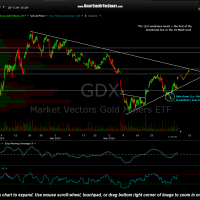

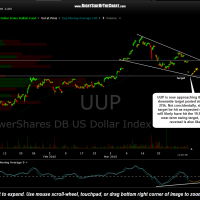

GDX is approaching the initial swing target of the 19.90ish level while the $USD (UUP) also approaches its initial downside swing target. As such, a reaction (consolidation and/or pullback) will be likely on the initial tag of these targets. Should the 19.90ish horizontal resistance level in GDX get taken out, the top of the symmetrical triangle pattern shown on this 60-minute chart is likely to act as resistance on the initial tag.

- GDX 15 minute April 6th

- GDX 60 minute April 6th

- UUP 60 minute April 6th

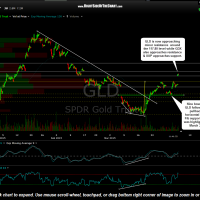

- GLD 60 minute April 6th

Adding to the case of at least a near-term pullback in the miners is the fact that GLD is also approaching a minor resistance level that comes in around 117.80. GLD has rallied sharply since the shallow correction to the dual horizontal price support/Fib support levels which were highlighted back on Tuesday. As such, more active traders might opt to book partial or full profits on GDX or NUGT around the 19.84 area (I typically book profits just shy of the actual resistance level) or at the very least, consider raising stops to protect profits at this time.