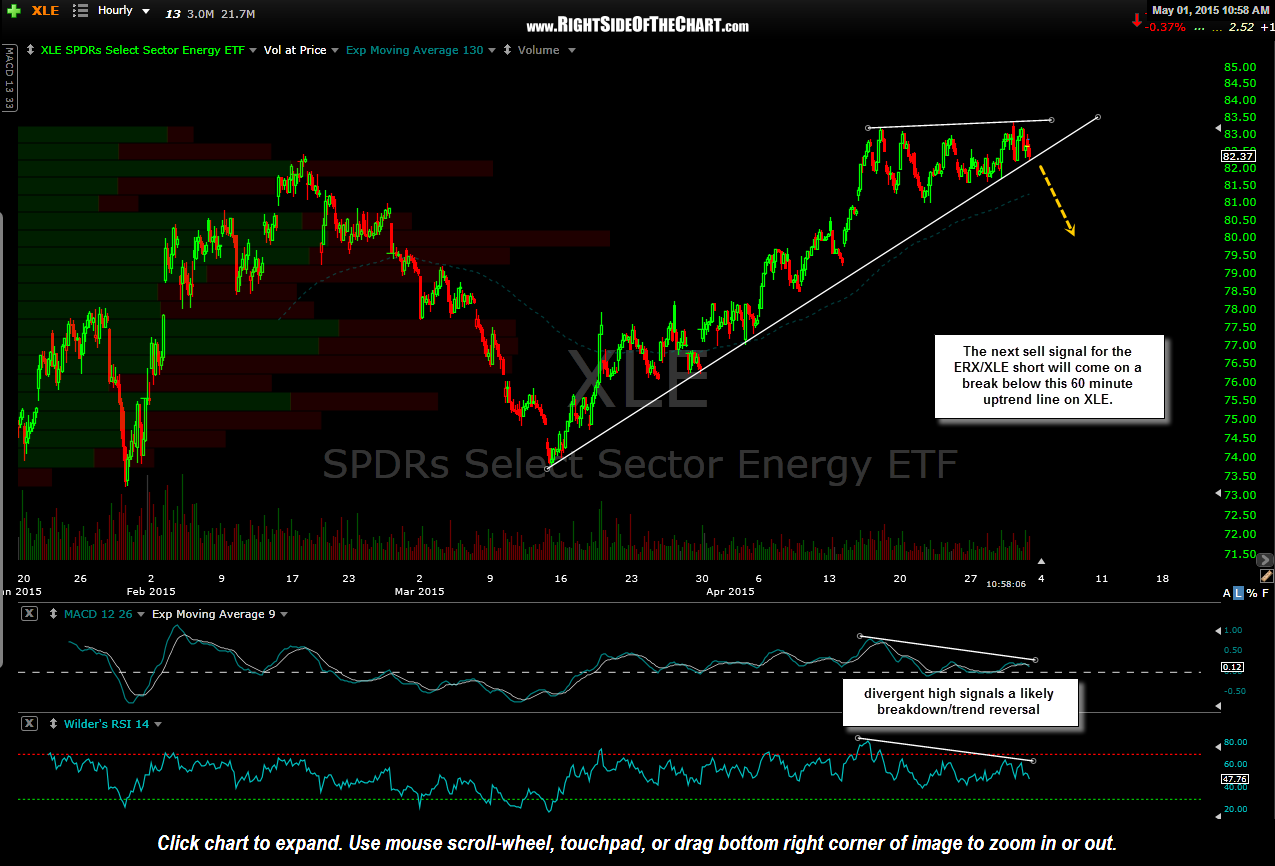

The next sell signal for the ERX/XLE short trade will come on a break below this 60 minute uptrend line on XLE (Energy Sector ETF).

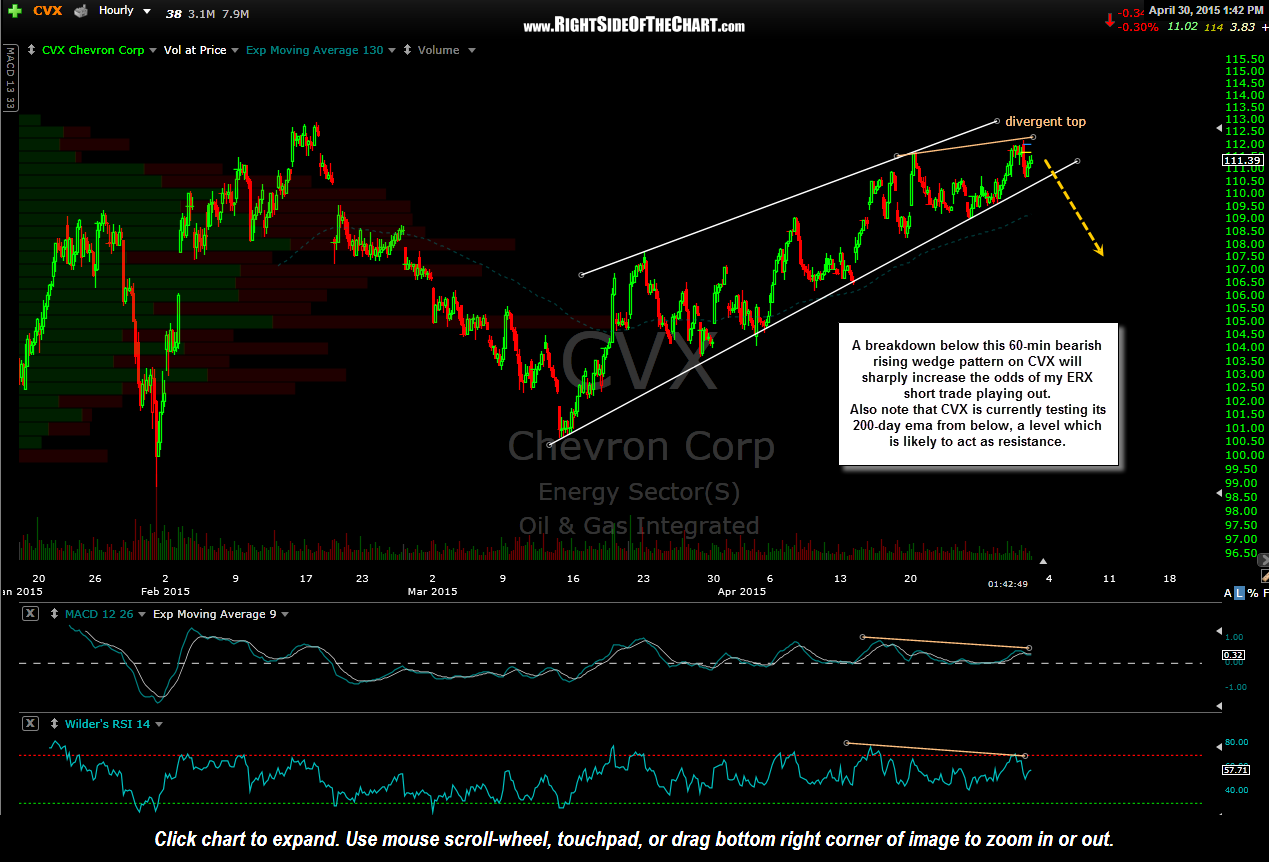

Shortly after the ERX (3x energy long etf) short entry yesterday, I followed up with a post of this 60-minute chart of CVX on Twitter (first chart below). As the second largest component of both XLE & ERX at a 13% weighting (just a hair behind XOM’s 15% weighting), where CVX goes, XLE is almost certain to follow. (yesterday’s 60 minute chart below):

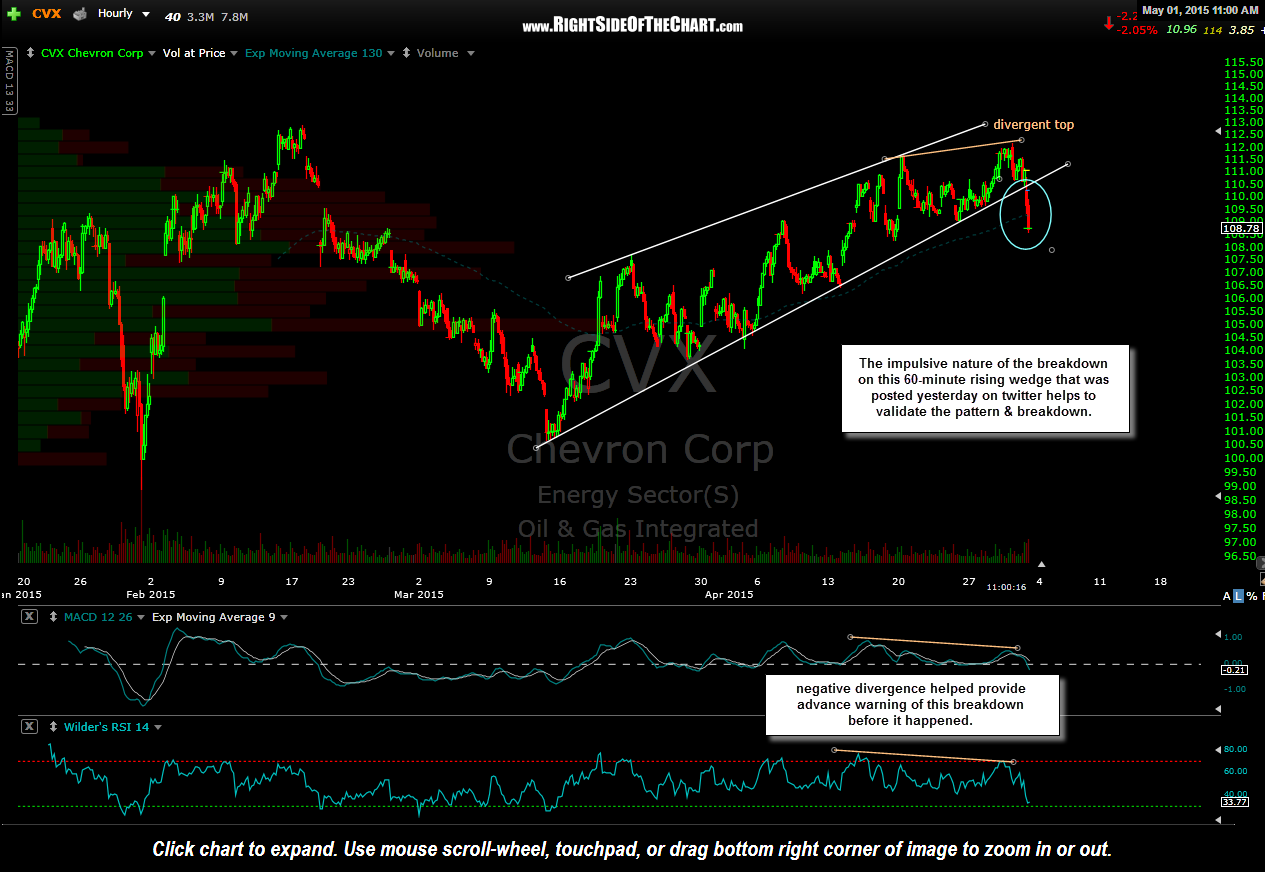

As this updated 60 minute chart below highlights, CVX did indeed go on to break below the bearish rising wedge pattern that was highlighted yesterday and the impulsive price action immediately following that breakdown helps to validate the breakdown, which greatly increases the odds that CVX will move lower in the coming days/weeks.

note: Although CVX will appear under the Short Trades (Setups & Active) categories as long as ERX & XLE remain Active Short Trades, CVX is not an official short trade although one could certainly short it here. As this post has been assigned the CVX symbol tag for reference along with XLE & ERX, all three ticker symbols will appear in whichever categories this particular post is assigned to going forward (from Short Trade Setup & Active Short Trade then eventually to Completed Trades once the profit target(s) is hit or the trade is stopped out. This is the same reason that $NDX or $SPX will often appear as Active Trades along with QQQ & SPY.