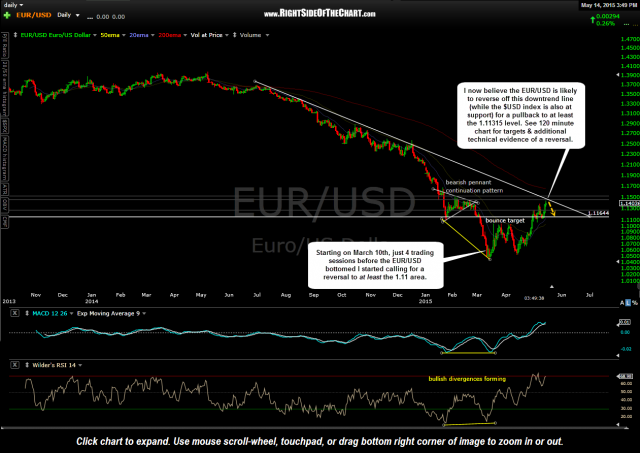

Starting on March 10th, just 4 trading sessions before the EUR/USD bottomed, I started calling for a reversal to at least the 1.11 area (first chart below). I now believe the EUR/USD is likely to reverse off this downtrend line (while the $USD index is also at support) for a pullback to at least the 1.11315 level. With the Euro comprising over half of the US Dollar Index (a 57.6% weighting), the updated daily & 120-minute charts below only help to affirm my case for a substantial bounce in the US Dollar & a correction in the Euro. If so, a substantial bounce in the $USD is likely to have an impact on dollar sensitive assets such as precious metals & commodities.

- EUR-USD daily March 10th

- EUR-USD daily May 14th

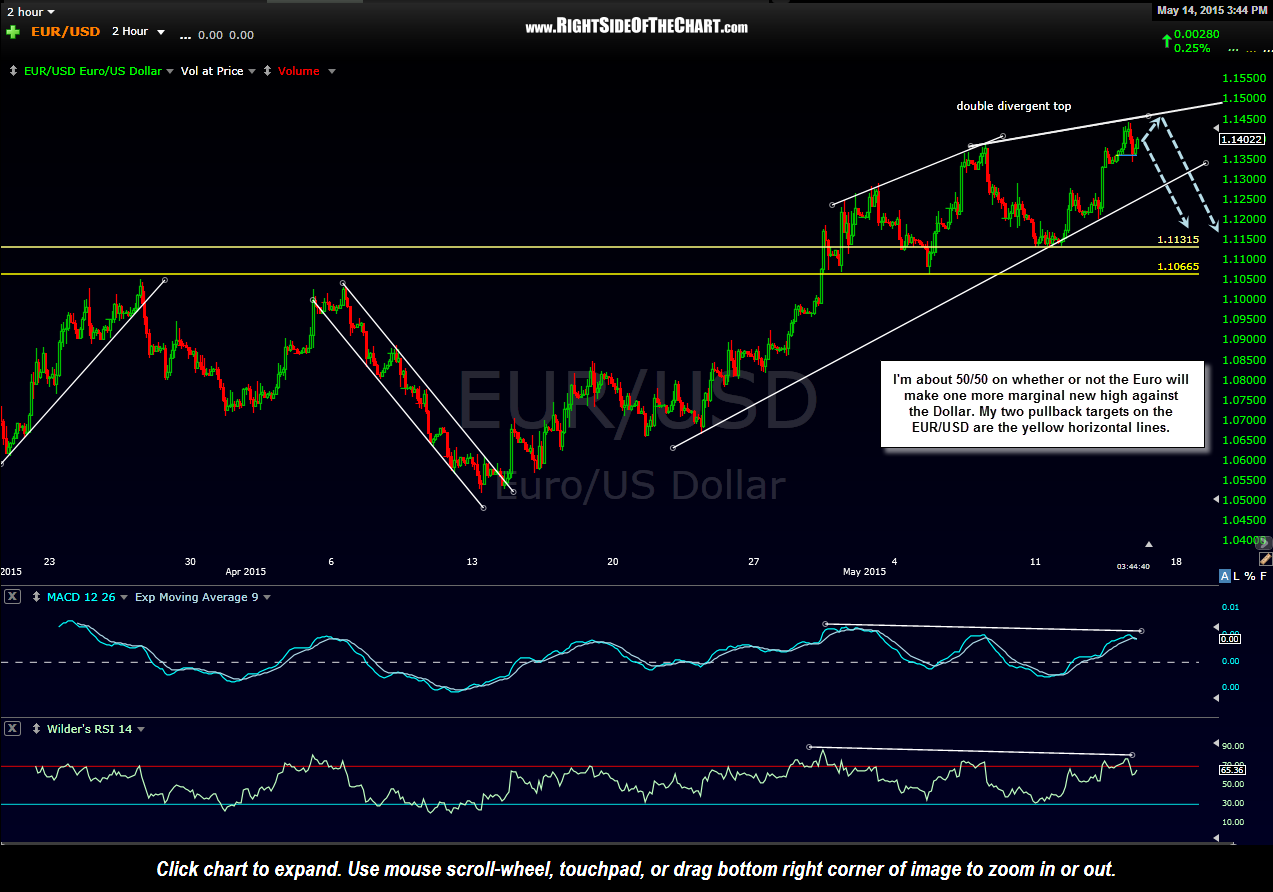

Zooming down to the 120-minute time frame on the Euro/US Dollar pair, I’m about 50/50 on whether or not the Euro will make one more marginal new high against the Dollar. Regardless, it would appear that any additional upside on the Euro at this point is limited. My two pullback targets on the EUR/USD are the yellow horizontal lines.