I’m still leaning towards more downside in gold & the mining stocks although my conviction still isn’t very strong as as such, GDX is not an official trade idea at this time. A break & close below this secondary uptrend line on this 60-minute chart of GDX in conjunction with a break below the comparable uptrend line on the GLD 60-min chart would likely bring GDX to any or all of these minor support levels.

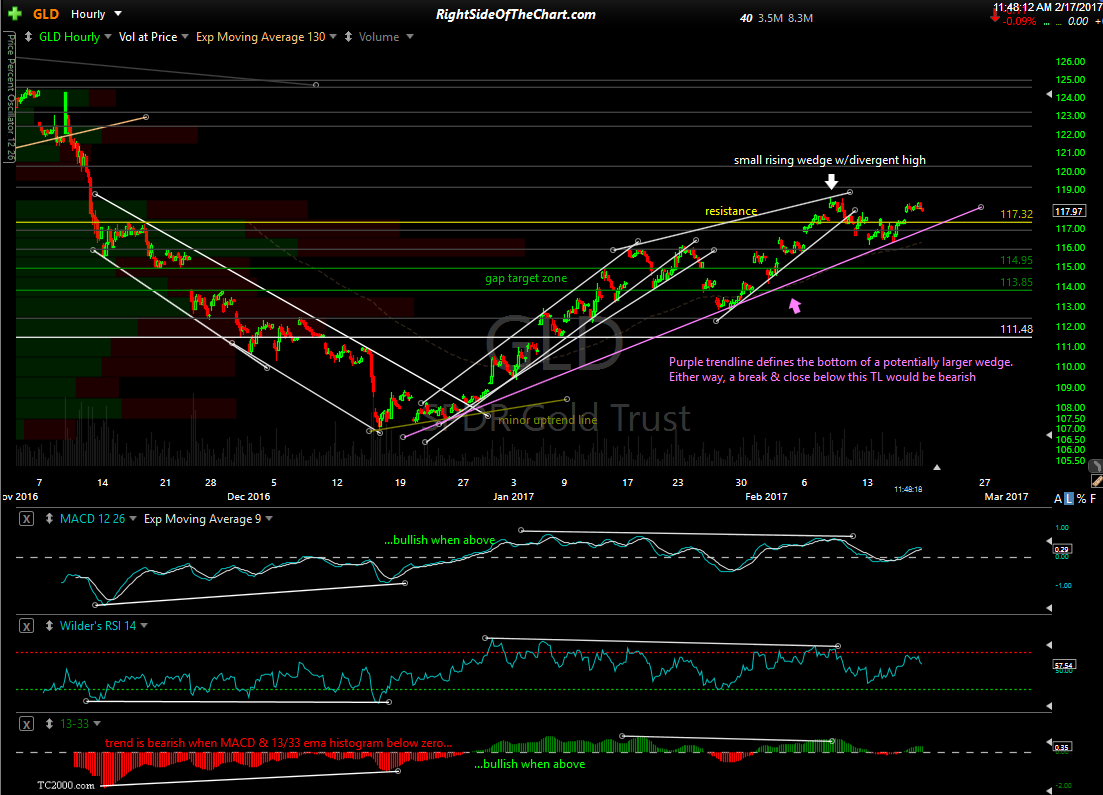

Looking at the 60-minute chart of GLD below, following the recent divergent high & breakdown below the minor (white rising wedge pattern), I’m keeping an eye on the purple uptrend line which appears to form an even larger rising wedge pattern (along with the same upper-most white trendline of the smaller wedge). The 60-minute trend indicators on GLD have been whipsawing lately as GLD has traded mostly sideways to slightly higher over the last few weeks.

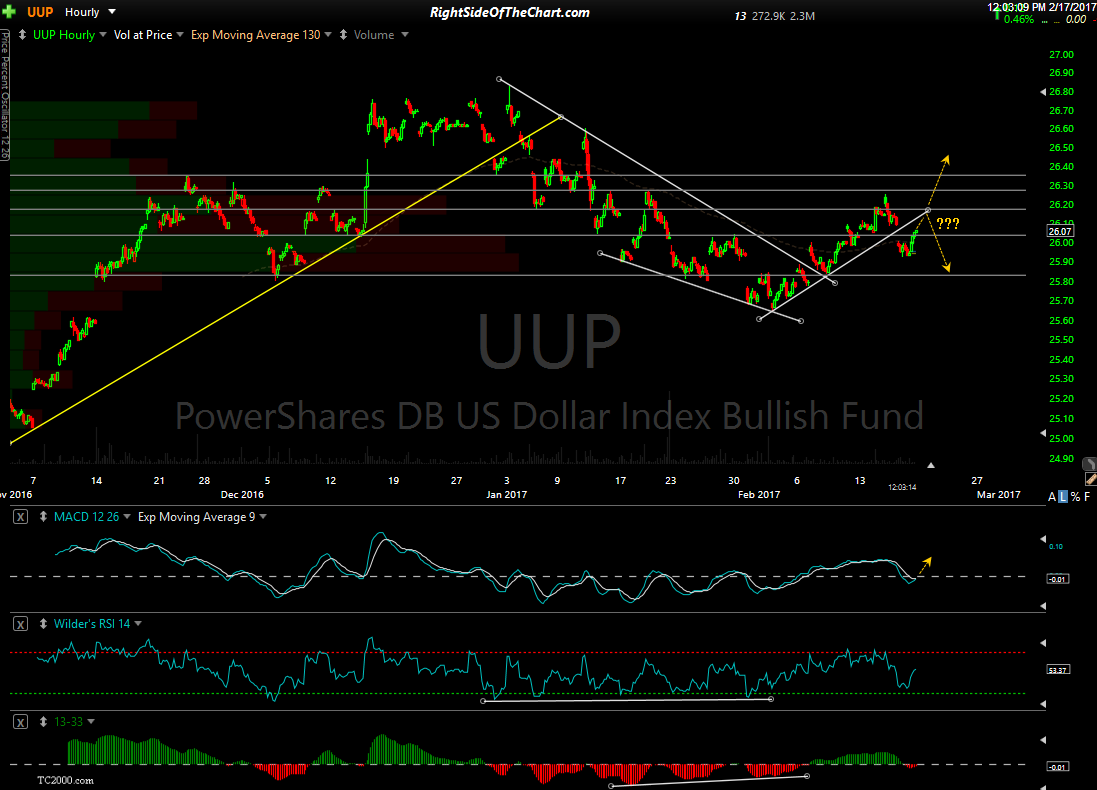

Where GLD & GDX go from here will likely depend largely on the US Dollar. Since my last video update covering UUP (US Dollar ETP), it did go on to reverse off my 3rd price target, going on to break down below the minor uptrend line that was highlighted in that video, thereby contributing to the recent, relatively small bounce in GLD. Again, my degree of confidence on where the dollar, metals & miners are headed in the near-term isn’t very high at this time but I’ve had several requests for updates & just wanted to pass along what I’m watching.