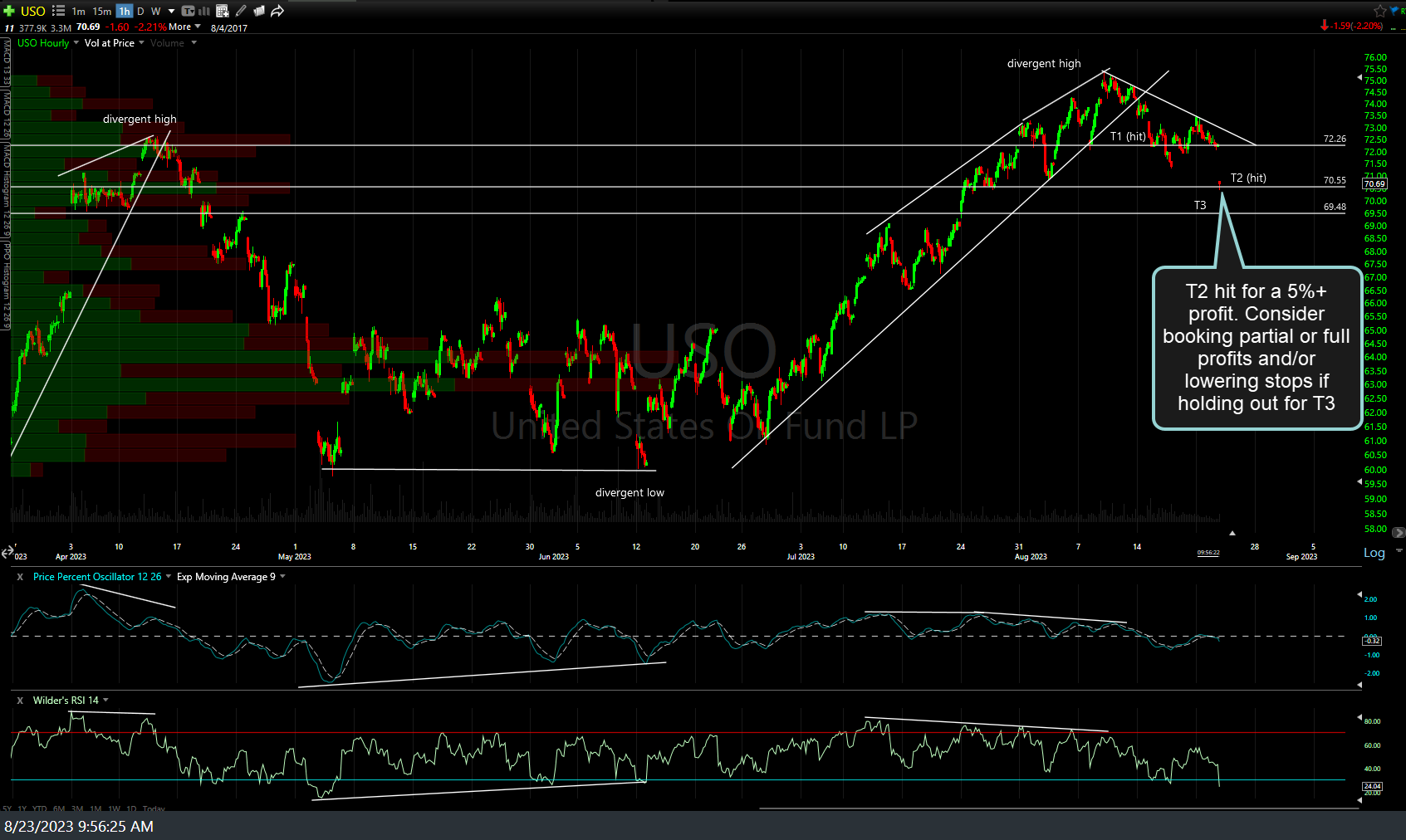

USO (crude oil ETN or /CL, crude futures) offers an objective re-entry or reversal back to short here at downtrend line resistance (with stops somewhat above) for those that booked profits and/or reversed to long when T2 was recently hit. Previous & updated 60-minute charts below.

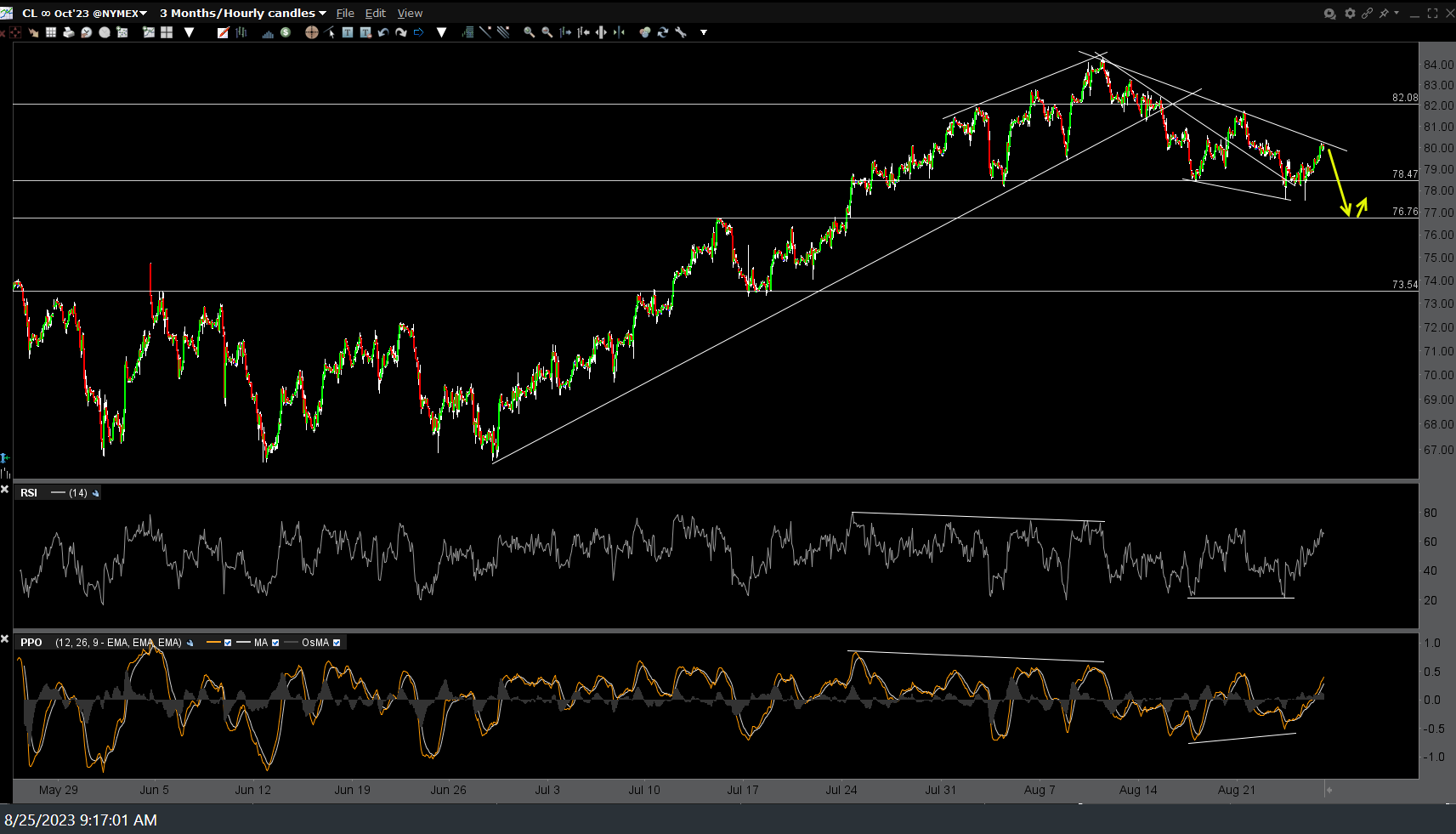

..and the 60-minute chart of /CL for those trading futures (including /MCL & /QM, the micro & MINY crude contracts which trade at the same price level as /CL but use smaller multipliers/leverage factors):

Keep in mind that as with most of the trade ideas that I share, the R/R begins to increasingly diminish as those trades approach the final target. As such, the fact USO has already hit the 2nd of 3 price targets AND has positive divergences forming between price & the momentum indicators, makes using a relatively tight stop somewhat above those downtrend lines prudent for those that are currently short or plan to re-short after gaming the bounce off T2 the other day.