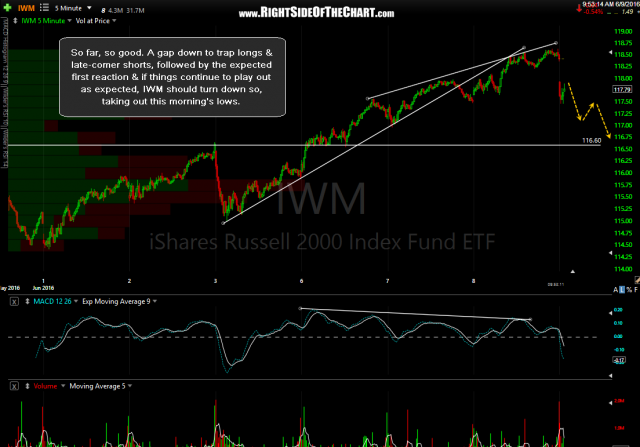

SPY scenario playing out so far. Looking for a reversal off the 211.77 former support, now resistance & a resumption of the selling. So far, so good on IWM as well. A gap down to trap longs & deny an optimal entry for late-comer shorts, followed by the expected first reaction & if things continue to play out as expected, IWM should turn down so, taking out this morning’s lows. Previous & updated 5 minute charts:

- SPY 5 minute June 8th

- SPY 5 minute June 9th

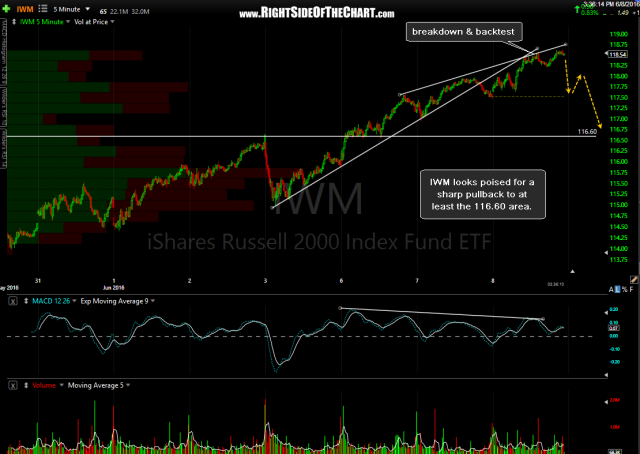

- IWM 5-minute June 8th

- IWM 5 minute June 9th