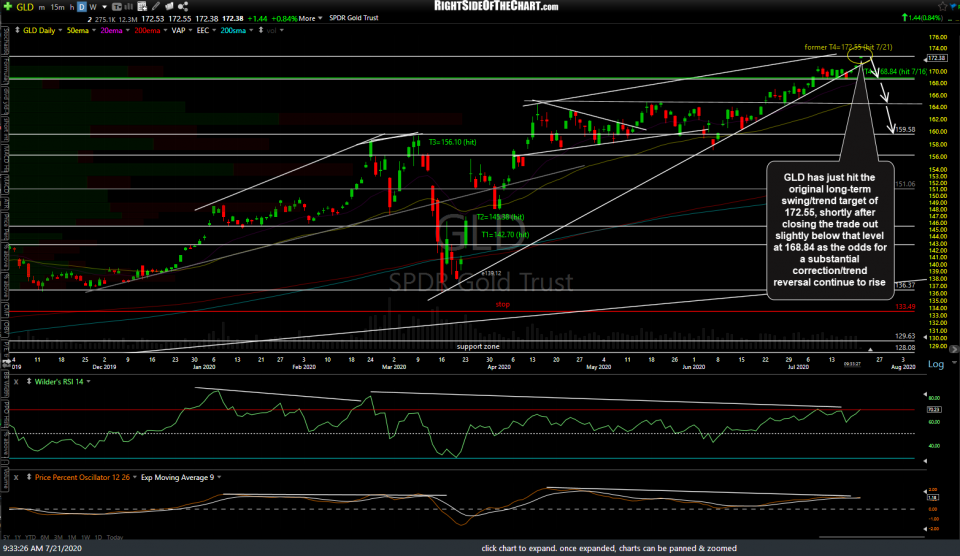

GLD (gold ETF) has just hit my original long-term swing/trend target of 172.55, shortly after closing the trade out slightly below that level at 168.84 on Thursday as the odds for a substantial correction/trend reversal continue to rise.

At the same time gold runs into long-term resistance, the $US Dollar is also approaching long-term support via the primary uptrend line off the early 2011 lows as shown in this weekly chart of $USD (US Dollar Index). While I remain longer-term bearish on the Dollar, it appears that the odds for a least a tradable bounce & near-to-intermediate-term trend reversal in the Dollar, which is likely to put pressure on gold, are elevated at this time. Long-term (20-year) weekly chart of $USD below.

Zooming down to the 60-minute time frame in order to zero in on exactly when the near-term trend in the Dollar might flip from bearish to bullish, it appears that /DX ($USD Index futures) offers an objective, although somewhat aggressive entry here around the 95.676 support with the next objective entry or add-on to come on a solid break above the downtrend line.

Looking at the 60-minute chart of /GC (gold futures), with GLD just hitting my original long-term target of 172.55, I’m on watch for a short entry, quite likely on a break below this minor uptrend line with an additional sell signal to come on a solid break below the 1817.70ish support level.

Bottom line: Gold remains solidly entrenched in a primary uptrend (bull market) as well as a bullish short-term trend with zero sell signals at this time while the $US Dollar remains in a downtrend without any buy signals. However, with the Dollar approaching support while gold is trading around long-term resistance, it appears that the R/R for new long positions is no longer favorable and at the very least, this would be a good time to book partial or full profits and/or tighten up stops on any long-term positions in gold or the mining stocks while flexible traders (i.e.- those as comfortable with shorting as going long) might be on the lookout for the aforementioned sell signals for a potential swing short on the metals and/or miners.

There are numerous proxies & related trades to play a pullback in the metals and/or a bounce in the Dollar with various precious metals & mining stocks ETFs, individual mining stocks, currency ETNs , futures, etc… Should the case for a reversal in the metals, miners, & currencies (US Dollar & Euro) continue to firm up, I will follow up with additional analysis & trade ideas. As of now, I’m watching to see how the US Dollar & gold handle these levels.