henpecked Benpecked (‘ben·pekd)

Definition

adjective

- (of a

manstock trader) continually harassed or tormented by the persistent nagging of awomancentral bank chairman (esp.his wifeBen Bernanke)

As I’ve discussed quite a bit lately, what makes the recent Sept 14-Nov 17th correction different from all other similar sell-offs in recent years is the lack of fear this time around. There are generally two types of traders who short the market, other than commercial hedgers: The “permabears”, who always think the market is going to drop and those more adept, flexible traders who are just as comfortable trading the short side as the long side, depending on the charts, valuation, and other market metrics. I like to believe that I fall into the latter categorization but I digress.

As I’ve discussed quite a bit lately, what makes the recent Sept 14-Nov 17th correction different from all other similar sell-offs in recent years is the lack of fear this time around. There are generally two types of traders who short the market, other than commercial hedgers: The “permabears”, who always think the market is going to drop and those more adept, flexible traders who are just as comfortable trading the short side as the long side, depending on the charts, valuation, and other market metrics. I like to believe that I fall into the latter categorization but I digress.

It seems to me from everything that I see, hear and read, that most short-side traders, be they permabears or flexible (long/short); retail or professional; rookie or seasoned veteran; etc… have finally succumbed to nearly four years of relentless and undeniable market intervention by the Federal Reserve, namely one Ben Bernanke, and as such they have become Benpecked.

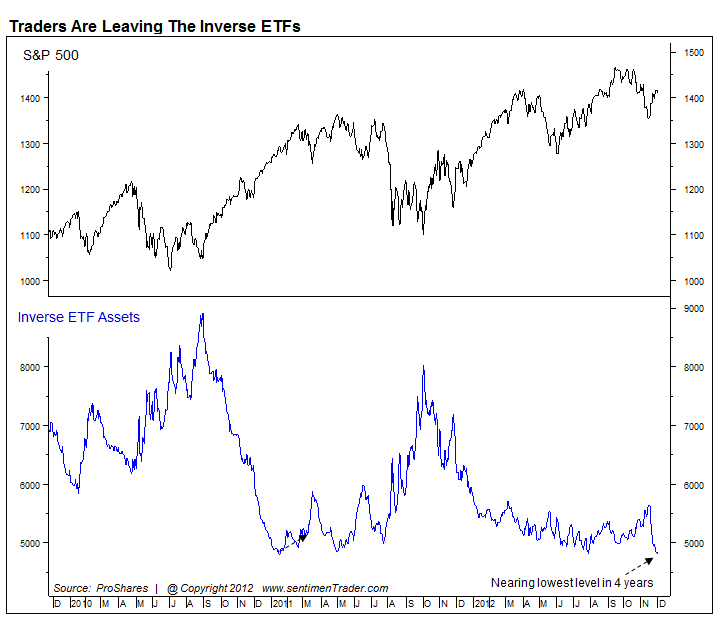

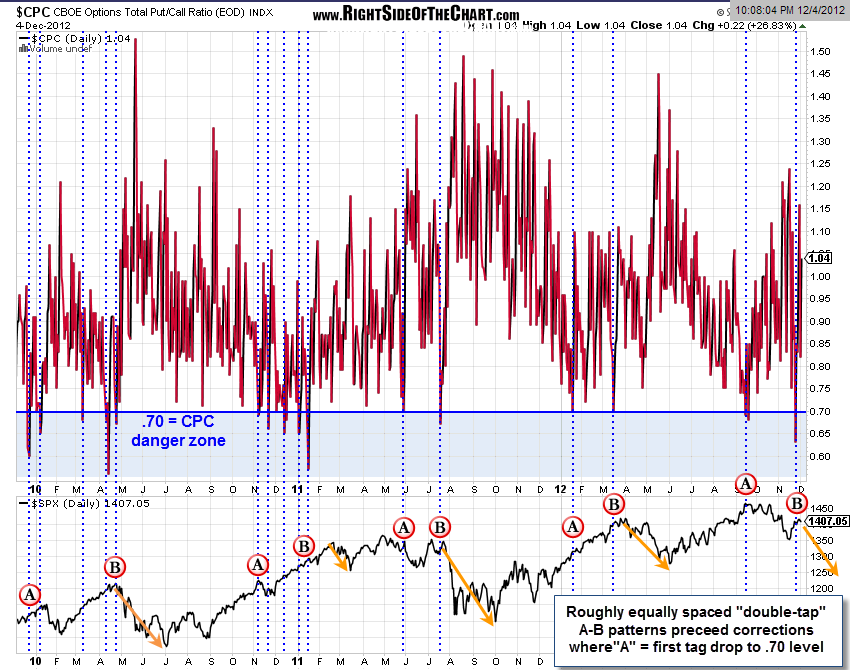

A Benpecked trader might talk the bearish talk (hence the reason that I don’t put too much stock into the various sentiment surveys unless they are at extreme levels) but they don’t walk the walk. In other words, they don’t put their money where their mouth is. I believe that the four measures of actual trader positioning below; the $VIX, Proshares inverse (short) ETF assets, Put/Call ratio, and the short interest (SPY & QQQ), help to illustrate this fact. What does this all mean? It means that a one-sided market void of short interest is a market that can & usually will fall faster and farther than most think possible, especially if that multi-year low short interest comes at a time when the macro-fundamentals are transitioning from an expanding economy to one that has clearly been contracting for the last six months. Add to that some underlying bearish technicals on the longer-term charts and you have all the makings for a significant retracement in stock prices, potentially much deeper and longer than the recent ~ 2 month, ~ 9% pullback.