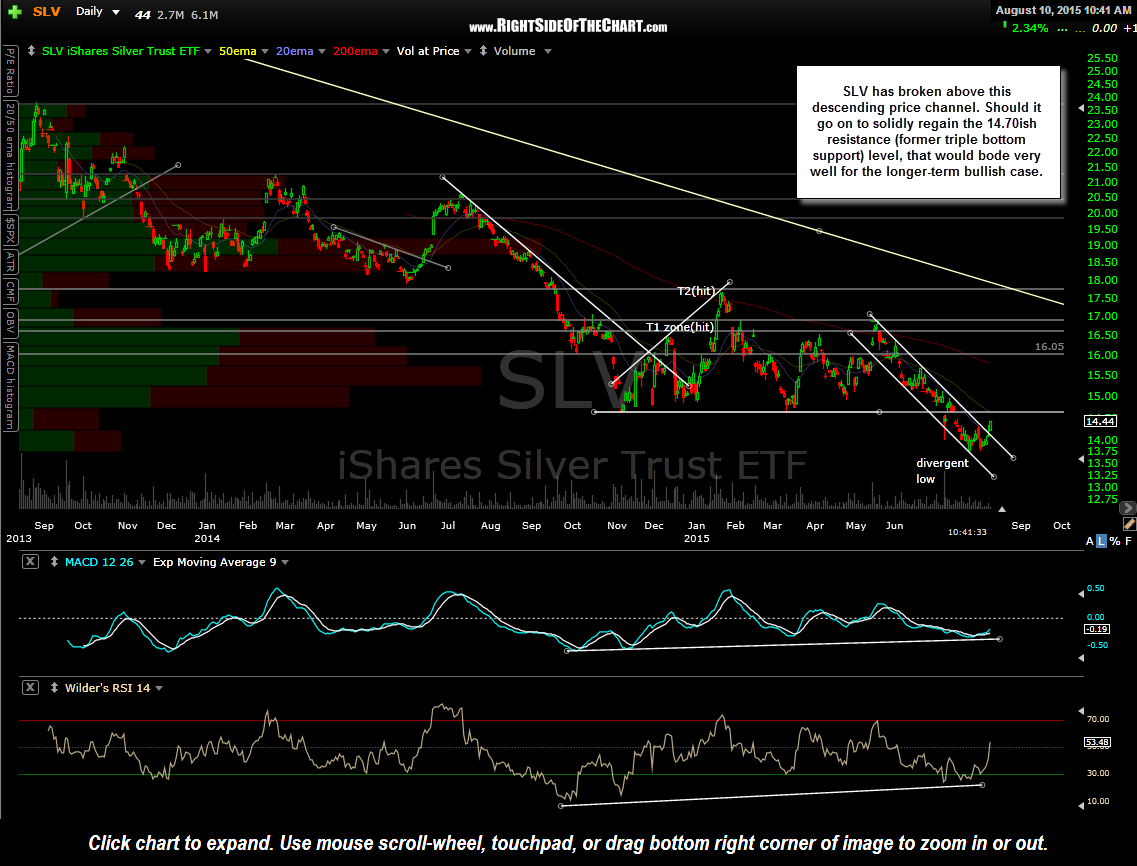

SLV has broken above this descending price channel. Should it go on to solidly regain the 14.70ish resistance (former triple bottom support) level, that would bode very well for the longer-term bullish case.

GPL (Great Panther Silver) has broken above this (blue) bullish falling wedge but so far, stalled at the 0.38 resistance level. All white lines mark overhead resistance/potential price targets. My thoughts on SLV, GPL & the entire precious metal mining sector are this: I’m still leaning towards the longer-term bullish case, however, like GLD needing to reclaim the trendline support recently highlighted on the weekly timeframe, SLV also needs to solidly reclaim that key 14.70ish resistance level. If so, GPL would likely go on to break above the white primary downtrend line shown on this chart, most likely signaling that a bottom is finally in place and a new bull market in the stock (along with most other miners) is underway. However, resistance is resistance until taken out so until then, any rallies/long-entries in the precious metal stocks should be viewed as counter-trend trades.

Although not an official trade at this time, GPL would offer an objective (and aggressive) long entry on a break above 0.38. Price targets are the white horizontal & downtrend lines which come in a 0.41, 0.44, the downtrend line (around .47-.48, depending if/when hit) and finally the 0.52 level. Best to set sell limit orders a penny or two below those actual resistance levels.