As per last night’s video, the Nasdaq 100 futures (/NQ) have put in a divergent low on the 60-minute time frame after the index closed on or slightly above key uptrend line support. As such, the odds for a rally in the coming days is elevated until & unless these divergences & the uptrend line support on QQQ is taken out.

Unlike the Nasdaq 100 futures, the S&P 500 futures would need to make another thrust down to or below last Friday’s low with indicators remaining above their respective previous lows to put in a divergent low. However, divergences, especially on all indices, are not a requirement for a rally, merely an indication that an impending trend reversal is likely.

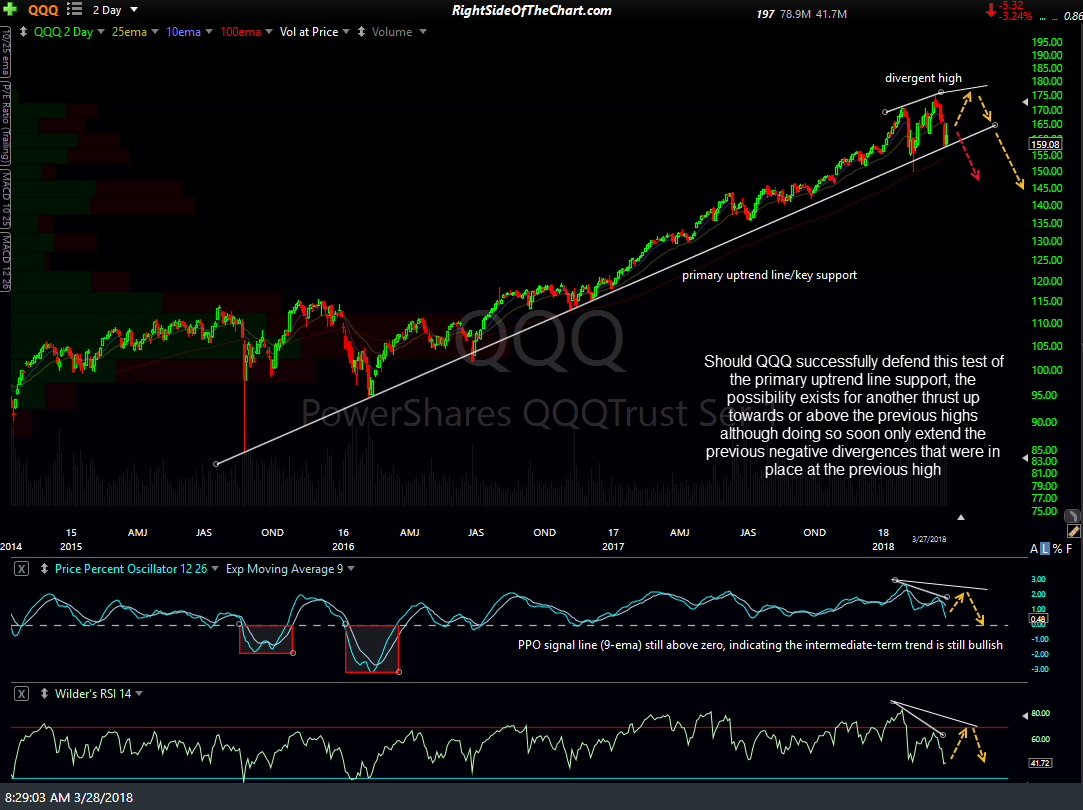

Should QQQ successfully defend this test of the primary uptrend line support, the possibility exists for another thrust up towards or above the previous highs although doing so soon only extend the previous negative divergences that were in place at the previous high, quite likely setting the stage for an even larger correction in Q2 or Q3 2018.