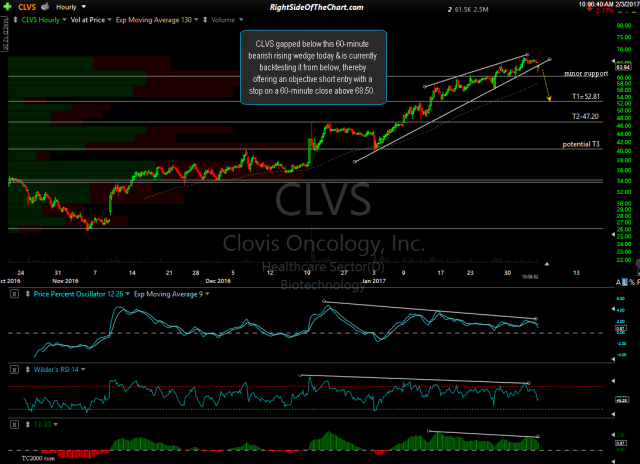

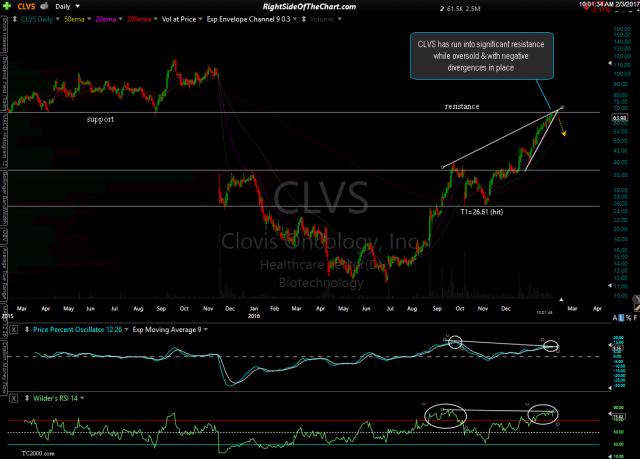

CLVS (Clovis Oncology) gapped below this 60-minute bearish rising wedge today & is currently backtesting it from below, thereby offering an objective short entry with a stop on a 60-minute close above 68.50. Zooming out to the daily time frame, CLVS has run into significant resistance while oversold & with negative divergences in place.

- CLVS 60-min Feb 3rd

- CLVS daily Feb 3rd

Overbought, at resistance with divergences in place. As with any trade, this one may or may not pan out but certainly seems very objective & offers an above average R/R based on the suggested stop & the final price target (one might consider a more aggressive stop if only targeting T1). The price targets are T1 at 52.81, T2 at 47.20 with a possible 3rd target to be added around the 40.60 area, depending on how the charts develop going forward. The suggested beta-adjustment for this trade is 0.7. note: CLVS is expected to report earnings on or around February 23rd.