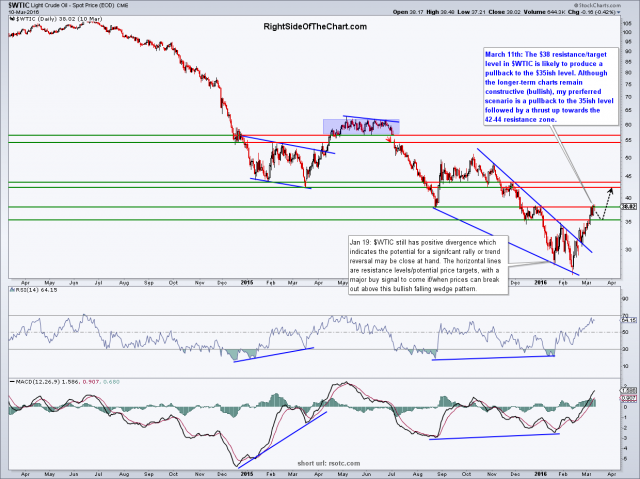

The $38 resistance/target level in $WTIC, which was outlined on the first chart below, posted back on January 19th, is likely to produce a pullback to the $35ish level. Although the longer-term charts remain constructive (bullish), my prerferred scenario is a pullback to the 35ish level followed by a thrust up towards the 42-44 resistance zone.

- $WTIC daily Jan 19, 2016`

- $WTIC daily March 11th

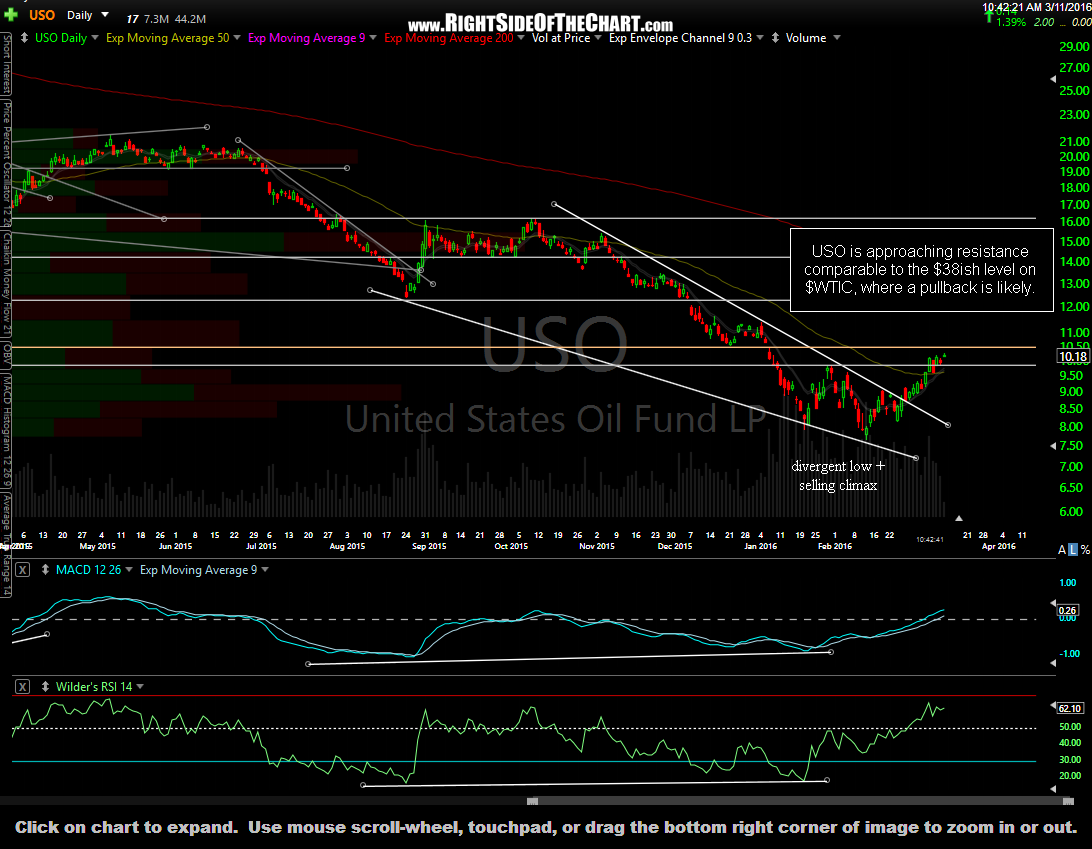

USO (Crude ETP) is approaching resistance comparable to the $38ish level on $WTIC, where a pullback is likely (daily chart):

This bearish rising wedge pattern on crude futures indicates that a pullback off the support levels on my $WTIC & USO daily charts is highly likely at this time. (120-minute chart):

I had posted reversing from a DWTI (3x short crude etf) short position to a UTWI (3x short crude etf) in trading room right about when USO/DWTI peaked today but in the time that I took to annotate these charts & compose the post, UTWI has already dropped by nearly 6% (3% drop in USO) so I’m going to pass on adding that as an official short idea as I was considering although I will say there is probably still plenty of meat on that bone. However, USO is close to backfilling today’s gap as I type so maybe best to either way for a bounce and/or short a break of the uptrend line on the 60-minute chart of USO, which should give way on any move much below today’s LOD. As such, a short on any crude proxy (CL, USO, UWTI) or a long in any of the crude short etfs will be an unofficial trade idea at this time, although this post will be placed under the Short Trade setups (it just won’t become an Active Short/official trade).