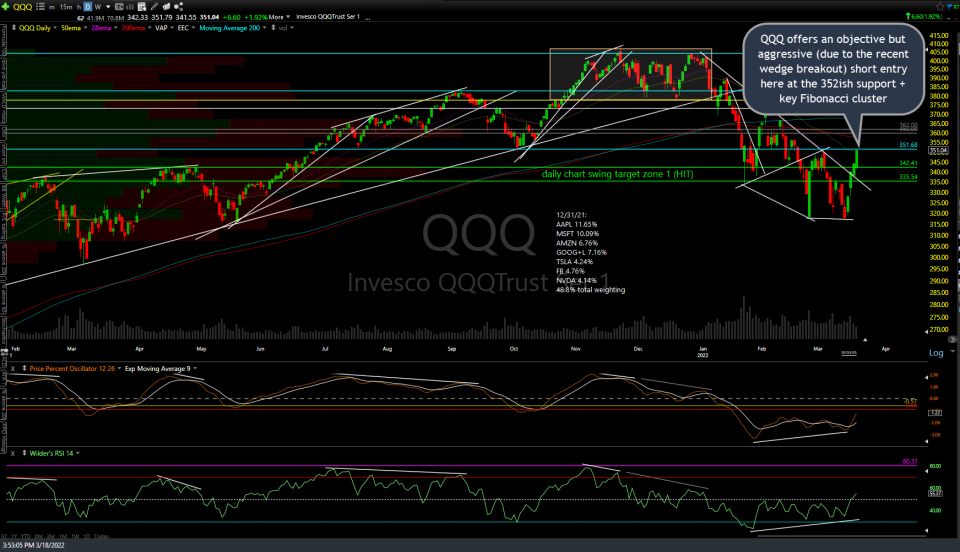

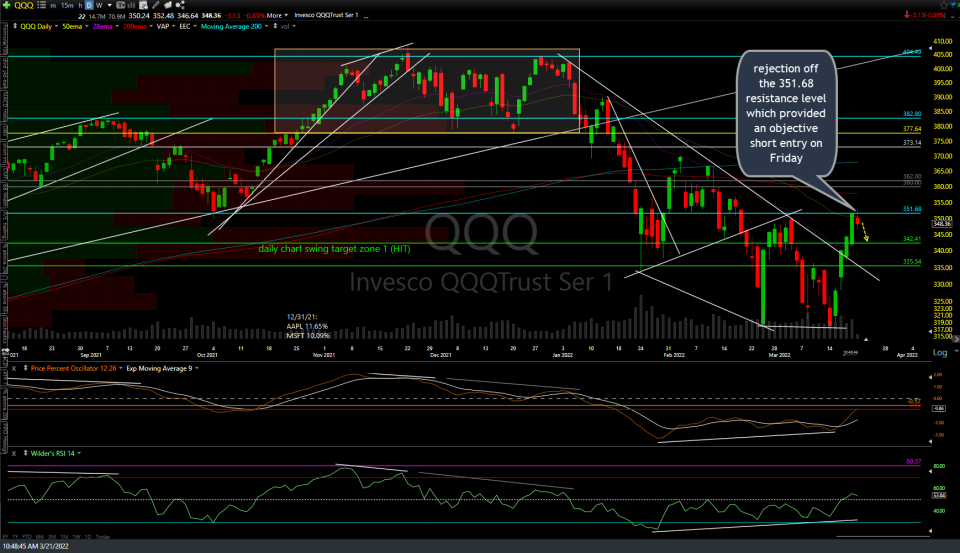

QQQ rejected off the 352 resistance (objective short entry #1) followed by a break below the uptrend line (objective short entry #2) with a potential near-term pullback target of 341.50 & the potential for a backtest of the primary downtrend line & possibly more although it would help to see QQQ, as well as SPY, put in negative divergences on the 60-minute time frame to make the case for that the rally off the recent lows has likely run its course. Previous (Friday’s) & updated 60-minute & daily charts below.

Until then, the odds for another thrust up after this pullback runs its course are still decent. One way to trade that for those that started adding back some short exposure late Friday or this morning would be to set stops at or just above entry & let the position ride, adding to it depending on how the charts develop going forward. Those still long off the divergent low and/or breakout above the bullish falling wedge pattern & looking for more upside can add on pullbacks to support up to, but not below the downtrend line with stops depending on one’s entry level(s) or a solid drop back below the uptrend line.

Likewise, /NQ was also rejected a hair above the 14365 resistance (objective short entry #1) followed by a break below the uptrend line (objective short entry #2). Potential targets/support levels where reactions are likely, if hit, are shown at the arrow breaks on the 60-minute chart above.