We had another solid red candlestick finalized yesterday which helps to confirm the recent sell signal on XLF (financial sector ETF) & increasing the odds of at least my first price target being hit in the coming days to weeks.

/GC (gold futures) continues to struggle following the recent divergent high + divergent low in the $USD while coming up on the primary uptrend line (60-min chart). A solid break below the trendline would lead to more downside in gold.

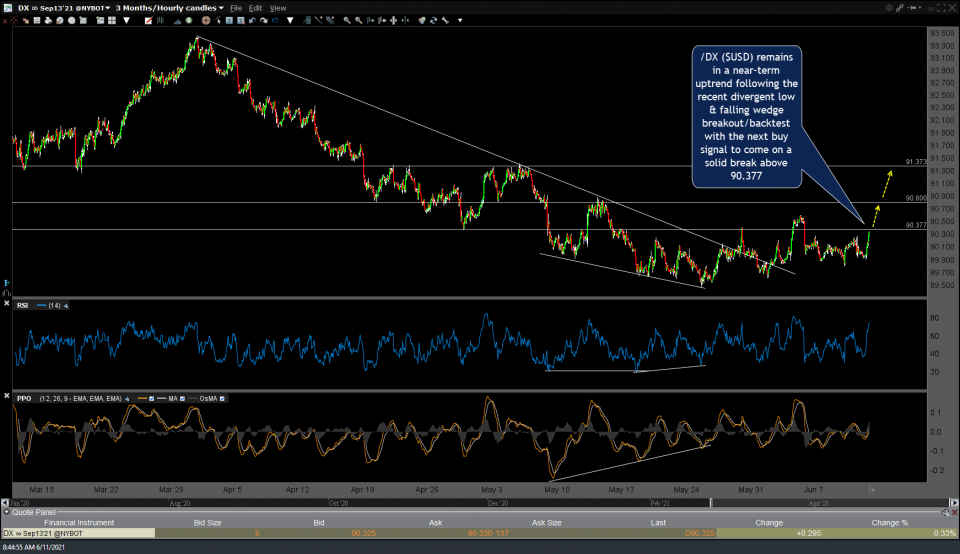

/DX ($USD) remains in a near-term uptrend following the recent divergent low & falling wedge breakout/backtest with the next buy signal to come on a solid break above 90.377.

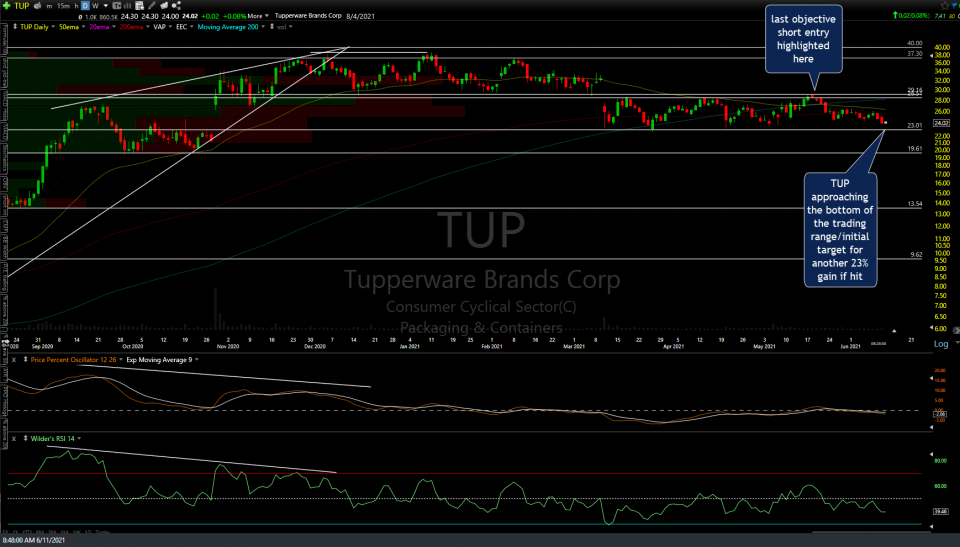

The TUP (Tupperware Brands Corp) short trade is approaching the bottom of the trading range/initial target for another 23% gain if hit.

BC (Brunswick Corp) hit the 94.53 target for an 8% gain from the entry (trendline break) with the next sell signal to come on a solid break below the recent lows (note: additional target added around 86.28).

We’ve had successive tags of the 31 price target/support on ETCG so far with a break below Tueday’s low likely to open the door to my next target(s).

WGO (Winnebago Industries) is coming up on the 66.60ish target with the next objective short entry or add-on to come on a solid break below it.

So far, AMC is good for a 28% drop off the first sell signal at Thursday’s low with the stock still offering an objective short entry on the snapback rally towards the 48.25 former support, now resistance level with a stop somewhat above the downtrend line.