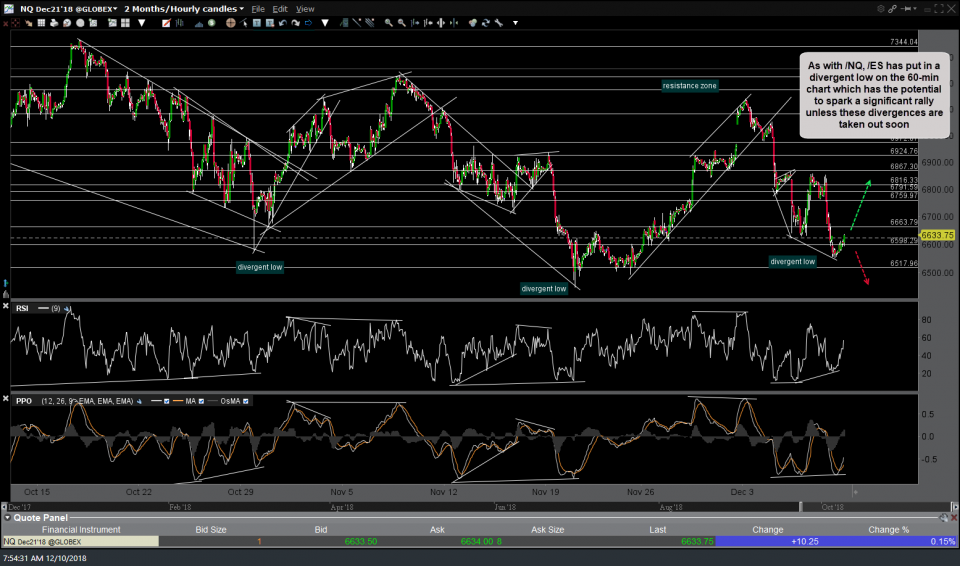

The positive divergences that had formed on the /NQ (Nasdaq 100) & /ES (S&P 500) E-mini futures last week were extended to even larger,potentially more significant bullish divergences in the overnight trading session last night (Sunday), with both /NQ & /ES reversing & continuing higher so far today in the pre-market trading session. Unless both /NQ & /ES reverse soon, these divergences have the potential to spark a rally in the equity markets this week & possibly into the end of the year while forming a triple bottom in the Nasdaq futures.

- NQ 60-min Dec 10th

- ES 60-min Dec 10th

Overall, the recent price action & technical posture of the stock market remains very bearish so I’ll continue to monitor these developments very closely today but FWIW, it appears to me that the fact the futures were down substantially last night & the bears had the chance to take out these divergences as well as the previous lows in /NQ & /ES but failed to do so now tips the near-term outlook for today & possibly beyond to bullish. We should have a better idea once the opening bell rings today & I will post another update once the regular session is underway.