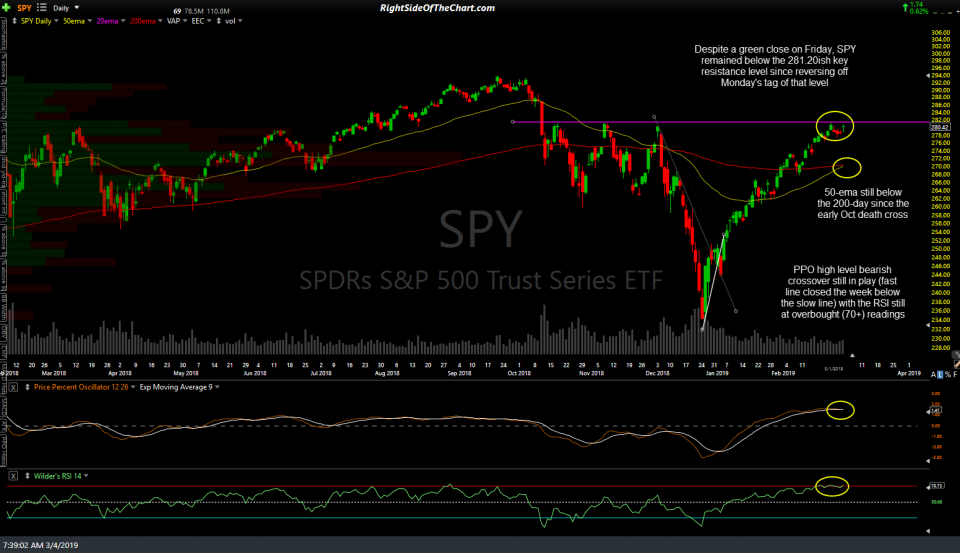

Despite a green close on Friday, SPY remained below the 281.20ish key resistance level since reversing off Monday’s tag of that level. The 50-ema is still below the 200-day since the early Oct death cross with the last week’s high-level bearish crossover on the PPO still in play (fast line closed the week below the slow line) with the RSI still at overbought (70+) readings.

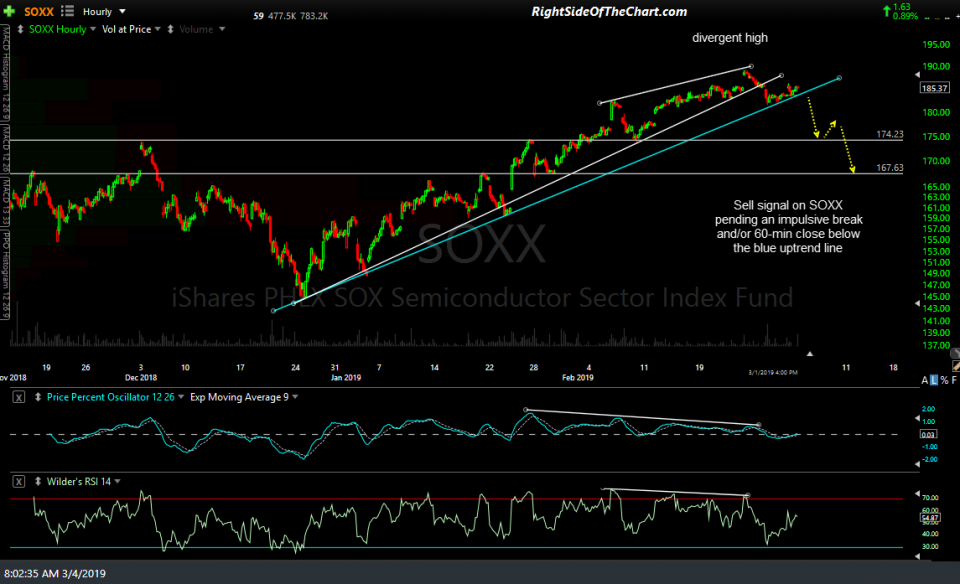

The semiconductor sector appears poised for a substantial correction. SOXX brokedown below primary uptrend line last week following a failed breakout above the primary downtrend line along with a backtest of the TL from below on Friday. Also, not the high-level bearish PPO crossover along with the RSI turning down off overbought levels. Sell signal on SOXX pending an impulsive break and/or 60-min close below the blue uptrend line with a couple of potential (unadjusted) price targets shown below.

- SOXX daily March 4th

- SOXX 60-min March 4th

BAL (cotton ETN) appears to be setting up as a potential long swing trade following the recent divergent low within this falling wedge pattern. No buy signals yet but one to watch and/or start scaling into with a stop below the recent lows.

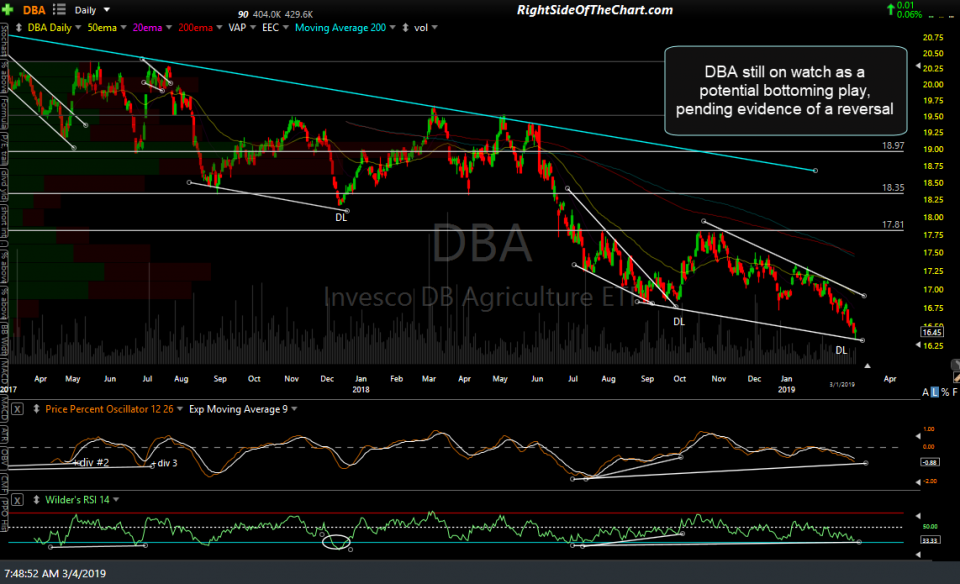

DBA (Agricultural ETF) is still on watch as a potential bottoming play, pending evidence of a reversal which could come with some impulsive buying this week following Friday’s hammer candlestick.

JO (coffee ETN) still looks poised for more upside, minor zigs & zags aside, following last week’s breakout while /KC (coffee futures) still look fine following last week’s breakout. Ideally, the 98.18ish support level below should contain any near-term pullbacks with a backtest of the minor downtrend line the next support below if not. /KC also appears to be bull flagging at this time so watch for an impulsive move higher today for a potential breakout & rally above the flag.

- JO 60-min March 4th

- KC 60-min March 4th