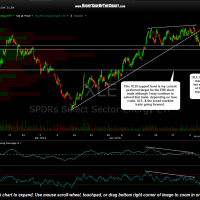

When ERX (3x short energy sector etf) was added as an Active Long Trade last Thursday, April 30th, I stated that the most likely pullback target at that time was the 63 area but that additional downside targets were likely. I had also stated that the reasoning for opting to short ERX was that this trade had the potential to morph into a multi-week or even multi-month trade and that continues to be the most likely case as oil & the energy stocks continue to play as forecasted. I also want to reiterate that I have not stated specific price target for ERX because I use the 1x long energy sector etf (XLE) to time my entries & exits on ERX due to the tracking error caused by the price decay suffered from leveraged etfs over time.

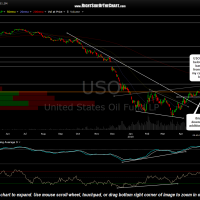

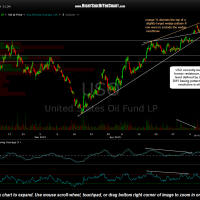

As I type, we are at an important technical junction for that trade as USO is currently backtesting the top of the aforementioned 2015 trading range in which prices made an extremely convincing gap-away breakout on Tuesday with an equally convincing strong follow-through move to the upside on Wednesday. I can only image how many traders bought into that breakout and although I decided to take other side of the trade, betting that breakout will fail, it is still anyone’s game at this point. In fact, I would almost be surprised not to see at least one half-decent rally off this backtest of the break out as there are really just two very objective ways to trade a breakout: Go long on the breakout or go long (or add) on a backtest of the breakout (former resistance, now support) level.

Regardless of whether or not USO bounces here, I continue to expect USO to break back below this key level & move considerably lower in the coming days to weeks+. If that does happen, we will have seen a bull trap in USO, one of the most powerful sell signals in trading as a cluster of stops from the Johnny-come-lately longs that took the breakout (following a very-overextended rally of 33% off the lows in just 1.6 months) begin to be hit & short-sellers that smell the blood in the water, pile in to take advantage of the rapidly shifting supply-demand dynamics in crude oil & energy stocks.

Again, first things first, and that would be to see crude clearly move back below the top of that trading range & ideally, below the 20.00 level. Here are a few charts on ERX, XLE, & USO with additional notes & commentary. For those interested or participating in the ERX or XLE short trade or even USO, which although not an “official” short trade, I will continue to actively post updated charts & targets as the ERX/XLE trade is largely dependent on how crude trades.

- USO daily May 8th

- USO 60 minute May 8th

- ERX daily May 8th

- XLE 60 minute May 8th

note: USO will appear in the Short Trades category only because many of the updates on ERY/XLE also contain charts & analysis on USO, hence those posts are tagged with the ticker “USO” which automatically populates USO along with ERX & XLE on any posted assigned to the Short Trades category.