Both /NQ & /ES flagged overnight & just recently hit the measured targets of those patterns in the pre-market session with /NQ currently trading on the 8317 support following a brief momo-fueled overshoot with the next sell signal to come on a break below this morning’s low although with the bear flags just hitting their measured targets & both /NQ & /ES trading just above support, at least a little more upside is likely before & possibly after the opening bell today.

/ES kissed & (so far) reversed off the 3115 support with a backfill of Friday’s gap on SPY. Hard to say how much more upside is left in this bounce although a break below today’s low would likely trigger another leg down.

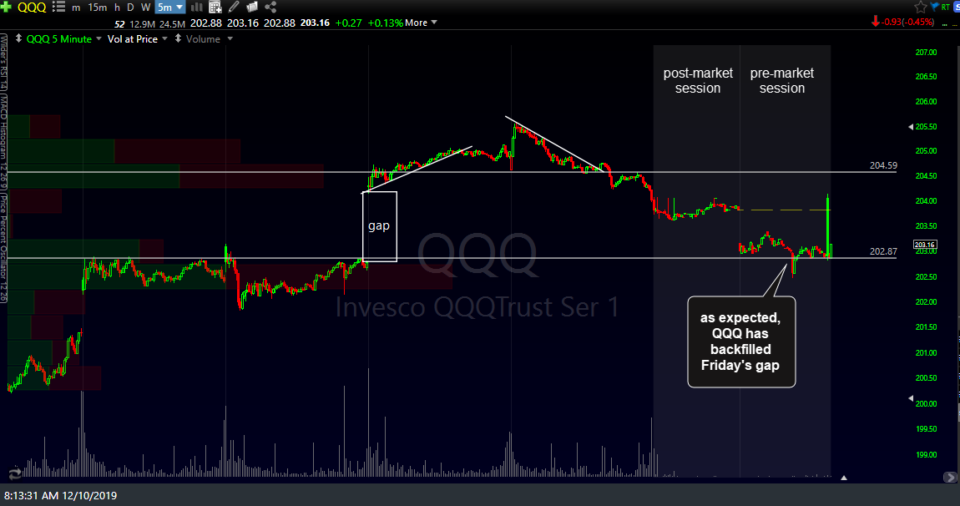

As expected, QQQ has backfilled Friday’s gap along with an almost perfect backfill of Friday’s gap on SPY. Previous QQQ 1-minute chart from yesterday’s ‘gap backfill’ trade idea posted in the trading room, followed by the updated 5-minute charts of QQQ & SPY showing the post & pre-market trades since yesterday’s close.

- QQQ 1m Dec 9th

- QQQ 5m Dec 10th

- SPY 5m Dec 10th

JO hit the 4th price target (T4 from the previous trade) with a slight momentum-fueled overshoot to close back right around the 41.57ish resistance level. Consider booking partial or full profits and/or raising stops if holding out for additional gains. A tight stop could be set just below the uptrend line/steep rising wedge pattern and/or the 39ish support level.

A break below the minor uptrend line could be the catalyst for a move back down to the bottom of this 60-minute Ascending Broadening Wedge pattern on /KC coffee futures as the negative divergences & overbought conditions continue to build.