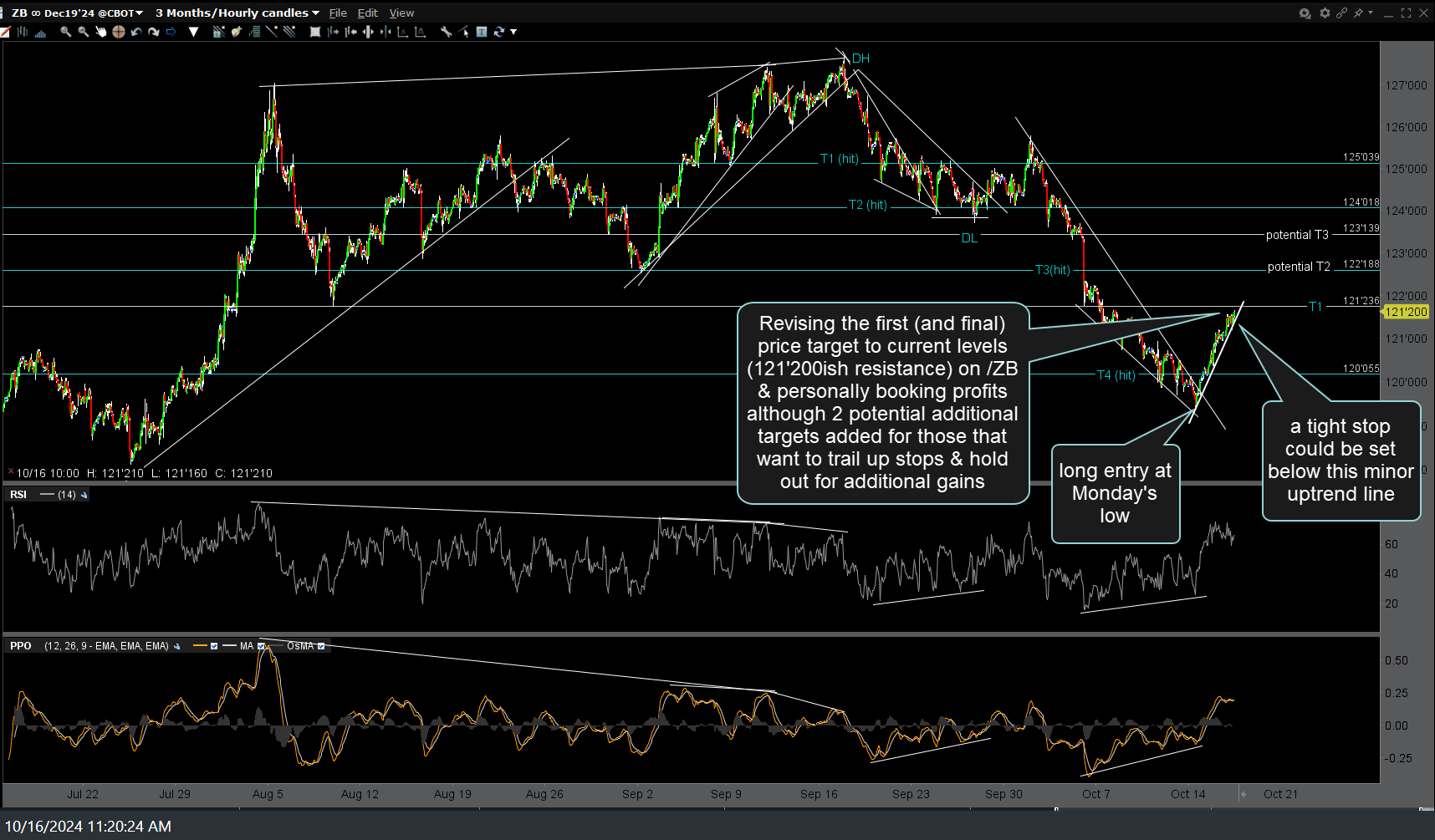

Upon further review of the charts, I’ve decided to close out the /ZB (30-yr Treasury bond futures) and TLT (20-30 yr T-bond ETF) swing trade & book the quick (2 day) gain of 3% (6%+ beta-adjusted profit due to the 2x+ position size) here at current levels. Previous & updated 60-minute charts below.

I’ve added an minor uptrend line to the /ZB chart above (a similar TL could be used for those trading TLT) in which a tight stop could be set, for those holding out for additional upside. I’ve also listed two potential additional price targets on that chart as well although personally, I’ve decided to book full profit here & will wait for the next objective entry, long or short.

As discussed in yesterday’s video, I can still see a decent chance of a drop to the 42.05ish support before the next leg up in $TYX (30-yr Treasury yield) but very open to this pullback in yields ending before then, with another leg up to the primary downtrend line on the daily chart above.