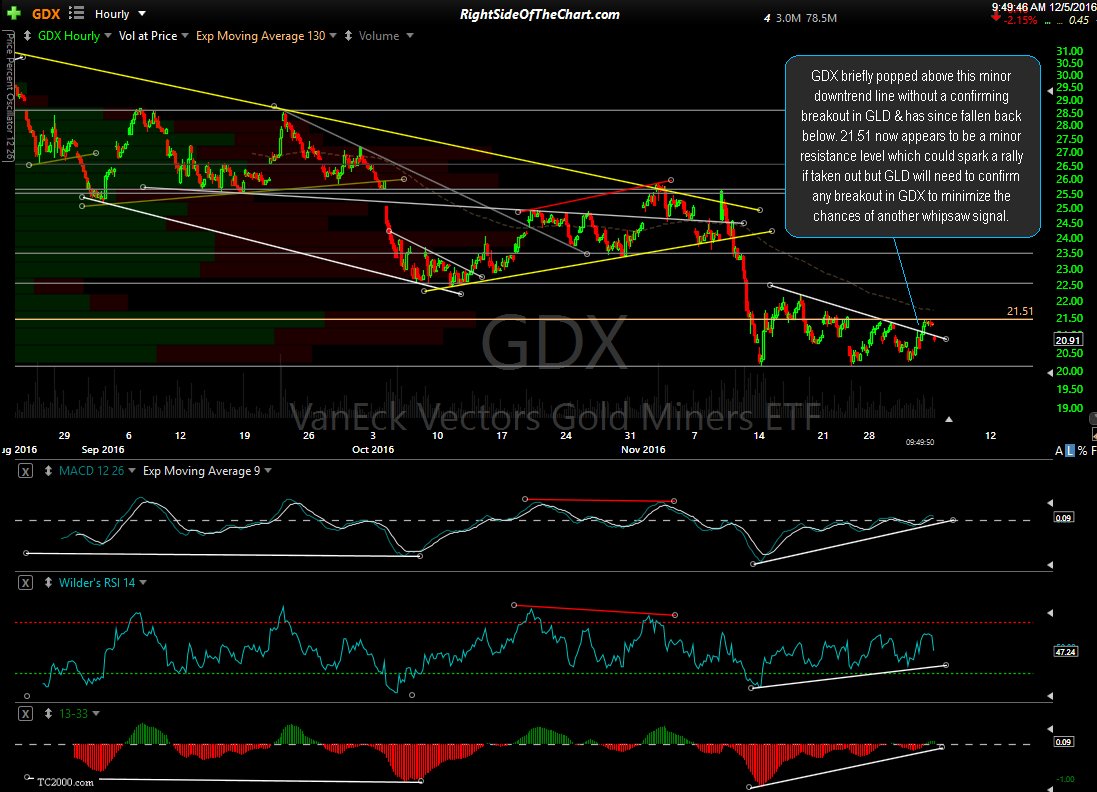

GDX briefly popped above this minor downtrend line without a confirming breakout in GLD & has since fallen back below. 21.51 now appears to be a minor resistance level which could spark a rally if taken out but GLD will need to confirm any breakout in GDX to minimize the chances of another whipsaw signal.

Bottom line: It still appears that a bottom may be close in gold, silver & the precious metal mining stocks which may very likely occur along with a top in the US Dollar. Scaling into a position in the PM sector still seems objective as although the trend remains bearish, the charts indicate that at least a tradable bottom appears near. One could also be on watch for a breakout in the metals & miners (all three, especially gold & silver) to establish a full long-side swing trade position. If I decide to add GDX as an official trade idea soon, price targets & a suggested stop-loss level will be provided.