/ES (S&P 500 Index E-mini futures) has now put in that divergent low that was mentioned as a possibility last week which could provide the catalyst for a rally if the divergences aren’t negated soon while a break below Friday’s low (my preferred scenario) would likely usher in another wave of selling. 60-minute chart below.

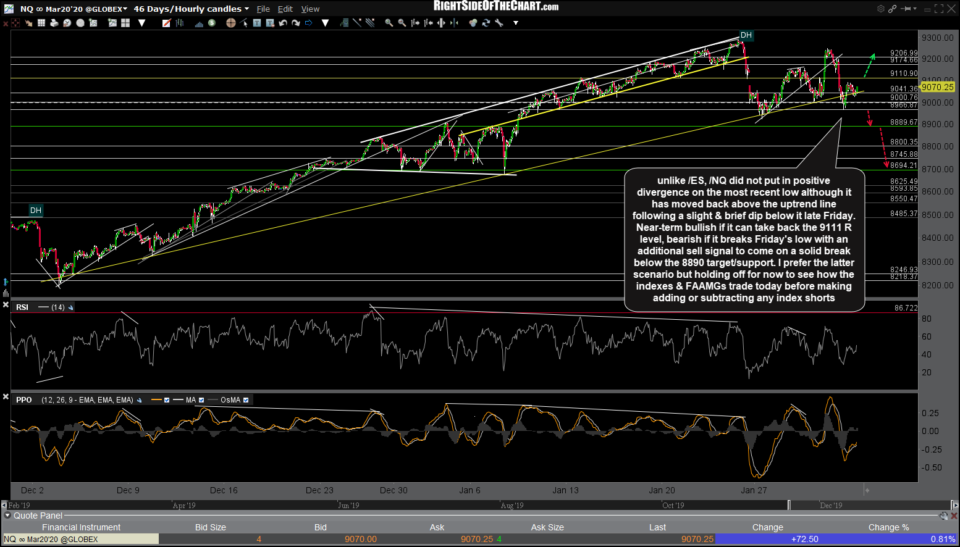

Unlike /ES, /NQ did not put in positive divergence on the most recent low although it has moved back above the uptrend line following a slight & brief dip below it late Friday. Near-term bullish if it can take back the 9111 R level, bearish if it breaks Friday’s low with an additional sell signal to come on a solid break below the 8890 target/support. I prefer the latter scenario but holding off, for now, to see how the indexes & FAAMGs trade today before making adding or subtracting any index shorts.