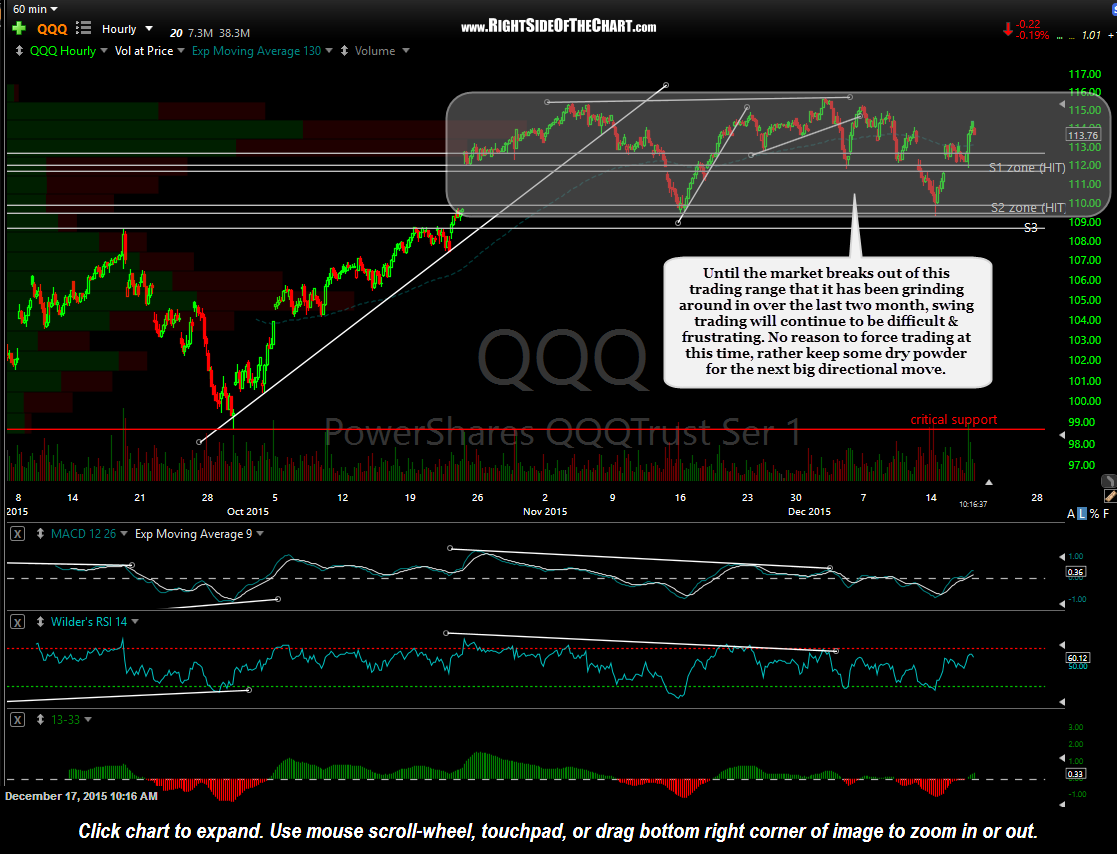

Until the market breaks out of this trading range that it has been grinding around in over the last two month, swing trading will continue to be difficult & frustrating. No reason to force trading at this time, rather keep some dry powder for the next big directional move.

This daily chart shows the key levels that I’m watching on the $NDX. Any up & down moves between resistance (4740) & S1 (4478) is just noise. As the longer-term charts remain bearish not to mention some obvious warning signs for equities such as the continued disconnect from the high-yield bond market as well as deteriorating breadth since the August lows, I continue to favor a downside break of the recent trading range, even if the $NDX/QQQ were to make a brief run at new highs (assuming the other, more diversified US indices don’t confirm with new highs as well).

TQQQ/QQQ remains an Active Short Trade & the suggested stop remains any daily close above 117.00. Despite the fact this trade was entered back on Oct 28th, while the market hasn’t gone down as much as I had anticipated since that point, it hasn’t gone up either, with QQQ trading today exactly where it was back on Oct 28th. Once again, the TQQQ short was/is intended as a longer-term swing trade with downside target TBD. Keep in mind that tomorrow is OpEx and in keeping with the previously highlighted trend of ramping the market higher on the week leading into options expiration (this week), I have highlighted in those previous posts how the market nearly always sells off each month almost immediately following OpEx.