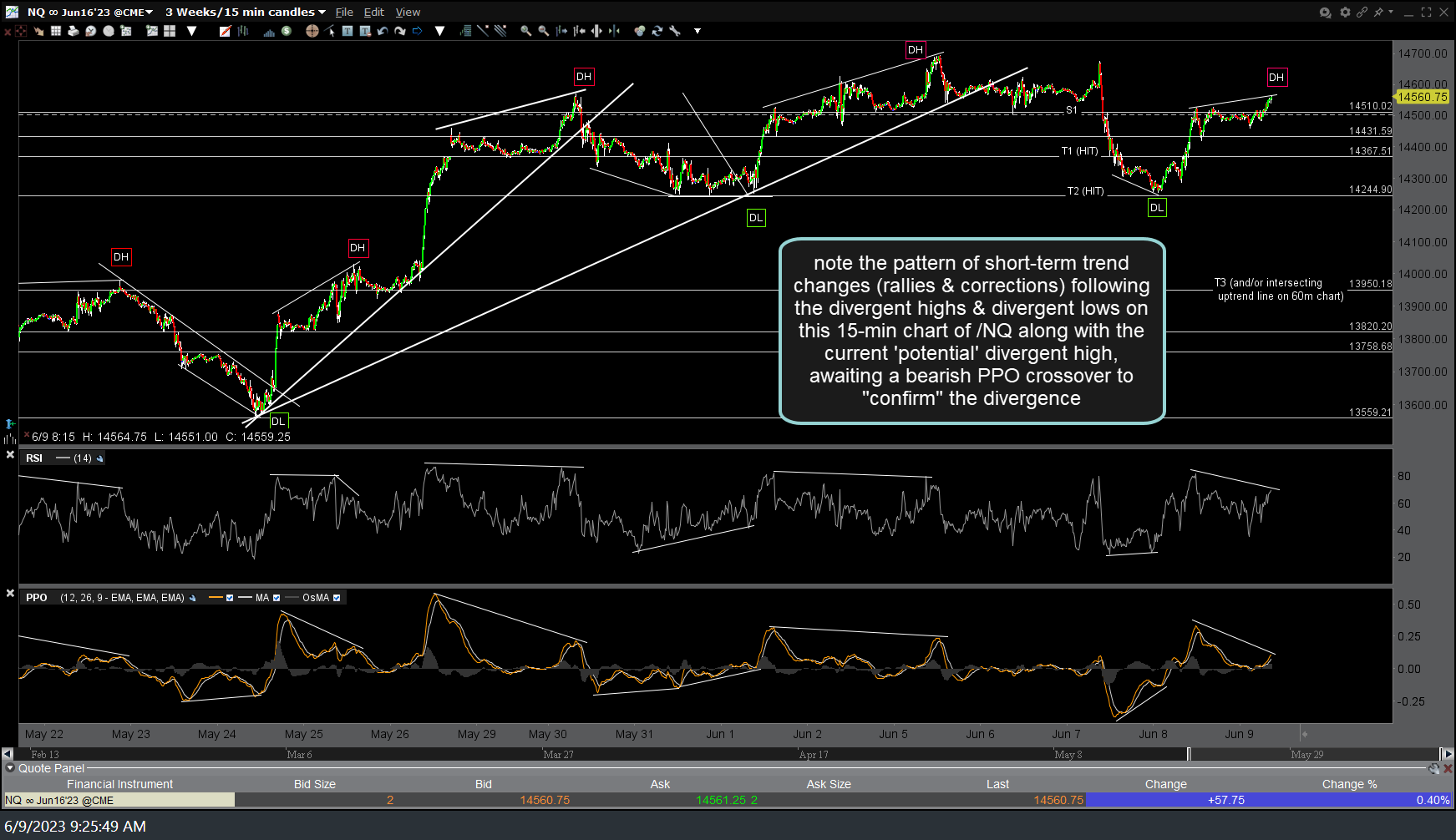

Note the pattern of short-term trend changes (rallies & corrections) following the divergent highs & divergent lows on this 15-minute chart of /NQ (Nasdaq 100 futures) along with the current ‘potential’ divergent high, awaiting a bearish PPO crossover to “confirm” the negative divergence.

The same pattern of corrections & rallies following the divergent highs & divergent lows are just as apparent on this 15-minute chart of /ES (S&P 500). /ES currently has a series of 3 smaller divergent highs within one much larger span of negative divergence with this triple-top high being the third consecutive divergent high as would be any marginal new high today.

As I like to say, divergences are not buy or sell signals, merely conditions that indicate a trend change is likely. Sell signals typically come on breaks below support levels such as trendlines or price (horizontal) support or resistance as well a candlestick reversal patterns.

As of now, the next sell signal on /NQ would be a solid move back down below the 14510 support/resistance level followed by a break below the T2 price target/support level that was hit at yesterday’s lows. It appears that the 4272 support on /ES is the most significant support that would likely usher in a wave of selling if/when taken out although a pop above the recent triple-top resistance of 4305 followed by a failure (solid move back below) would also be quite bearish.

Until & unless that happens, the potential for these current divergences to be “negated” with the momentum indicators taking out their previous reaction highs is certainly a possibility so personally, I don’t think it is prudent to add to any shorts until & unless the aforementioned sell signals are triggered & those current short should have stops inline with their average entry price relative to their preferred price target(s).

Likewise, as breakouts that occur with negative divergences have a much higher chance of failing vs. breakouts without divergence, it does not appear objective to go long on breakouts above the recent highs on the $SPX and/or the $NDX either IMO.