My reply to my thoughts on crude oil in the trading room earlier today:

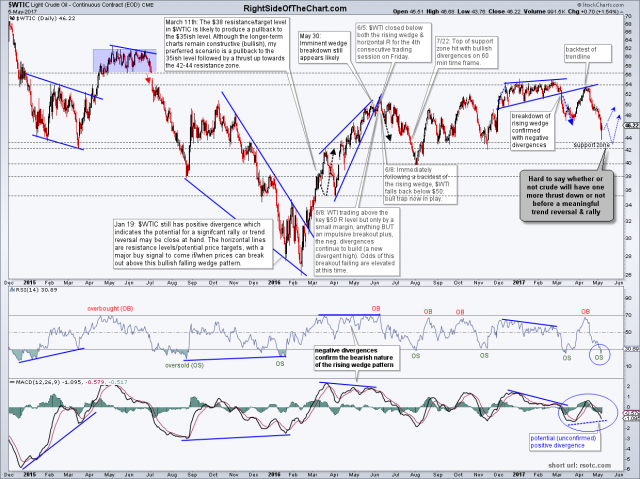

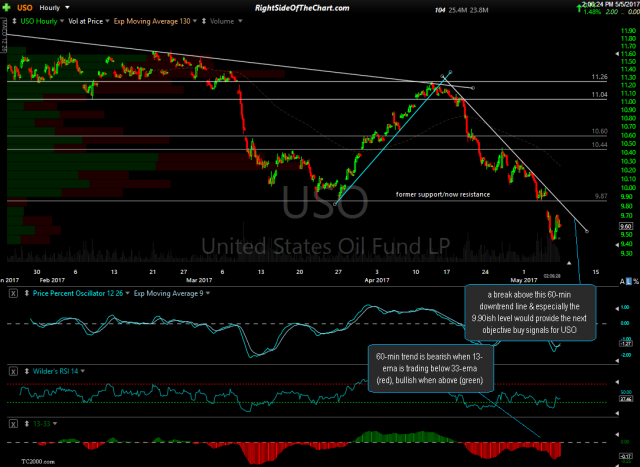

Here’s my daily chart of $WTI & 60 minute chart of USO. Crude remains in free-fall after the backtest of the rising wedge of the daily chart on WTI. Only “potential” bullish developments that I see there are the oversold reading on the RSI & potential (unconfirmed) positive divergence on the MACD. I certainly favor at least a small counter-trend rally very soon but remember that oversold can become more oversold or stay oversold for a while. As such, hard to rule out a move down to that support zone around 42.43.USO near-term trend clearly remains bearish although a break above this 60-min downtrend line & especially the 9.90ish level could spark a rally up to at least the 10.45ish level.

The daily chart of $WTIC (West Texas Intermediate Crude) has been updated to reflect the close of today’s trading & the 60-minute chart of USO was the same one posted in trading room shortly after 2pm ET today.

- $WTIC daily 2 May 5th close

- USO 60-min May 5th