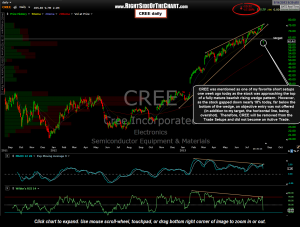

One week ago today, CREE was mentioned as one of several attractive short setups that I came across in reviewing the charts. The charts and notes on some of those trade ideas in that post were covered under separate posts while others, including CREE, were not. I’ve been working to keep the trade ideas at a manageable level, preferring to post the charts in the most timely manner possible. With CREE, the official entry would have been on a break below the bottom of this bullish falling wedge pattern and as such, I was waiting for prices to move closer to the bottom of the wedge.

One week ago today, CREE was mentioned as one of several attractive short setups that I came across in reviewing the charts. The charts and notes on some of those trade ideas in that post were covered under separate posts while others, including CREE, were not. I’ve been working to keep the trade ideas at a manageable level, preferring to post the charts in the most timely manner possible. With CREE, the official entry would have been on a break below the bottom of this bullish falling wedge pattern and as such, I was waiting for prices to move closer to the bottom of the wedge.

As CREE had a massive gap (now trading down 20%) on disappointing earnings guidance today, the stock never did offer an objective entry. This isn’t a hindsight post but more of an educational post for those new to trading. Most of the trade ideas posted on RSOTC are shared while in the latter stages of a bullish or bearish price pattern with a specific trigger(s) for entry. In the case of a large gap above (for bullish patterns) or below (bearish) the stated entry trigger, such as a trendline break, an objective entry was never offered as the stock will often be too close to the price target (or beyond it, as in the case of CREE) and therefore, does not offer an attractive risk to reward ratio. CREE actually could have been taken at the top of the pattern recently by more aggressive traders but as this was not suggested, CREE will just be removed from the trade setups and not considered an Active or Completed Trade.