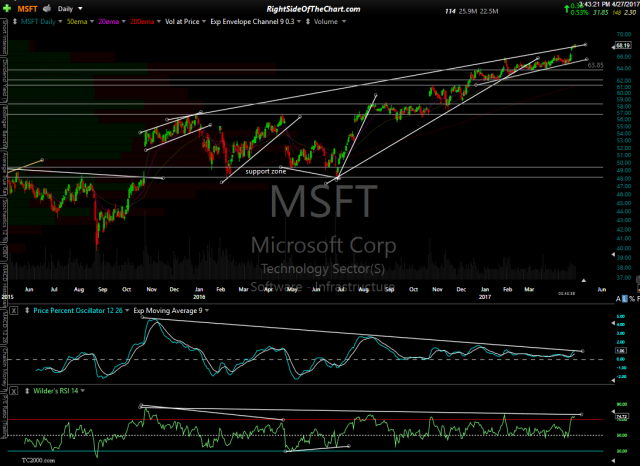

Just a heads up for those not aware, 3 of the 5 FAAMG stocks (i.e.- the leading stocks that have been doing most of the heavy lifting in the Nasdaq 100 in recent months) are scheduled to report earnings after the close today. Amazon (AMZN), Alphabet (GOOG/GOOGL) and Microsoft (MSFT) will be report after the bell which all but assures some volatility in the after-hours trading session today as well as a likely gap at the open in one direction or the other. As such, risk adverse traders might consider reducing or hedging their exposure to the market. One other consideration might be to temporarily suspend or widen stops on any positions that are trading close to those stops until any post- AMZN/GOOG/MSFT noise has subsided during the regular trading session tomorrow. Daily charts with some key technical levels for each below:

- AMZN daily April 27th

- GOOG daily April 27th

- MSFT daily April 27th