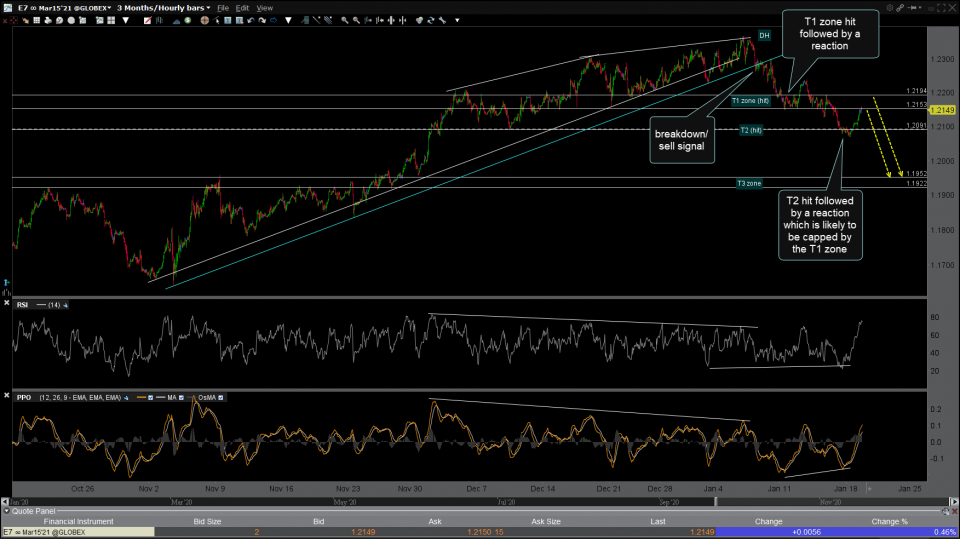

/E7 (Euro futures) has hit T2 (second price target) followed by the typical reaction so far. As support, once broken, becomes resistance, the most likely end-point for this counter-trend bounce in the Euro is the first target zone of 1.2153-1.2194. Should the Euro reverse soon & take another leg down towards the T3 zone (1.952-1.1922), that will most likely correlate with another leg down in Euro/Dollar sensitive assets such as equities, crude oil, industrial commodities, and possibly gold (although at times gold will rally when equities fall as a flight-to-safety trade). Previous & updated 60-minute charts of /E7 outlining the breakdown & reactions off each target so far posted below.

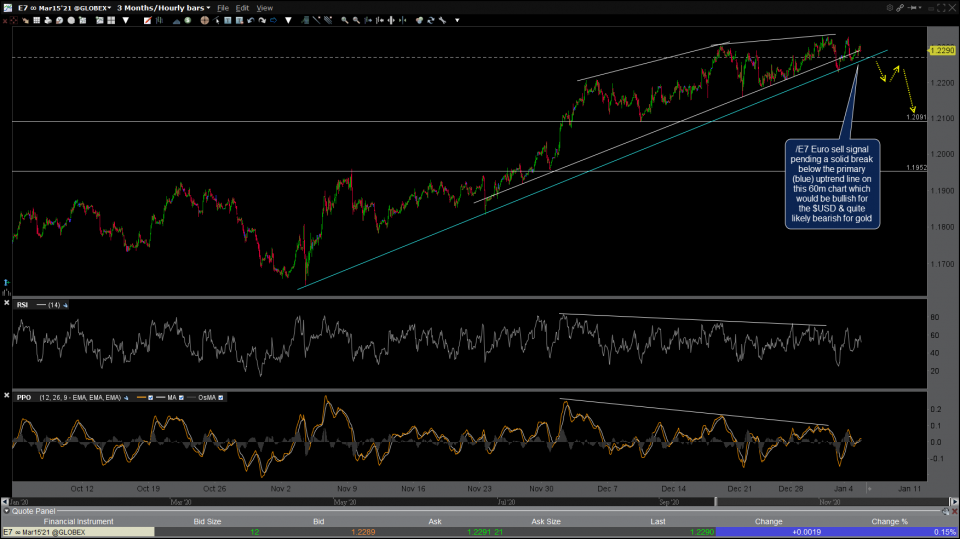

- E7 60m Dec 5th

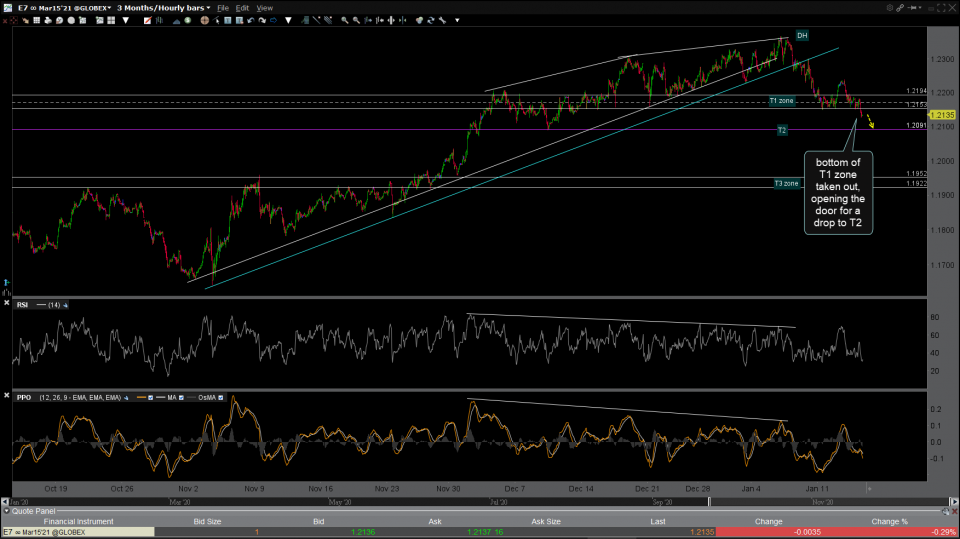

- E7 60m Jan 8th

- E7 60m Jan 14th

- E7 60m Jan 19th

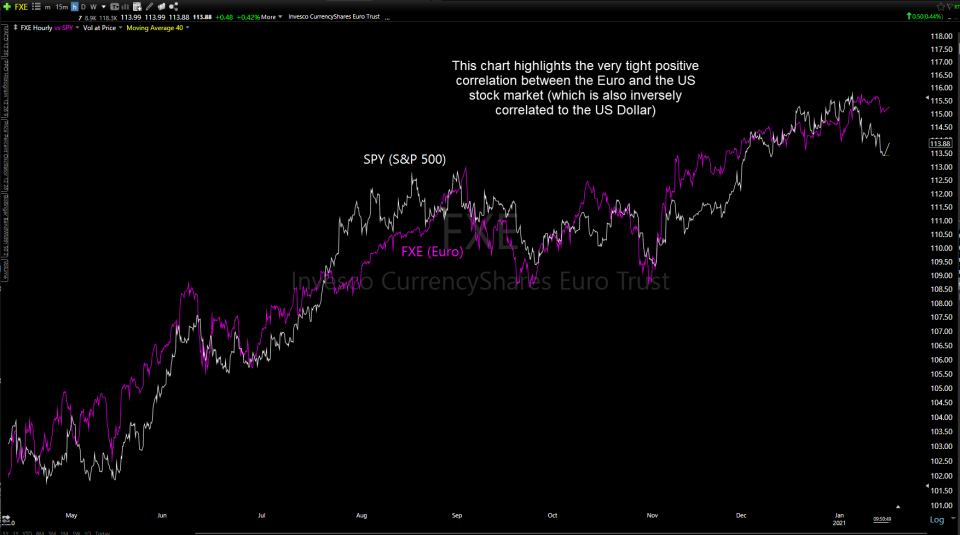

The chart below highlights the very tight positive correlation between the Euro and the US stock market (which is also inversely correlated to the US Dollar).