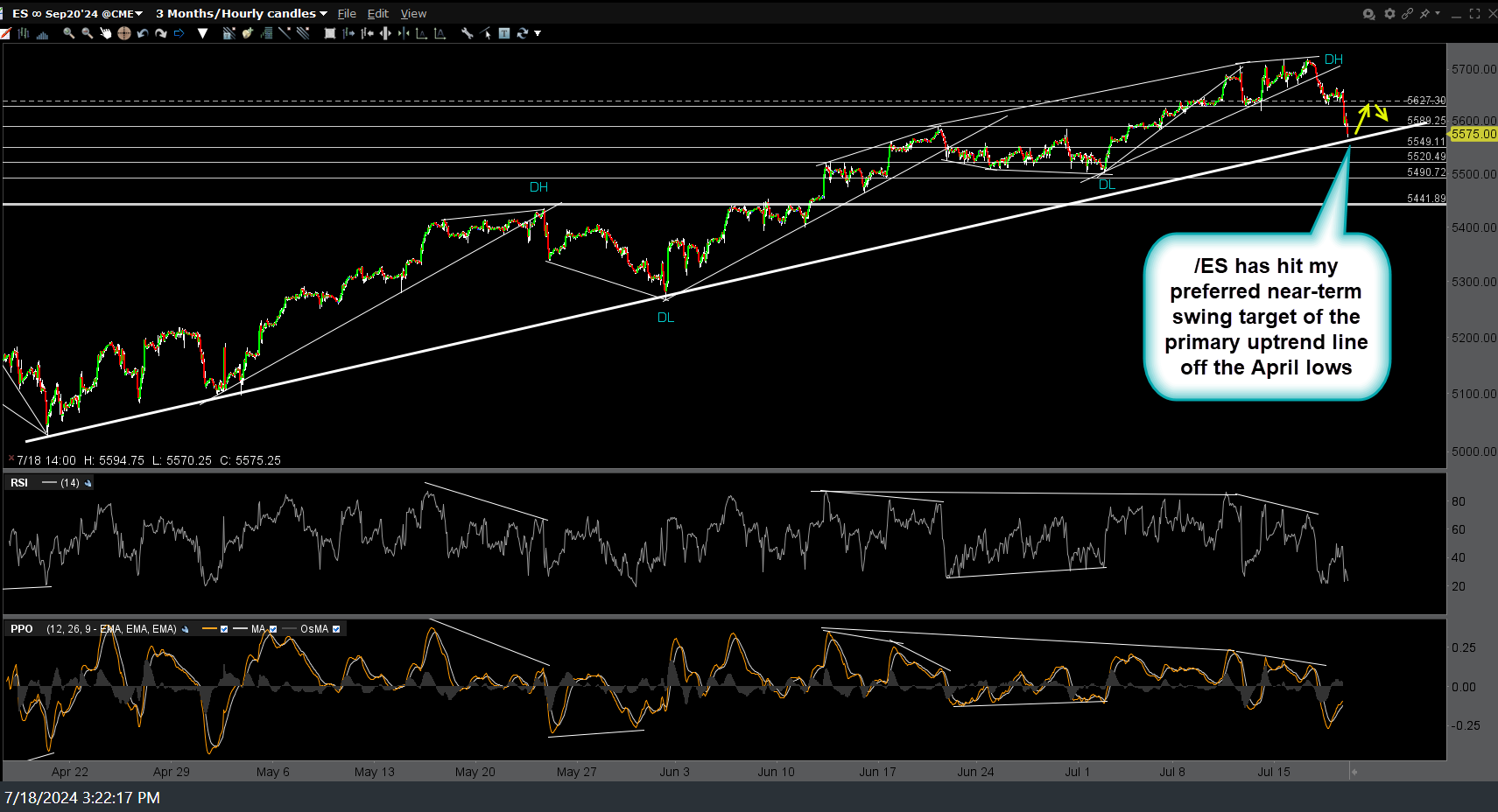

/ES (S&P 500 futures) has hit my preferred near-term swing target of the primary uptrend line off the mid-April lows. While the odds for a market crash/meltdown have increased recently, with both the $SPX & $NDX at my preferred near-term swing targets, a tradable bounce on or around current levels is still the most likely scenario at this time IMO. Previous (June 24th) & updated 60-minute charts below.

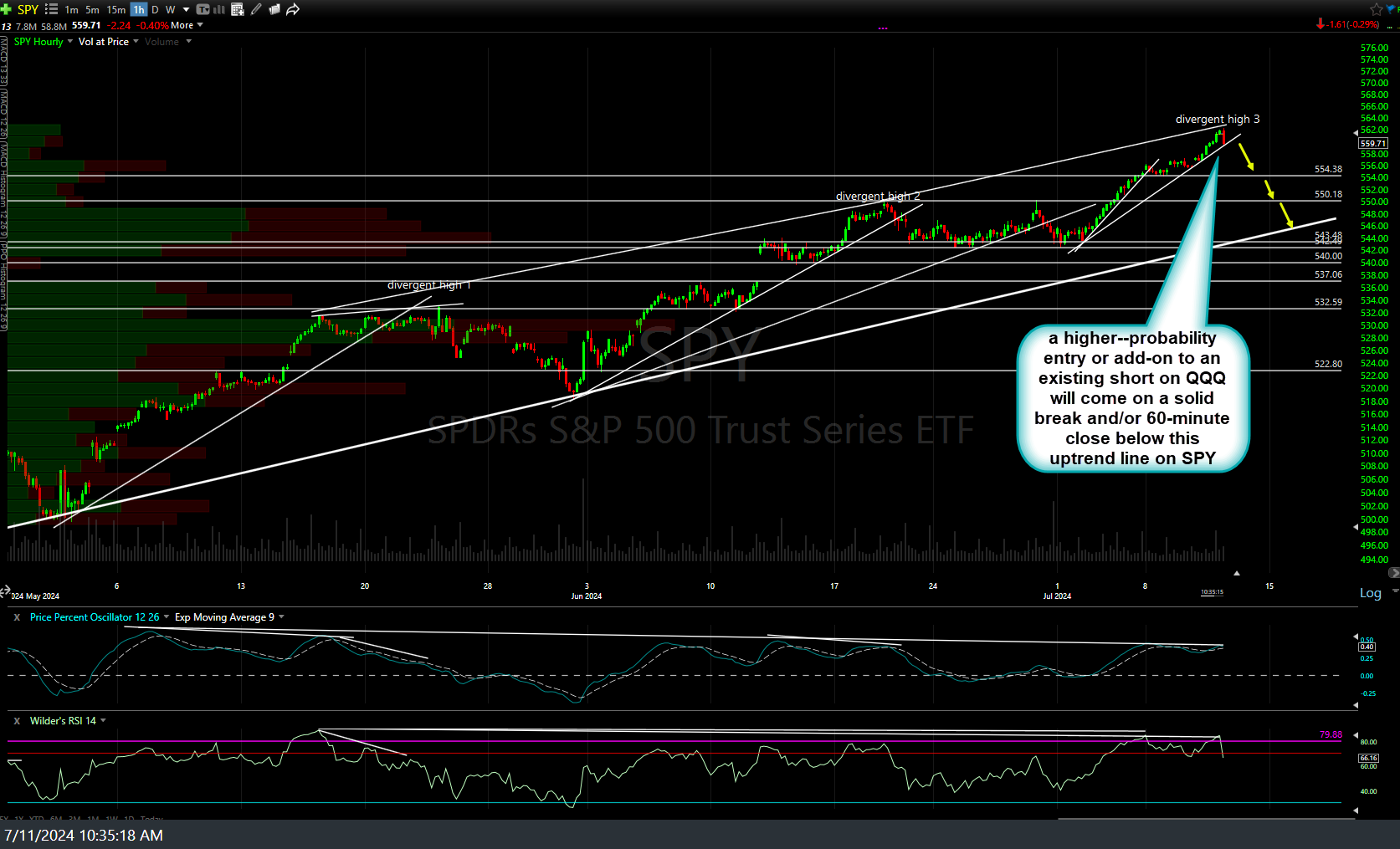

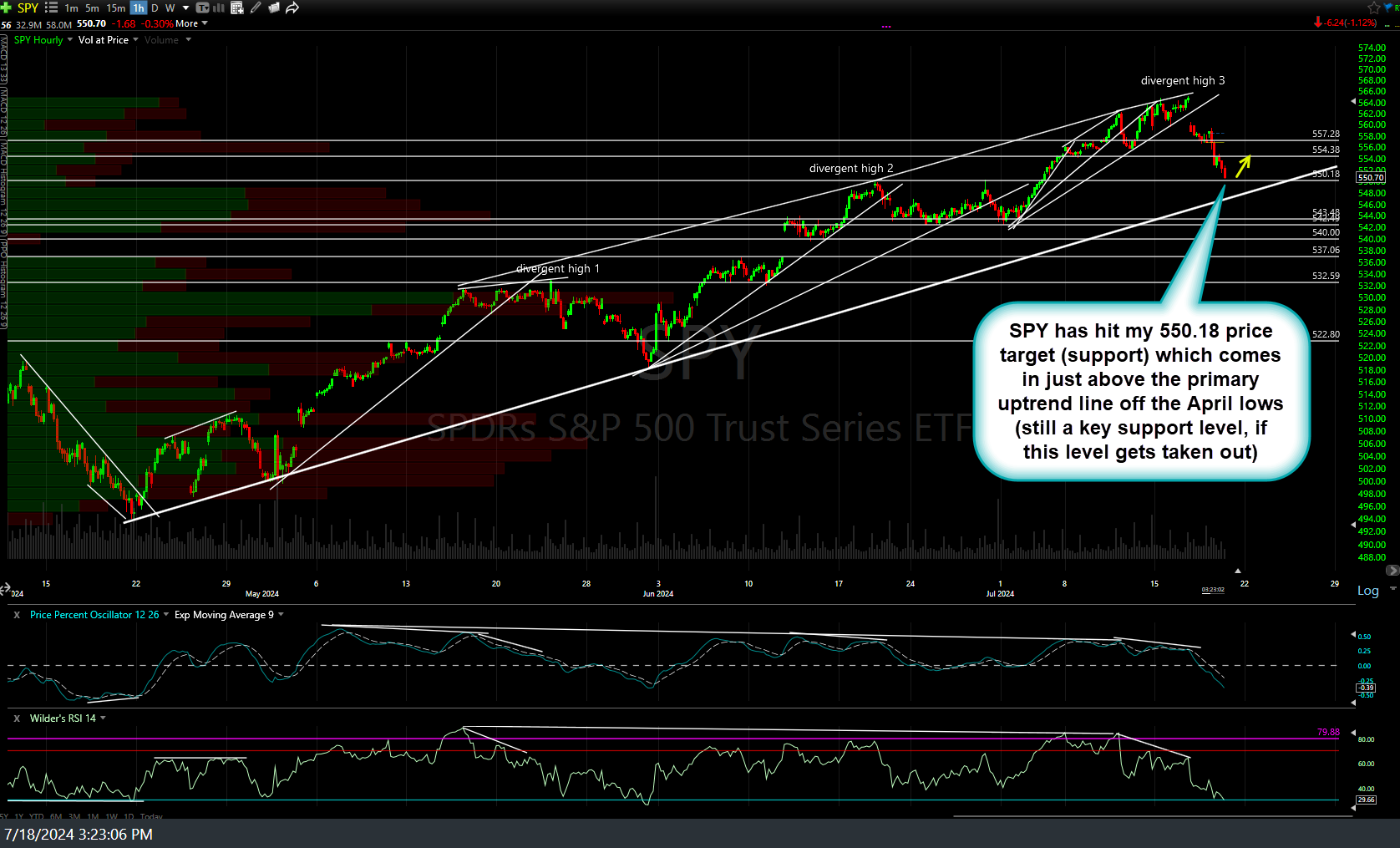

However, it is also worth noting that SPY (S&P 500 tracking ETF) is still somewhat above its comparable uptrend line on the 60-minute chart although it has currently just hit my 550.18 price target (support), where the odds for a reaction are elevated. Previous (July 11th) & updated 60-minute charts below.