A quick update on a couple of the things that stand out this morning. First, GLD (Gold ETF) has gapped down below the purple rising wedge pattern. I still don’t care to short it & just plan to watch to see if it can regain the wedge shortly or for the next objective long entry if it moves lower from here.

As gold & the broad markets often move inversely, that relationship held true today with the broad markets gapping up at the open with the gap being largely attributed to Trump’s speech last night, which was apparently lacking in details from what I can gather. Hopium rallies & gaps, especially those that occur in a very low-volume market can be erased just as quick as they happen & my expectation is that today’s gap in the broad market, much like the large gap in the semiconductors, which was nearly completely faded so far on very impulsive selling, will also be erased & then some in the very near future.

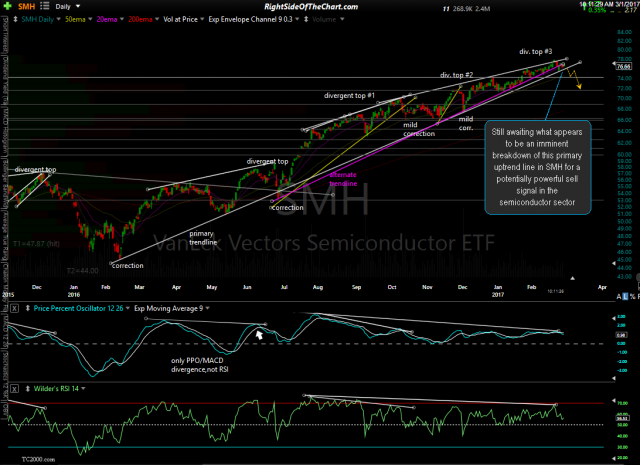

The semiconductors are still on watch as a potential official trade idea & still look to be one of the more promising sectors for a multi-week to multi-month swing short as soon as we get confirmation via an impulsive break & close below the primary (white) uptrend line on the daily chart below. I’ve also included as 60-minute chart of SMH highlighting a breakdown & backtest, where SMH was impulsively rejected today, fading nearly all of its large gap & I would be surprised to not see the semis close red today.

- SMH 60-min March 1st

- SMH daily March 1st