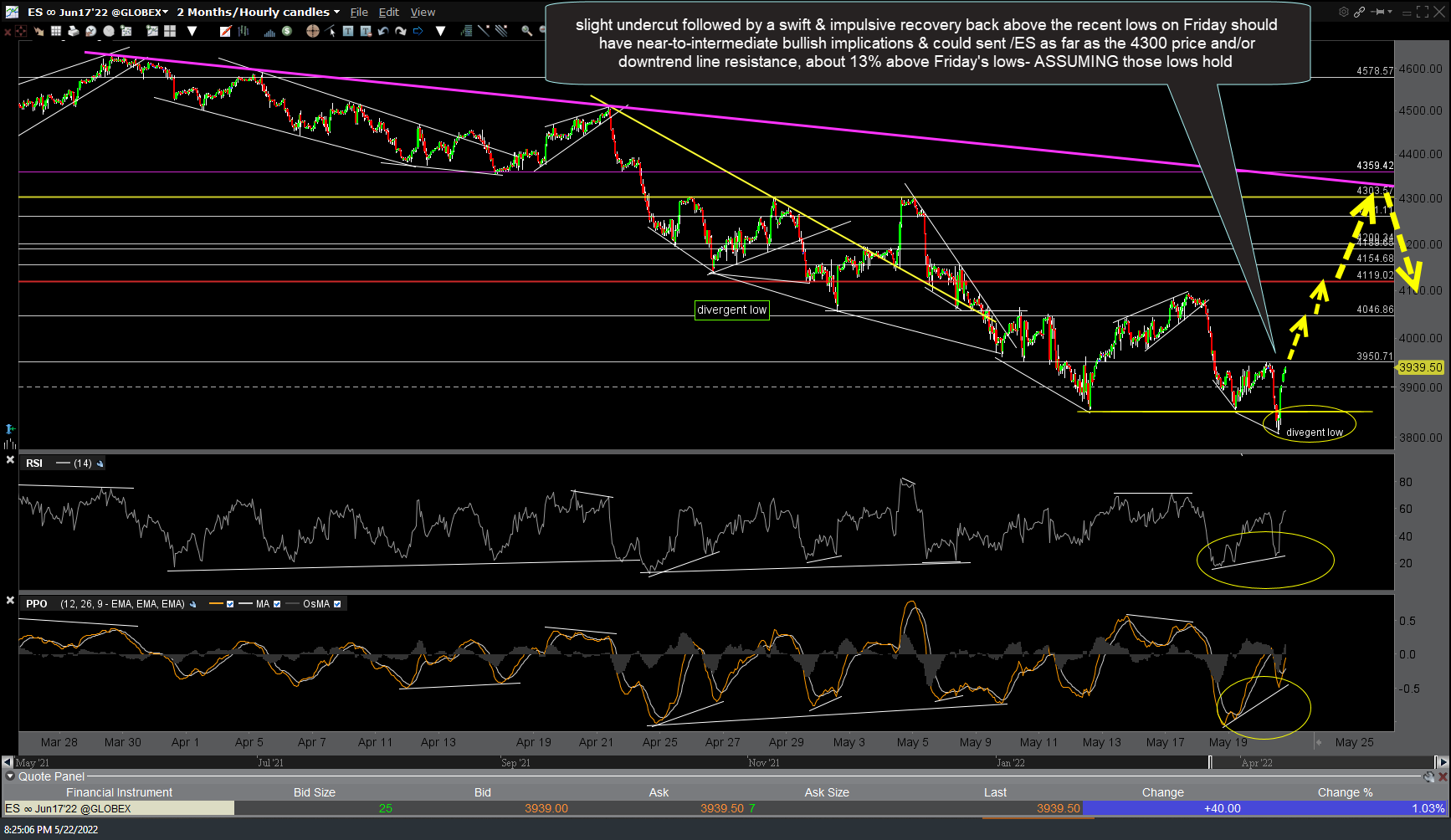

Finally back home with full access to the charts & so analysis & trade ideas will resume as normal starting tomorrow morning but as I was unable to post any updates before the market closed on Friday, here’s a quick update along with the 60-minute charts of /NQ (Nasdaq 100 futures) and /ES (S&P 500). Solid breaks above /NQ 12085 & /ES 3951 will also provide objective long entries or add-ons to existing positions as well as provide objective stop levels (somewhat above) for those still short.

Essentially, both major large-cap indexes made very slight & brief undercuts of their recent double-bottom lows followed by a swift & impulsive recovery. As such, those are whipsaws and potential bear-trap moves that likely clear out a ton of long-side stops & sucked in more shorts. Therefore, as long as Friday’s lows are not taken out with conviction & the bullish (positive) divergences remain intact, the odds for a substantial rally in the coming days to weeks are still favorable. Again, additional updates to follow but until & unless Friday’s lows are taken out, the charts remain constructive & the potential for a tradable rally on the indexes & just about all stocks & sectors with constructive charts, including those that fell to support just before I left for vacation & were highlighted on Thursday, May 19th, offer objective long entries or add-ons with stops somewhat below the recent lows.

On a final note, we are still in a bear market without very strong evidence that a near-term or intermediate-term bottom has been put in. Should the indexes solidly take out last week’s lows, that could very well be the catalyst for a move down to my next long-term targets on the weekly charts which I still maintain (again, as long-term targets). As such, active traders should remain flexible & ready to pivot quickly, if & when the charts dictate. Now that I’m back at my desk, I will post any significant developments asap.