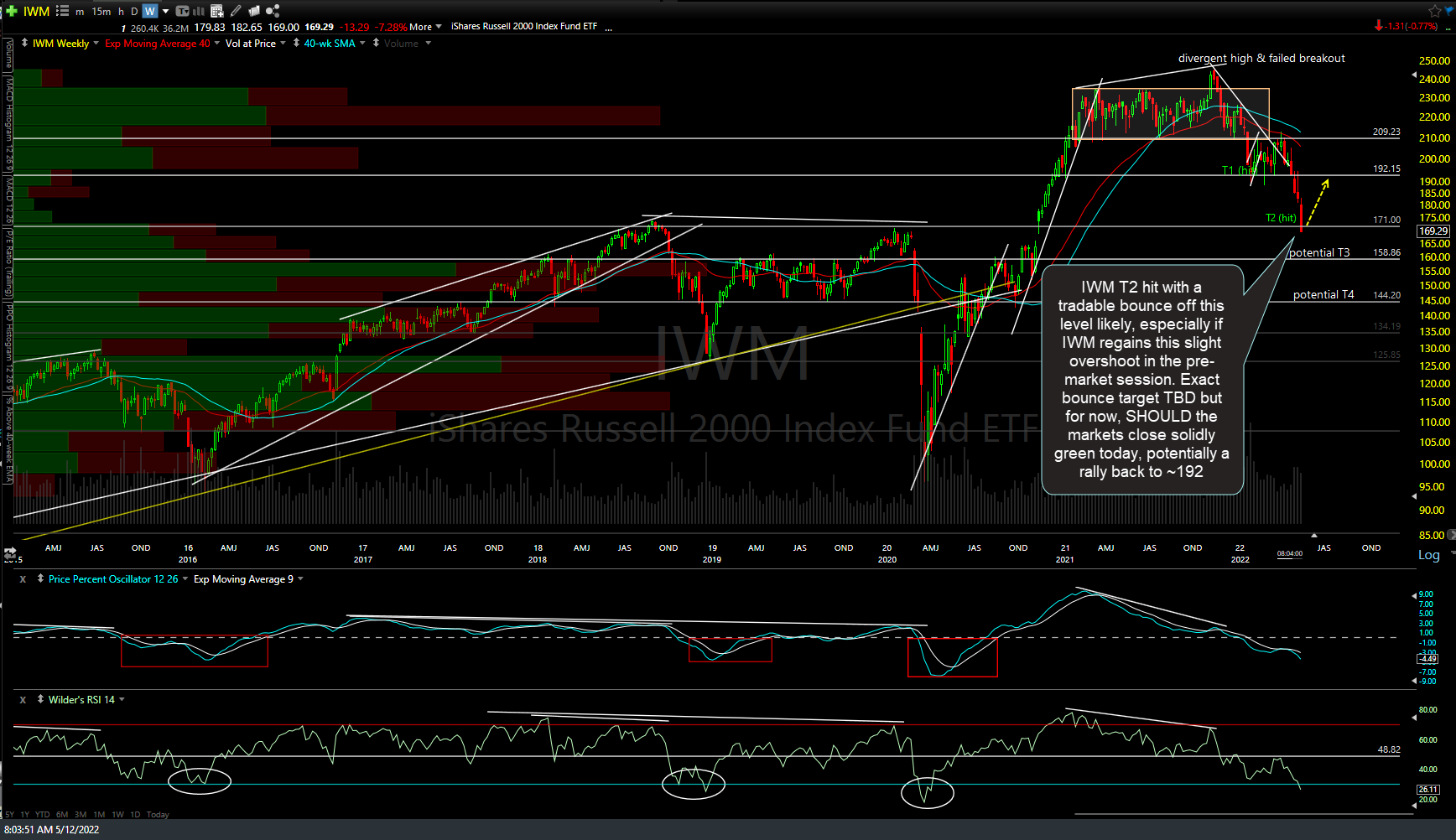

I’ll follow up with some charts & additional details but just wanted to get a quick post out to let you know that I’ve decided to start covering some, and possibly all (depending on how today develops), of my index shorts (swing & trend positions) here in the pre-market session & may soon pivot to a net long positioning. I have covered & reversed my /RTY (IWM) index shorts & also taken a starter long on AMZN as partial hedges to my remaining index shorts on the $NDX (some of which I have just covered, as well to lock in profits & reduce what was a heavy short exposure).

IWM (Russell 2000 Smallcap ETF) has just hit (and slightly overshot) my 2nd price target on the weekly chart (171) with a tradable bounce off this level likely, especially if IWM regains this slight overshoot in the pre-market session. Exact bounce target TBD but for now, SHOULD the markets close solidly green today, potentially a rally back to ~192.

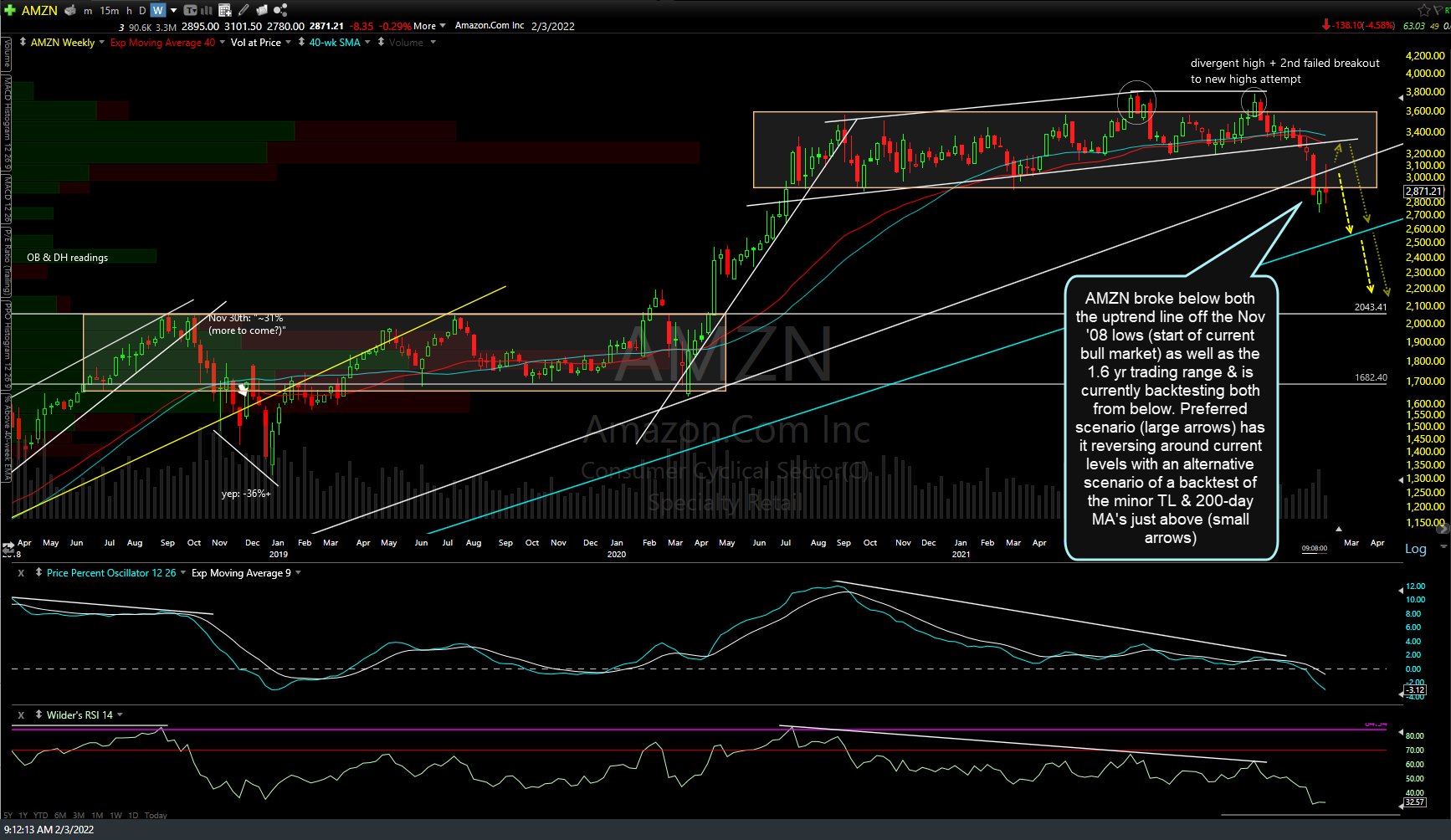

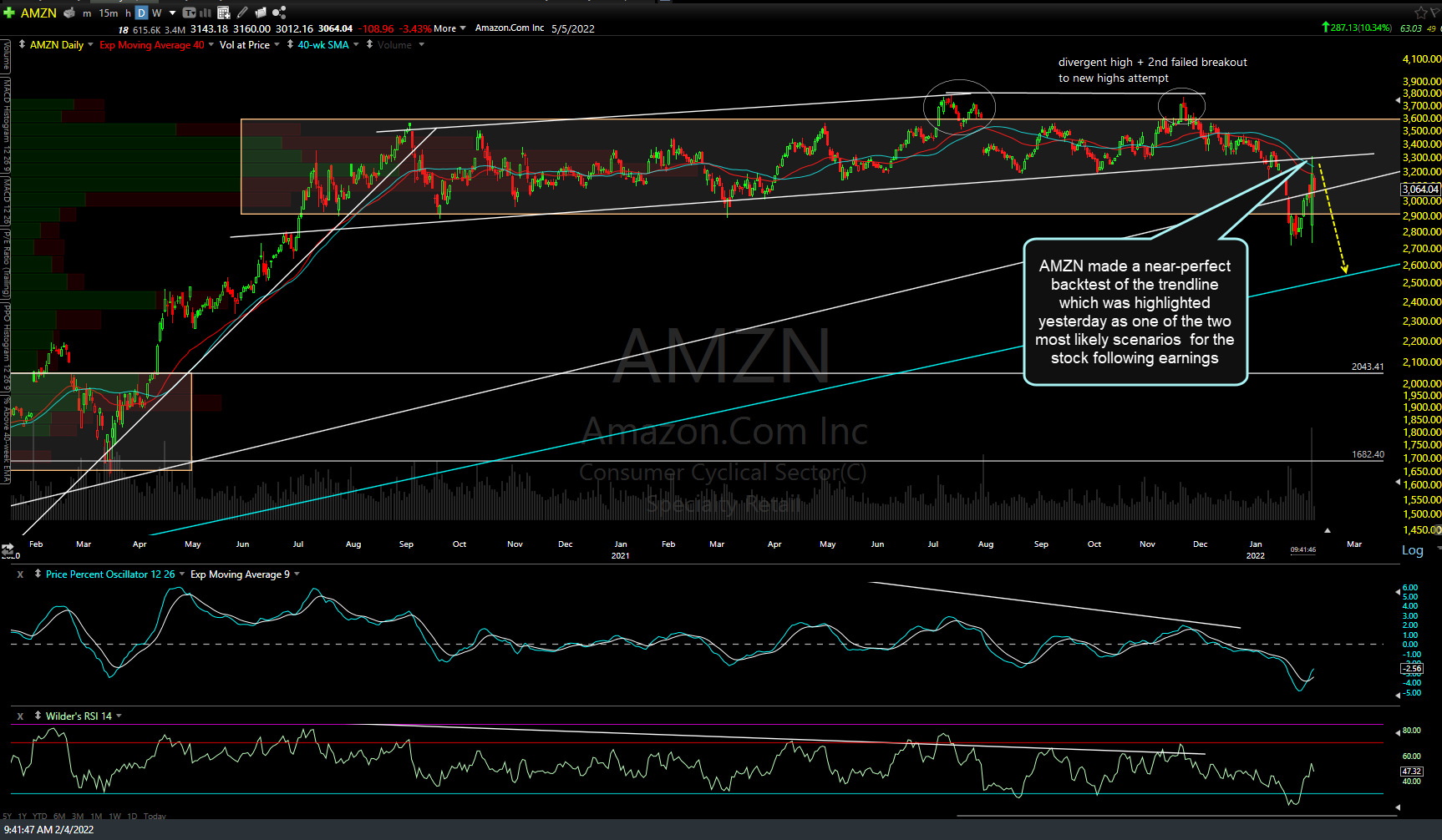

Additionally, AMZN (Amazon) has also hit my final long-term target that I posted shortly after the start of the year. The first 4 charts below are the weekly charts of AMZN from this post back on Feb 3rd (and the followed up chart posted the following day highlighted the objective short entry on my bounce scenario of a backtest of the trendline, which has been followed by a 38% drop right to my final target in the pre-market session today), calling for a drop to exactly where the stock is trading as I type. The last chart is the current weekly chart including today’s pre-market session current price.

I’m going to continue to review the charts & will follow up with some additional commentary & charts after the open today. As of now, with both AMZN & IWM (as well as some other big stocks) falling to support, many with divergences still intact, it would at least be prudent for those holding out for additional downside in swing/trend shorts to tighten up stops (if still allowing for relatively wide stops) and/or watch for any potential signs of a reversal today and/or the next few trading sessions. Should I decide to move back to an aggressive short position today, I will let you know asap.

Also, please note that I will be on vacation tomorrow & all of next week. I do plan on posting occasional updates, especially if I see any significant developments, although I will have limited access & be 6-hours behind (Hawaii GMT-10 time zone) so timely updates may not be possible.