The Euro, which is by far the largest component of the US Dollar index at a weighting of 57.6%, appears poised to rally if E7 (Euro futures contract) can impulsively move back above the 1.1010 level. If so, that would likely spark a short-covering rally with a thrust up to the primary downtrend line off the June 24th highs & quite possibly, a breakout above that downtrend line (following a reaction off at least the initial tag), which would trigger a much more powerful buy signal on the Euro/sell signal on the US Dollar, if so.

As with any trade setup, a setup is just that: an untriggered setup/potential trade pending an objective buy or sell signal. There are several ways to capitalize on a rally in the Euro which would equate to a correction in the US Dollar. Other than trading Euro futures, one could go long the Euro ETN, FXE, short the US Dollar ETN, UUP, short US Dollar futures, /DX, long UDN (bearish or inverse US Dollar ETF), etc. Some of those charts, including potential targets (unadjusted) are below.

- UDN 60m Sept 27th

- UDN daily Sept 27th

- UUP weekly Sept 27th

- EUR-USD weekly Sept 27th

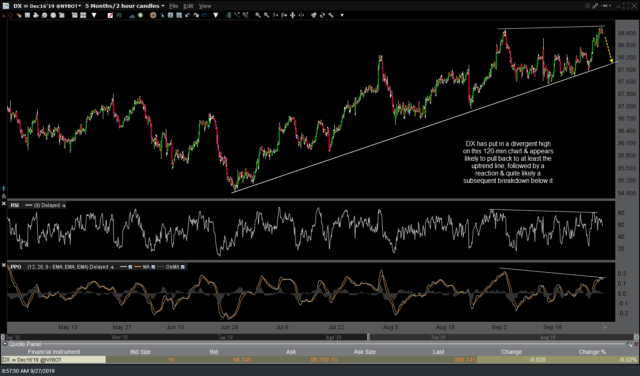

- DX 120m Sept 27th

- DX 60m Sept 27th

click on first chart above to expand, then click on right of each expanded chart to advance

I’m passing these along as unofficial trade ideas for now although keep in mind that currencies move in relatively small percentage moves and as such, one could either trade the futures contract, which have a fair degree of leverage, or use an increased position size on the forex ETFs (UUP, UDN, FXE, etc.), maybe 2x – 3x a typicaly position size due to the below-average volatility & gain/loss potential.