In a nutshell, the big drop in the Nasdaq 100 today was largely isolated & almost exclusively due to the drop in the same handful of big tech stocks that have been nearly single-handedly carrying the market higher for months. Most of the 11 sectors in the S&P 500 & non-tech stocks in the broad market (especially if you strip out the big tech stocks that overweight sectors such as Communications XLC top-heavy in META & GOOGL), Consumer Discretionary XLY (top-heavy in AMZN & TSLA), and Consumer Staples XLP (top heavy in COST, not a tech stock but one of the top-weighted components of the $NDX) did quite well today. So a one-day wonder/profit-taking day in the intertwined & highly-correlated big tech stocks? Maybe. However, the technicals have been indicating a big drop coming & today may very well prove to be the start of a much deeper drop still to come.

What I can say, besides the bearish technical posture of SPY & QQQ, which became “more bearish” with both of those leading indices finalizing those bearish engulfing candlesticks that I covered in today’s video, is that the undisputed King of financials, JPM (JP Morgan Chase & Co.) has the potential to determine the path of the stock market when they report earnings tomorrow morning along with some other key banks such as C (Citigroup), WFC (Wells Fargo), & BK (Bank Of NY Mellon).

As I often do during earnings season, if the technical posture of a stock heading into its quarterly earnings report is clearly bullish or bearish then I like to make a “guess” as to the next major direction of the stock. Not necessarily how these stocks will trade in the pre-market session after they report tomorrow morning or even how the will close the day, but more so what the next major direction in the coming weeks to months will be.

In several of the videos posted back in late March/early April, I shared JPM as a short setup with a sell signal to come on a break below the uptrend line & 193.90 price support just below it. The stock triggered the sell signal shortly after than, followed by a hit & reversal off my first price target. Following the early April sell signal & reversal off T1, JPM has made a marginal new & still divergent high with the odds favoring a post-earnings drop down to my next targets, whether the stock pops or drops (more likely IMO) tomorrow.

An earnings induced pop into either the 69ish or 73ish resistance levels tomorrow on C (Citigroup) would most likely extend the existing divergences & provide for an objective shorting opp as would a gap down (my favored scenario) that triggers a bearish crossover on the PPO to “confirm” the current potential divergence.

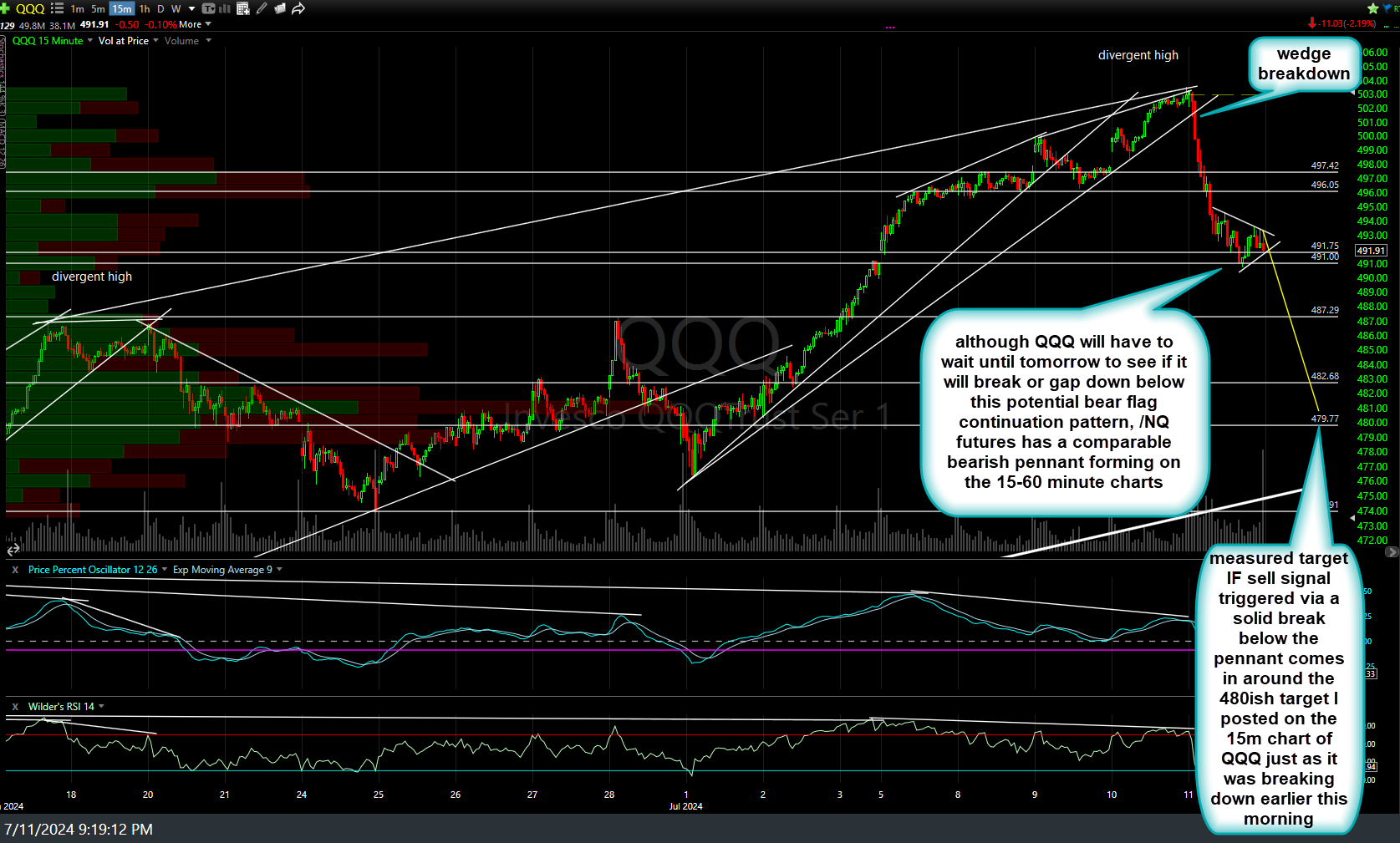

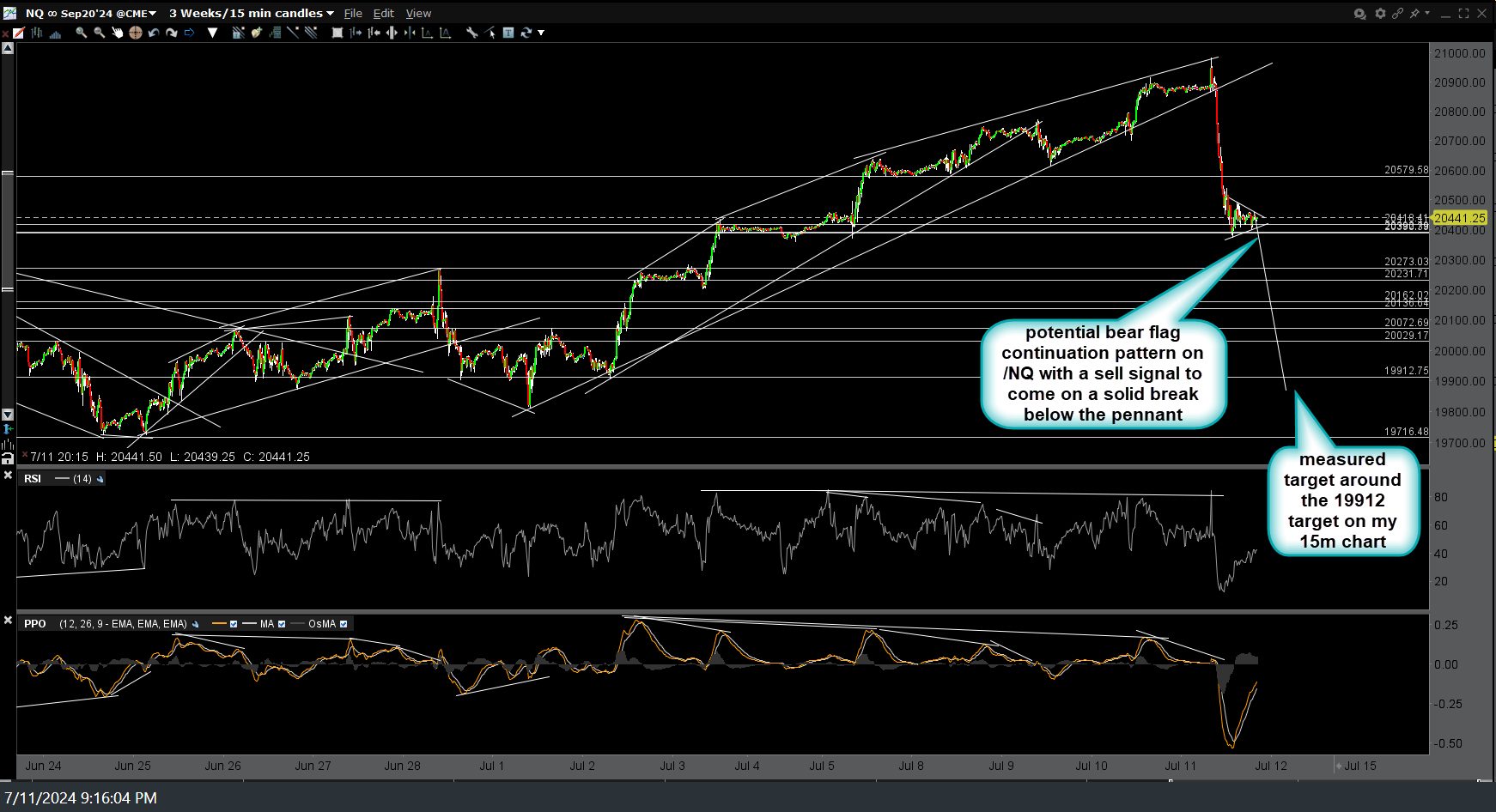

The Nasdaq 100 stopped cold on that July 3/5 gap support that I highlighted in today’s video & did bounce a bit but nothing more than a dead-cat bounce, so far. In fact, that small bounce & consolidation above that support level since then has taken the form of a potential bearish pennant continuation pattern on /NQ (Nasdaq 100 futures) & even QQQ into the close. The trigger for a bearish pennant (similar to its close cousin, the bear flag continuation pattern) is a solid break below the pennant (or one could wait for a break below today’s low, which is just a hair below the pennant). I’ve posted some measured targets on the 15-minute charts of QQQ & /NQ below (with the 15-minute chart of QQQ posted this morning highlighting the very timely wedge breakdown first).