Nice impulsive move down in /NQ last night & so far this morning which should give us that bearish QQQ gap down scenario I laid out in Friday’s video. As I type, QQQ is trading at 179.90 in the pre-market session vs. Friday’s close of 183.02.

Unless the buyers step in aggressively during the regular session today, this increases the odds that T3 on the QQQ Active Short Trade will be hit today or sometime early this week. Also, keep in mind that I am still considering adding additional price targets to the QQQ trade although T3 remains the final official target as of now.

There are bullish divergences forming on this 15-min chart of /GC (gold futures) and with stock futures trading down sharply, there is a good chance that gold rallies today, this week & possibly beyond. I’d still like to see a breakout in the EUR/USD so only passing this along as an unofficial trade for now with gold still on watch as a potential official swing/trend trade.

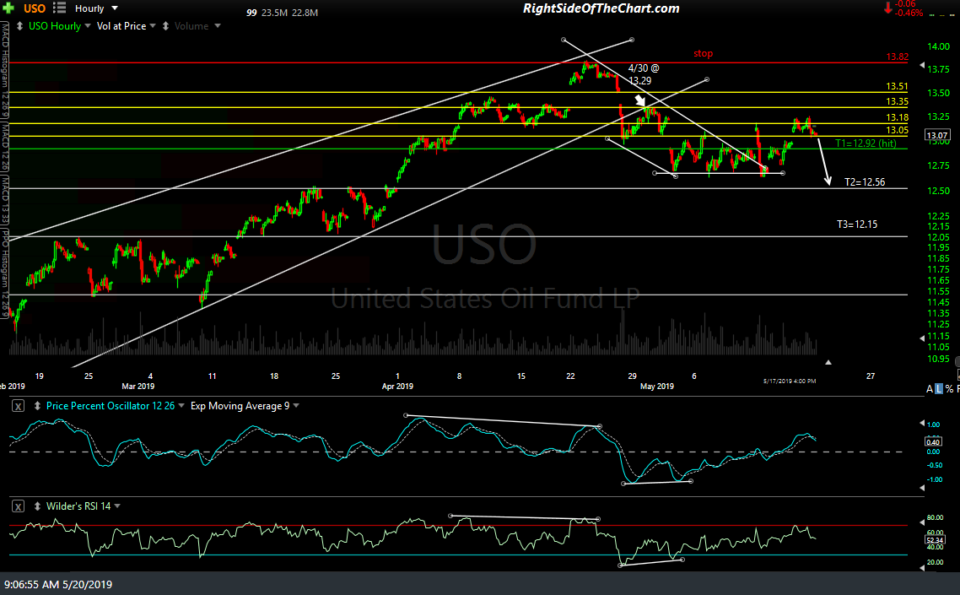

A solid break below 62.65 is likely to spark a drop in /CL to at least this minor uptrend line & help bring the USO (crude ETN) Active Short Trade closer to the next price target, T2 at 12.56. (note: multiple charts in gallery format, such as the remaining charts in this post below, may not display in the subscriber email post notifications. Click on the link of the post in the email to view these charts on the RSOTC.com).

- CL 60-min May 20th

- USO 60-min May 20th

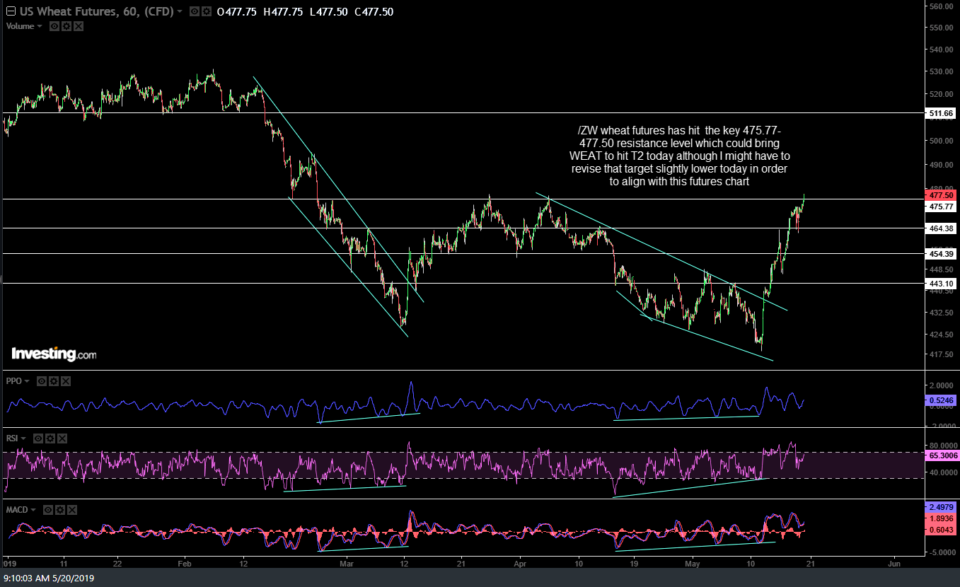

/ZW wheat futures has hit the key 475.77-477.50 resistance level which could bring WEAT to hit T2 today although I might have to revise that target slightly lower today in order to align with this futures chart.

- ZW 60-min May 20th

- WEAT daily May 20th