/E7 (Euro futures) has hit the 1.1208 price target where the odds of a reaction are elevated before a resumption of the uptrend. Previous & updated 60-minute charts below. Click on first chart to expand, then click on right of chart to advance.

- E7 60m Oct 1st

- E7 60m Oct 2nd

- E7 60m Oct 10th

- E7 60m Oct 17th

- E7 60m Oct 18th

- E7 60m Oct 21st

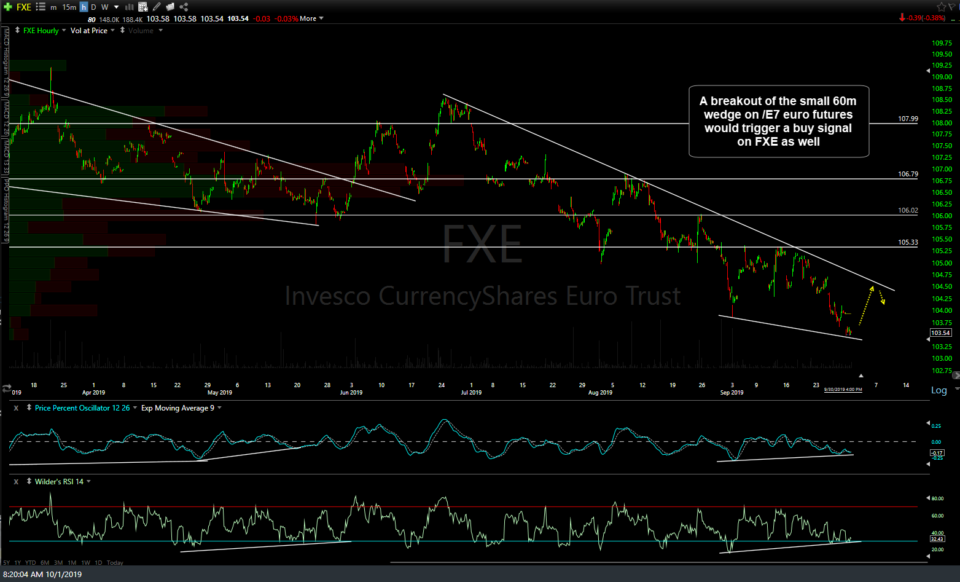

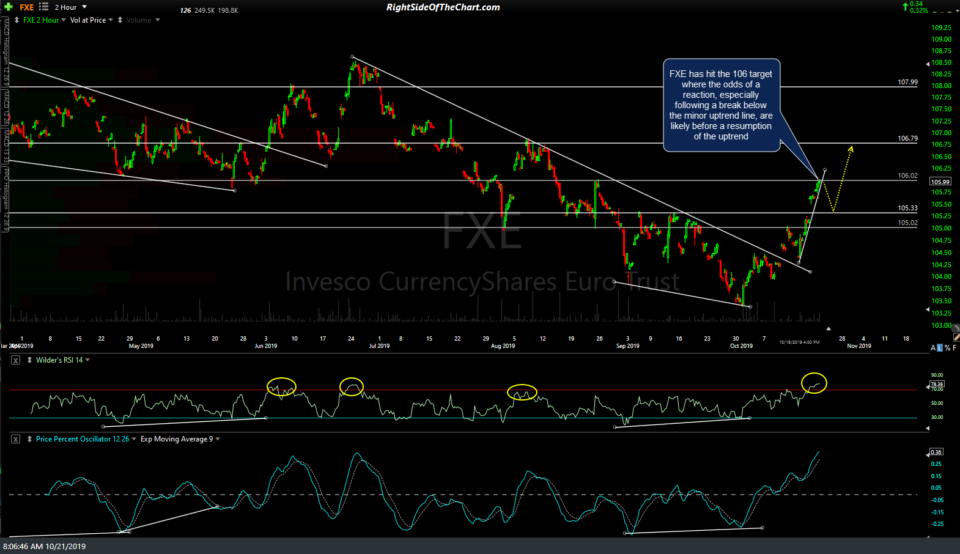

Likewise, FXE (Euro ETN) has hit the 106 price target where the odds of a reaction, especially following a break below the minor uptrend line, are likely before a resumption of the uptrend. Previous & updated 60 & 120-minute charts below.

- FXE 60m Oct 1st

- FXE 120m Oct 10th

- FXE 120m Oct 21st

I had also highlighted UDN (US Dollar Bearish ETF) as another proxy for a long on the Euro which is effectively a short on the US Dollar. Far from coincidence, UDN has also hit my 20.64 price target at the same time the Euro trading proxies above have hit their comparable targets.

- UDN daily Sept 27th

- UDN daily Oct 21st

Just to be clear, while the odds for a reaction in the US Dollar & Euro are elevated at this time, that does not mean that they will or must pull back. It still appears that the US Dollar (Euro) may have put in a major top (bottom) although there isn’t enough evidence in the charts to say that with the highest degree of confidence just yet. As such, active traders might opt to book partial or full profits here and/or tighten up stops while longer-term swing & trend traders holding out for any of the additional targets might continue to periodically raise stops while riding out the counter-trend pullbacks.

Regarding the other official & unofficial trade ideas, for the most part, there aren’t any material changes to the technicals or what I’m trading/watching right now. My focus remains on alternative assets that have little to no correlation with the major stock indices such as the currencies above, Bitcoin, natural gas, coffee, cannabis stocks, etc.. as the major indices are likely to experience opening gaps as we have a slew of potential market-moving earnings reports this week including MSFT after the market close on Wednesday followed AMZN & INTC on Thursday, just to name a few.