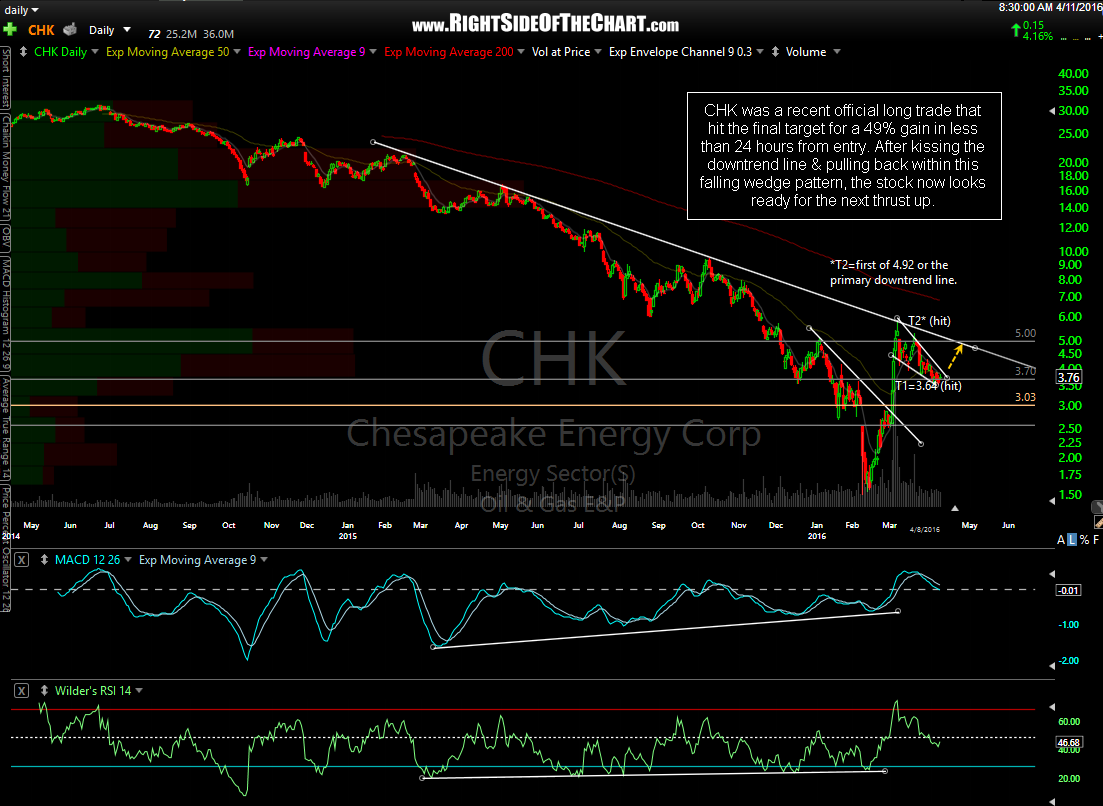

CHK (Chesapeak Energy Corp) was a recent official long trade (March 2nd – 3rd) that hit the final target for a 49% gain in less than 24 hours from entry. After kissing the downtrend line & pulling back within this falling wedge pattern, the stock now looks ready for the next thrust up.

As the stock has started to move in pre-market, I’m going to wait see how it opens before deciding whether or not to add this as an official trade idea. Whether I do or don’t, for those interested, my initial & minimum price target would be that same downtrend line from the previous trade which currently comes in right around the 5.00 resistance level & my stop would be on move below 3.65, possibly higher, depending on my entry price.