I’ve included an update on MJ & top picks of the 8 individual cannabis stocks that were posted as trade ideas on Tuesday, many of which appear to be forming potential bull flag continuation patterns after posting double-digit rallies earlier this week. I also wanted to point out that the stock market is closed on Monday for the MLK Holiday and I will be away from my desk on Tuesday so analysis & trade updates will resume on Tuesday evening or Wednesday morning. The updates on MJ plus those 8 cannabis stocks first highlighted on Tuesday are posted in the same order below with Tuesday’s chart followed by today’s updated chart below each update. (click on charts to expand, then pan and zoom for additional detail).

MJ (cannabis sector ETF) rallied 11% from where it was posted on Tuesday to hit & briefly overshoot the 18.78 target where it has been consolidating in what appears to be a bull flag continuation pattern since with the next buy signal to come on an impulsive break above the flag and/or Thursday’s high.

- MJ daily Jan 14th

- MJ daily Jan 17th

TLRY (Tilray Inc) rallied 30% from where it was posted on Tuesday to hit & briefly overshoot the 21.43 target and has been consolidating in what appears to be a bull flag continuation pattern.

- TLRY daily Jan 14th

- TLRY daily Jan 17th

ACB rallied 37% from where it was posted on Tuesday to come within a few cents of the 2.36 unadjusted price target (best to set sell limit orders just shy of the actual R level in case the sellers step in early!) with any backtests of the downtrend line or 1.87 level will offering the next objective long entry with a stop somewhat below.

- ACB daily Jan 14th

- ACB daily Jan 17th

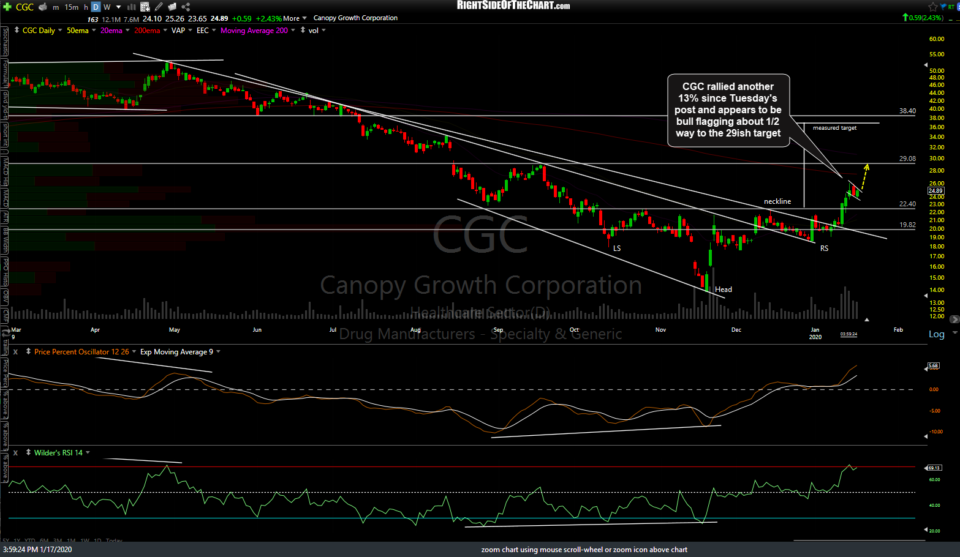

CGC rallied another 13% since Tuesday’s post and appears to be bull flagging about 1/2 way to the 29ish target.

- CGC daily Jan 14th

- CGC daily Jan 17th

CRON rallied 17% from Tuesday’s post to break above & backtest the 7.93 target/former resistance level which should now act as support. The stock appears to be forming a potential bullish pennant over the last few trading sessions as well.

- CRON daily Jan 14th

- CRON daily Jan 17th

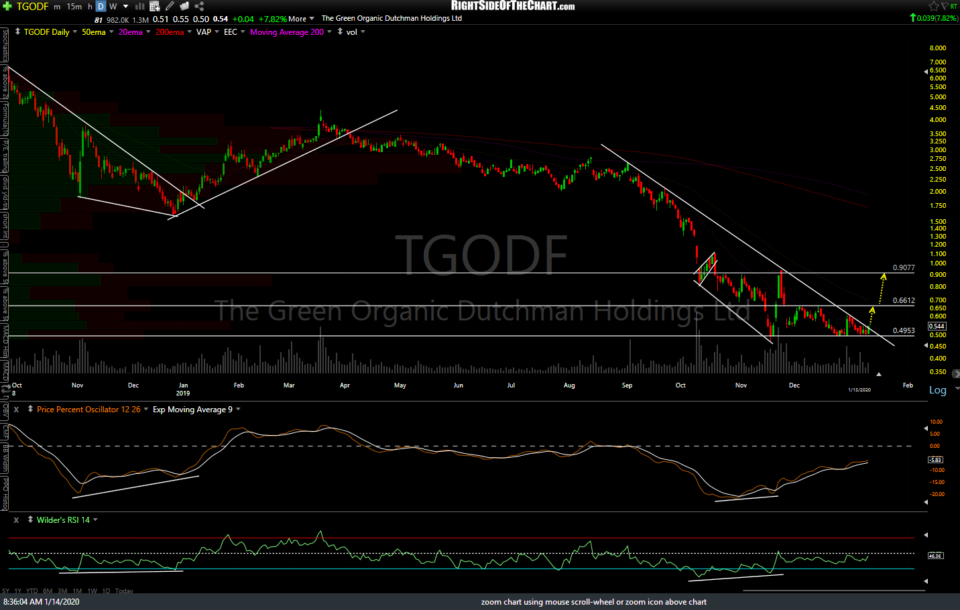

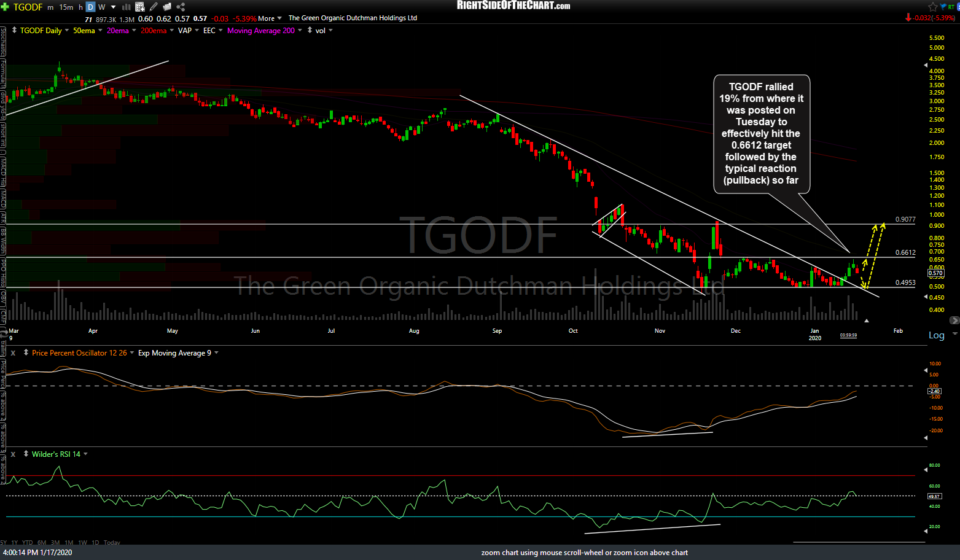

TGODF rallied 19% from where it was posted on Tuesday to effectively hit the 0.6612 target followed by the typical reaction (pullback) so far.

- TGODF daily Jan 14th

- TGODF daily Jan 17th

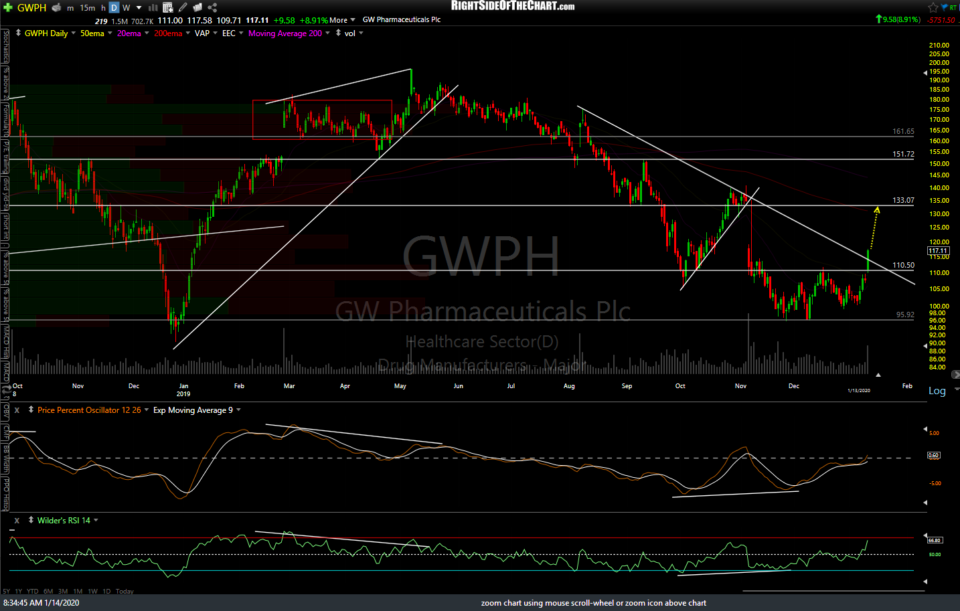

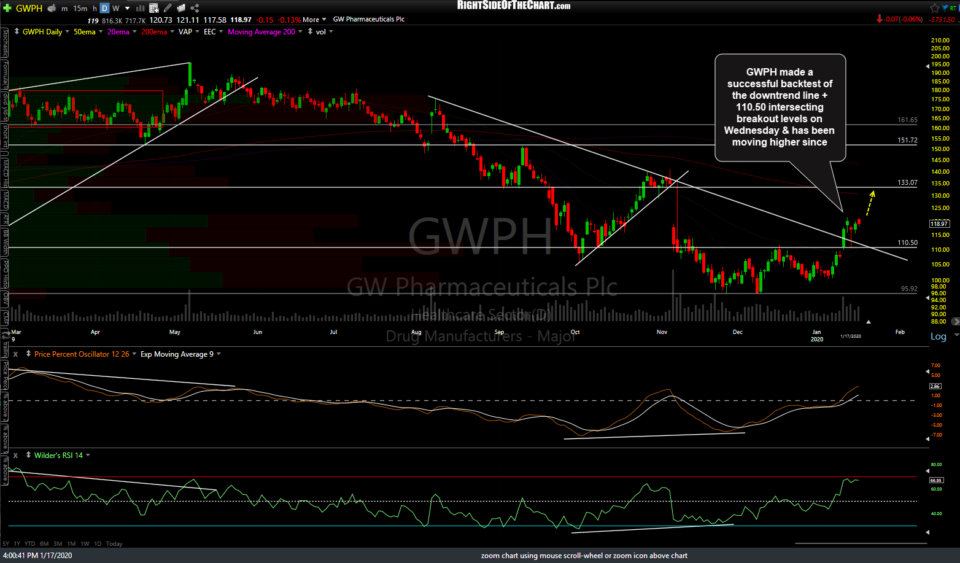

GWPH made a successful backtest of the downtrend line + 110.50 intersecting breakout levels on Wednesday & has been moving higher since.

- GWPH daily Jan 14th

- GWPH daily Jan 17th

OGI rallied 63% from where it was posted as a trade idea on Tuesday to hit & briefly overshoot the 3.36 target and might be forming a bull flag continuation pattern with an impulsive break above the flag triggering the next buy signal en route to the additional (unadjusted) price target I’ve added at 4.15.

- OGI daily Jan 14th

- OGI daily Jan 17th

HEXO rallied 35% from where it was first posted as a trade idea on Tuesday to hit the 2.00 target which was significant resistance. The stock pulled from there back close to the 1.53 support today offering an objective long entry or re-entry (and still might next week) for those that booked profits this week.

- HEXO daily Jan 14th

- HEXO daily Jan 17th