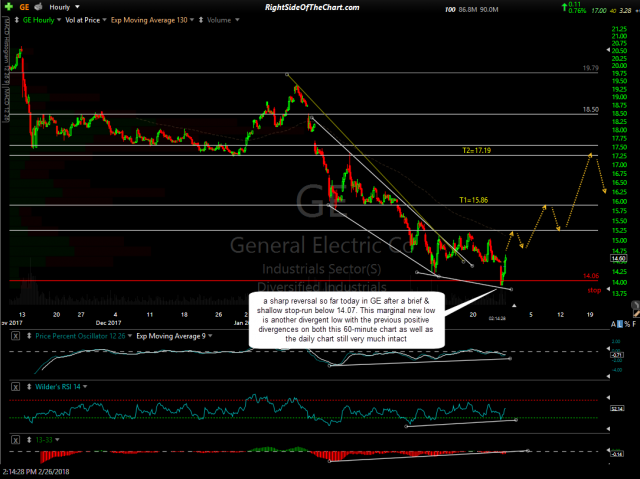

The GE (General Electric Co.) swing trade briefly clipped the suggested stop of any move below 14.09 today, falling less than 1% below that level before reversing, with the stock steadily moving higher since. As the suggested stop was hit, accounting for a loss of 5% on the trade, GE will now be moved to the Completed Trades archives. Previous & updated daily & 60-minute charts below:

- GE daily Feb 14th

- GE daily Feb 26th

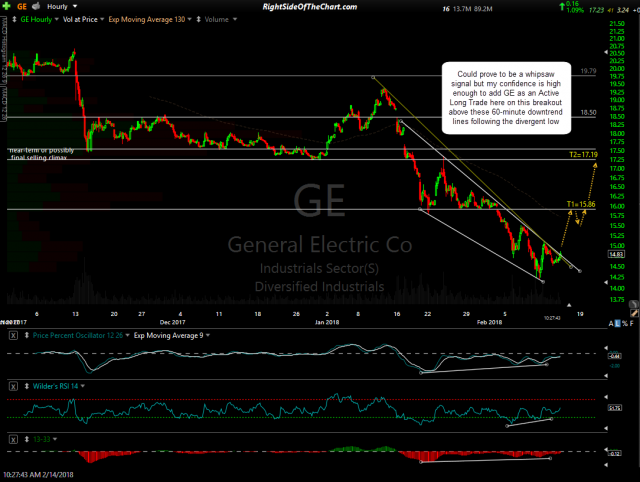

- GE 60-minute Feb 14th

- GE 60-minute Feb 26th

click on first chart above to expand, then click anywhere on the right of each expanded chart to advance to the next image

I have some thoughts on GE which were posted earlier in the trading room (pasted below) along with some additional thoughts on swing trading in general, in particular my preferred method of setting my stops based on my preferred use of a 3:1 R/R or better on my swing trades. The use of stops are an essential part of trading & investing. Trading styles, typical holding periods, percentage gains for profit targets & loss allowances will vary among swing traders & investors. As such, the price targets & suggested stops provided on RSOTC are just that; general suggestions based on the outlook for the stock with the suggested stop typically calculated using a risk-to-reward ratio of 3:1 or better. Quite often, the stops are further refined based on the technicals, i.e.- set slightly below a support level or trendline which roughly aligns with the R/R for that trade.

Sometime around the start of the second half of 2017 & so far into 2018, I’ve noticed an unusually large number of the official trade ideas on the site that experienced very brief & shallow stop-raids where the position would dip very slightly below the suggested stop, only to reverse from there with the majority of those trades going on from there to hit one or all of the price targets as the charts had indicated when the trade was entered.

In the past I would specify many of the stop parameters of a trade to be based on a daily close below the suggested stop (or on a 60-minute close below, if the trade was based off the 60-minute time frame vs. the daily charts) vs. any intraday move below the stop level. I moved away from last year as it seemed to create confusion for some but a key part of trading is adapting & modifying your trading strategies to current market conditions. As such, going forward I may return to using suggested stops on various closing time periods (i.e.- a daily close below $XX.XX vs. any move below $XX.XX). I will also consider using an R/R around 2:1 or 2.5:1 or better to allow for a little more room on the stops relative to the price targets as, again, many of the trades that experienced brief & slight stop-runs over the past year or so have gone on to play out as the charts indicated, hitting one or all profits targets & then some in many cases. As always, use stops that are commensurate with your own risk tolerance/loss allowance & trading style.

Although GE will now be removed from the Active Trades category, with all related posts on this trade archived indefinitely in the Completed Trades category, here are my thoughts as per my reply in the trading room early today:

Officially, GE is stopped out (I had mentioned it earlier today at the bottom of this trading room reply): https://rightsideofthechart.com/members/irawood/activity/33094/#acomment-33095

However, FWIW, I still like it as a bottoming play. It’s been a very busy day for me so far as I’m working on some back-end (programming) items & improvements for the site so I’ll post an official update & move the GE trade to the Completed Trades archives asap but following that very brief run below the suggested stop, GE has snapped back (although still trading red) & the charts still show potential as a bottoming play here.

Your call if you want to give it some more room or cut it loose & wait for the charts to firm up a bit more with some decent evidence that a bottom may be in. Of course, that will entail buying back in at a higher price if so. You might also want to see if the stock can close the day green today. If so, I think that would be quite bullish but if not, maybe best to let it go.