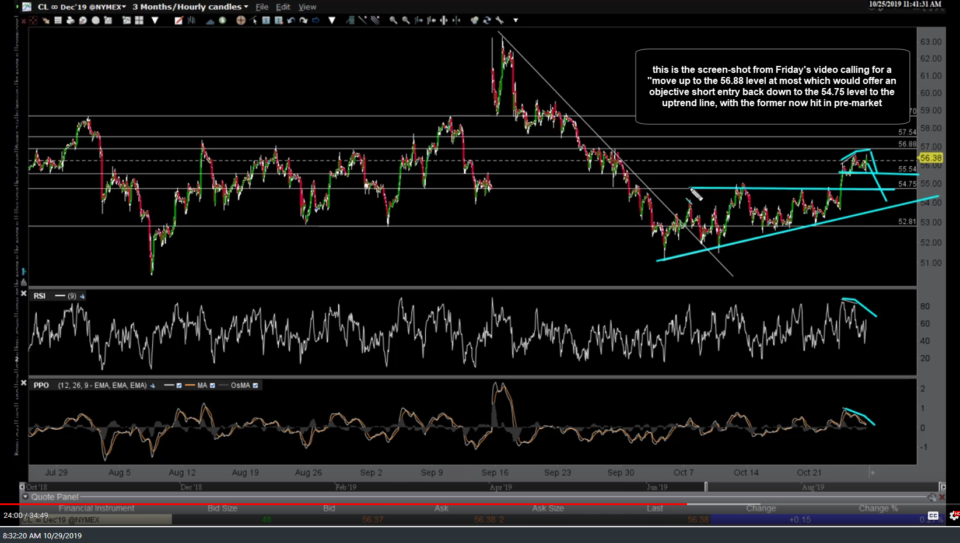

/CL crude oil futures played out as predicted in Friday’s video, continuing up to the 56.88 resistance level, putting in a divergent high & reversing from there, going on to break the 55.54 support which triggered impulsive selling down (very close to) the 54.75 minimum target now, offering an objective level to book profits on a short and/or reverse to a long for a bounce. Screenshot from Friday’s video followed by the updated 60-minute chart below.

- CL 60m video screenshot Oct 25th

- CL 60m Oct 29th

I favor a minor/tradable bounce back up to at least the 55.54ish level off the initial tag (or near tag, as I like to cover shorts and/or go long just above the actual support level which is likely to produce a reaction.. and I have just reversed short to long here) although I still can’t rule out continued downside to the uptrend line, as per my scenario covered in Friday’s video (target range 54.75 down to the uptrend line). As such, my plan is to take a 1/2 position here, addition if & when /CL approaches the downtrend line with a stop somewhat below.

Whether or not crude continues lower to the uptrend line, my plan is to let the position ride while periodically raising stops up to (just below) the 58.70 target until/unless I see something in the charts that convinces me to close out the trade, such as decent evidence of a reversal in the stock indices or of course, something bearish in the charts of crude. Crude (USO, UWT, /CL) remains an unofficial trade for now. Comparable support & resistance/price target levels for UWT (3x long crude ETN) are shown on the 60-minute chart above. (UWT chart shows prices as of yesterday’s close with UWT trading around 10.50 in pre-market right now).