I’m on watch for a sell signal on /CL (crude oil futures) with an impulsive break and/or solid 60-minute candlestick close below the uptrend line/wedge pattern although it would help to see additional confirmation with a break below the 37.40ish support level (first support just below the trendline). Should crude confirm this potential sell signal (the next drop below today’s low of 37.98 should do the trick), the minimum price target would be around 31.00. 30-minute chart below.

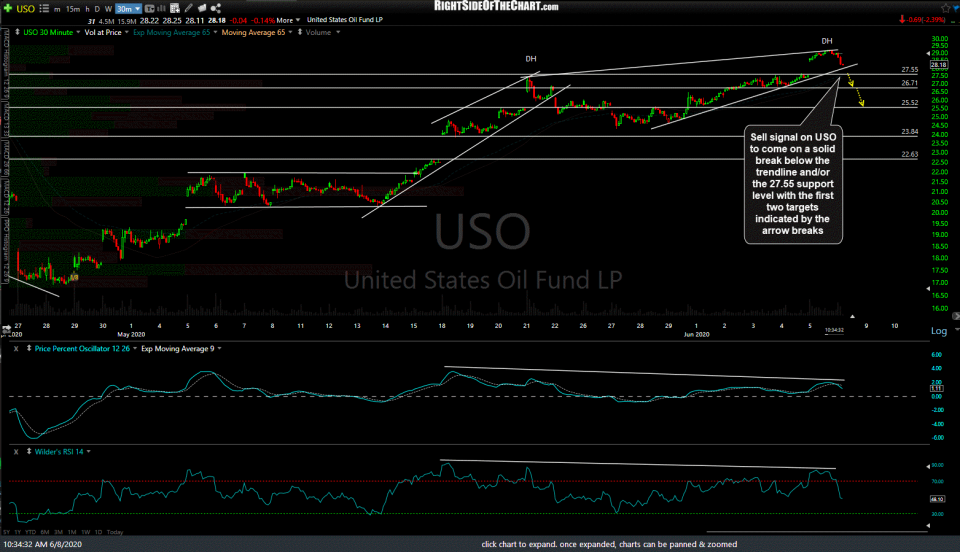

For ETF/ETN traders or those looking to help confirm a sell signal on crude futures in order to minimize the chances of shorting on a false breakdown/whipsaw, a sell signal on USO (crude ETN) will come on a solid break below the trendline and/or the 27.55 support level with the first two targets indicated by the arrow breaks. 30-minute chart below.

As of now, I’m passing crude along as an unofficial trade as any short swing trade on crude is likely to face a headwind until we get some decent evidence of a reversal in the stock market although personally, I have taken a starter short on /CL & plan to add to it if, and only if, we get the additional confirming sell signals outlined above. I’ve also made a point to highlight the nearby supports on /CL & USO that would help to confirm a sell signal as the recent uptrend in crude has been unusually resilient, just as with the equity market. However, with the overbought conditions & still precarious fundamentals, both stocks & crude oil could very well experience swift & large drops on a crowded rush for the exits, should either or both trigger solid sell signal soon.