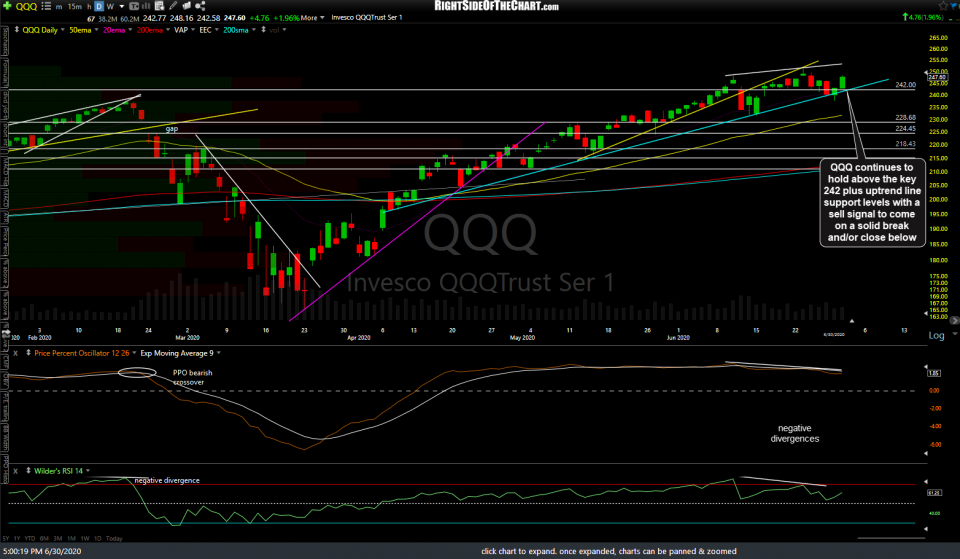

QQQ continues to hold above the key 242 plus uptrend line support levels on the daily time frame with a sell signal to come on a solid break and/or close below.

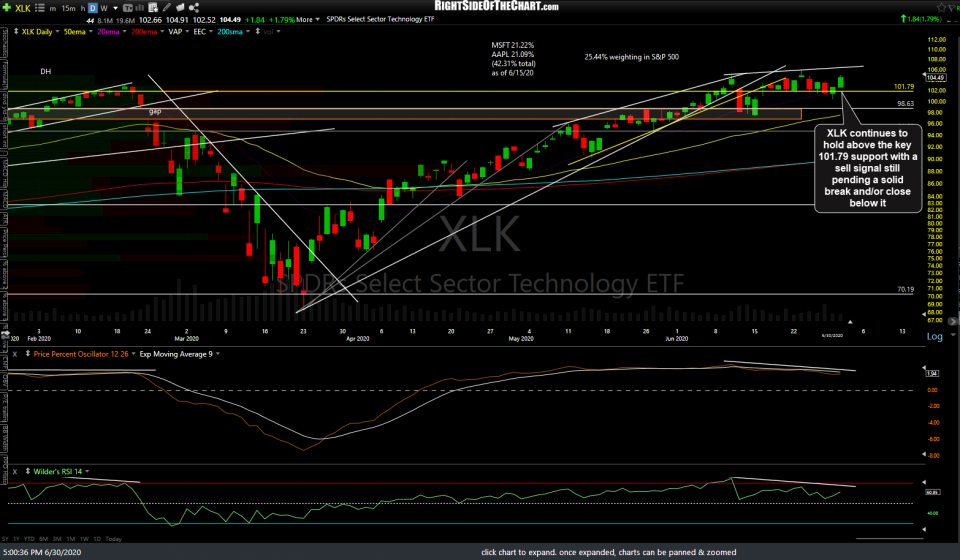

Likewise, XLK (tech sector ETF) continues to hold above the key 101.79 support with a sell signal still pending a solid break and/or close below it.

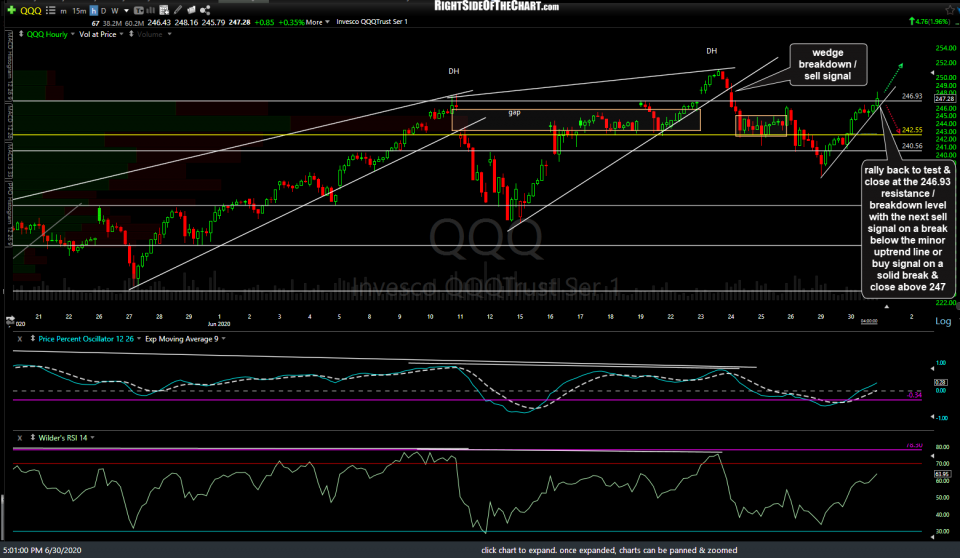

Zooming down to the 60-minute time frame, QQQ rallied back to test & close at the 246.93 resistance/breakdown level with the next sell signal on a break below the minor uptrend line or buy signal on a solid break & close above 247.

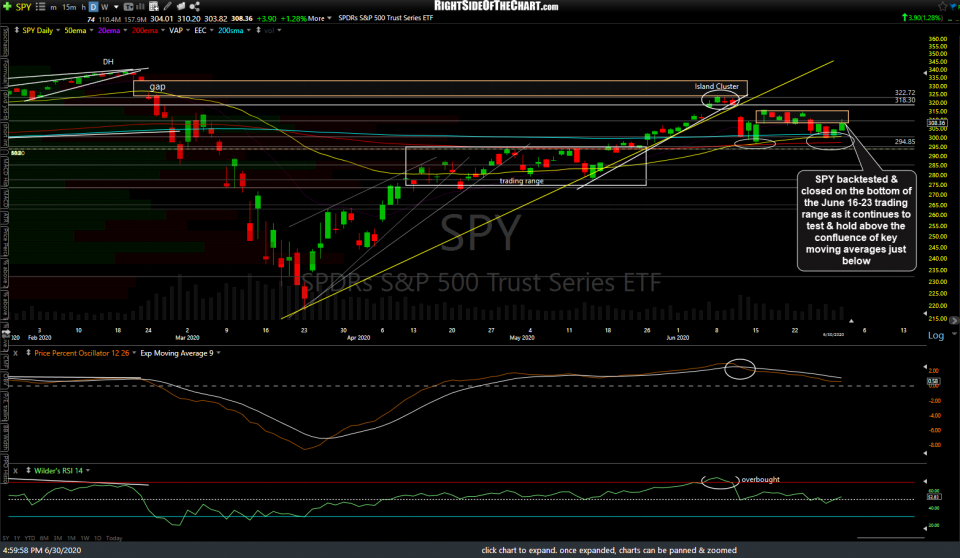

SPY backtested & closed on the bottom of the June 16-23 trading range as it continues to test & hold above the confluence of key moving averages just below.

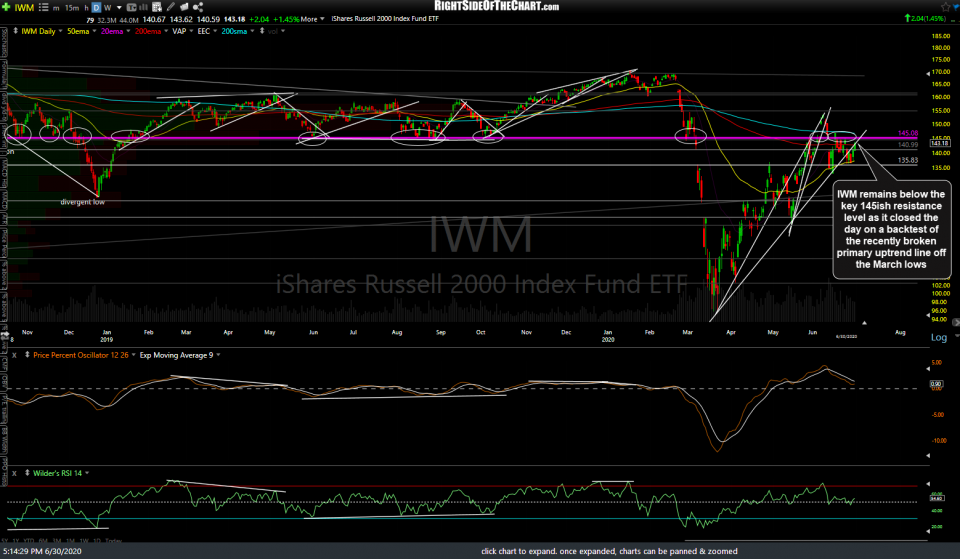

IWM remains below the key 145ish resistance level on the daily time frame as it closed the day on a backtest of the recently broken primary uptrend line off the March lows.

Zooming down to the 60-minute time frame, IWM is sandwiched between support & resistance while backtesting the TL off the March lows with the next sell signal to come on a break below 133.50 while a solid break & close above 146 would be near-term bullish.